Professionals with Flavor — Weekly Market Intelligence & Strategy Brief

Weekly Market Intelligence & Strategy Brief

Professionals with Flavor

Week of February 9, 2026 • Rates, Energy, Metals, Grains • Structured thinking over hot takes

Executive Snapshot

Markets continue to oscillate within well-defined ranges, masking elevated underlying risk beneath seemingly calm surfaces. Volatility compression remains selective, not systemic. This is not a week for bravado — it’s a week for patience, structure, and disciplined exposure.

Across rates, energy, metals, and grains, price action is increasingly range-defined, while macro catalysts stack tightly into the back half of the week. Our posture remains unchanged: selective exposure only, no risk-seeking behavior.

Interest Rates & Macro

10Y Treasury Yield Context

Yields opened the week under pressure, dipping toward 4.15%, before reversing higher and settling back near 4.20% — a level that has effectively become the market’s gravitational center.

This marked the 14th out of the last 15 sessions where yields closed within the 4.20–4.30% corridor, reinforcing that despite daily noise, the broader regime remains range-bound.

- Early downside pressure stemmed from softer labor signals and a risk-off bid into duration.

- The rebound reflected stabilizing equity sentiment and continued supply absorption.

- CME Group’s CVOL index shows lower day-to-day volatility, but week-over-week risk remains elevated.

Looking ahead, the calendar tightens materially: rescheduled labor data mid-week, CPI on Friday, and heavy Treasury supply via 3Y, 10Y, and 30Y auctions.

Insert uploaded TYAH26 chart image here.

Energy

WTI Crude Oil

WTI crude continues to trade constructively but contained, holding near 63’75 and respecting a two-week range between 62’00 and 65’40.

- Support came from firmer equity markets and stable U.S. consumer sentiment.

- Despite being off short-term highs, crude remains elevated relative to late-2025 levels.

- Momentum through early 2026 remains intact, but directional conviction is absent.

Natural Gas pulled back ~2.5%, retracing after a three-day rally. Recent volatility appears to be stabilizing as the market recalibrates demand expectations.

Insert uploaded CLEJ26 chart image here.

Metals

Silver & USD sensitivity

Silver continued its recent slide, marking its third decline in five sessions and setting up to close at its lowest level since early January. The pressure is not technical alone — it’s macro-driven.

- U.S. dollar strength rebounded over 2.3% from late-January lows.

- Dollar strength remains a headwind for USD-priced industrial and precious metals.

- Silver’s dual role (precious + industrial) magnifies sensitivity to currency shifts.

Gold & positioning

Gold remains structurally strong but increasingly volatile near recent highs. Larger daily ranges reflect position adjustment, not panic.

Insert uploaded GCEJ26 chart image here.

Insert uploaded CPEK26 chart image here.

Grains

Grain markets ended the week mixed, with soybeans quietly leading.

- Soybeans settled at 1,115’2, up 0.51% on the week, supported by chatter around potential Chinese demand.

- Export data, however, remained soft — enthusiasm outpaced confirmation.

- Corn held firmer at 430’2.

- Chicago Wheat slipped 5.5 cents, snapping a four-week winning streak.

Brazil remains a wildcard: potential 14MM metric tons of Jan–Feb soybean exports, with farmer selling constrained by currency strength and freight costs.

Insert uploaded ZSEH26 chart image here.

What We’re Watching Next

This is a data-dense, liquidity-sensitive week — expect volatility to cluster around release windows.

- Retail Sales & CPI: Inflation optics remain pivotal — not just direction, but dispersion.

- Energy Inventories (API & EIA): Confirmation vs contradiction of recent stabilization.

- Labor Data: Markets are hypersensitive to second-order labor signals.

- Treasury Auctions: Demand quality matters more than yield levels.

Insert uploaded economic calendar image here.

Risk Posture

This is not the environment to force trades or chase narratives. Optionality, structure, and patience dominate. The absence of follow-through is itself information.

Professionals with Flavor — Closing Thought

In environments like this, performance doesn’t come from prediction — it comes from process.

Emerging traders and niche specialists often outperform here not because they “know more,” but because they:

- Respect ranges

- Scale risk deliberately

- Trade structure instead of opinion

That discipline is what separates participation from performance.

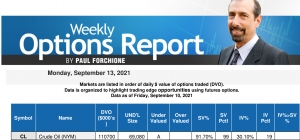

Below is an illustration trading futures options on Gold. Our post shows bullish and bearish positions using a combination of call and put options.

Below is an illustration trading futures options on Crude Oil. Our post shows bullish and bearish positions using a combination of call and put options.