Get your copy of Paul Forchione's book, "Trading Iron Condors". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

Straits Financial Daily Market Commentary

CME Morning Cattle

Livestock: Thursday saw some fill in business getting done with prices at the low end of this week’s range and actually a few trades at 124 cents being noted late week. We will stick with the thought that this week’s cash trade was 2.00-3.00 cents lower than the week prior and that it suggests the cash top has been put in place.

Beef: Boxes were under pressure on Thursday with both choice and select down a cent or more. Through Thursday the choice cutout has lost 1.65 cents on the week from last Friday’s ending quote for last week, but the select is still holding to a modestly higher level at 0.88 cents over last Friday. We expect to see a weaker trade today and so it is questionable whether the beef trade ends up mixed on the week as we have been calling for, but it should not be far off if we miss.

Futures: In a lighter futures trade yesterday (50k caks) and open interest down just 500 contracts, the market managed a small range on the day and mixed closes…firm in the front and weaker in the back. This looked very corrective considering the strong selloff of the prior four trading days and we would not expect to see much of a higher follow through today or early next week. The front month April is running slightly premium to the cash which is rolling over and turning down, so futures strength should be seen as a selling opportunity and not necessarily considered to be a signal that the next move in the underlying cash market is back higher. DTN has a mixed call for the opening Friday morning. We would think there should be a try higher on ideas the market has priced is this week’s lower cash market, but there should be limited upside potential, and if they crack the hog market strong again (high probability) the cattle should weaken as well and we could see a poor close today as a lead into next week’s lower market expectation. Grain Stocks and Prospective Planting numbers are out later this morning.

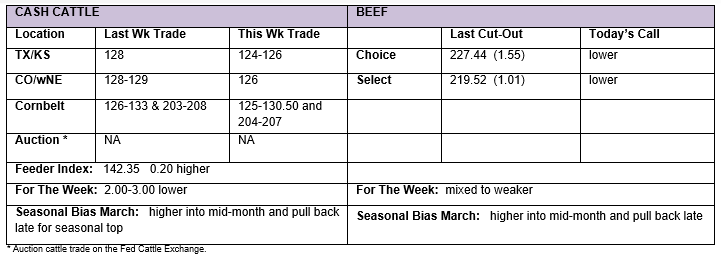

Basis: Last week’s cash cattle trade at the feedyard was a range from 126 to 133 cents with the bulk of the cattle trading 128 cents south and 129 cents north. Compared to last Friday’s futures close at 129.72 cents, this tightened the basis from the prior week and left the high end of the cash trade vs. the front month futures at a little less than -1.00 cents and certainly in line with historical expectations. For this week as we wrap things up, the front month futures contract has lost 3.20 cents to the 126.52 level. Based on the 126 cent live trade at best for a guess on an average trade level this week, the implied basis sits just at the -0.50 to -1.00 cent level and is in line with historical expectations. The basis should continue to converge and brief periods of small positive basis readings with respect to the front month April is certainly possible. As we get ready to approach the April delivery timeframe and the end-game for the April futures contract, a quick peek at the June futures that closed at 119.62 cents shows an implied basis of about +6.00 cents…dead on the historical expectation that we have for the June basis at the start of April.

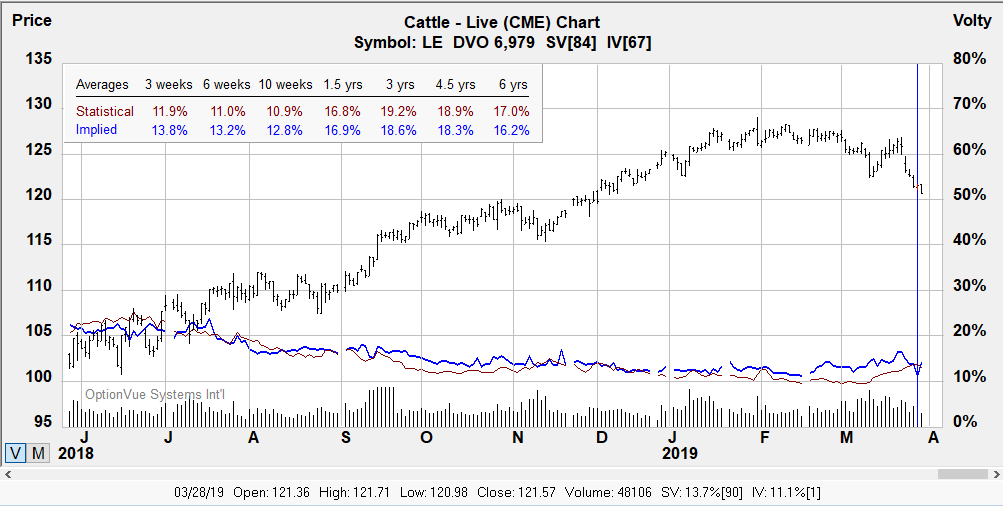

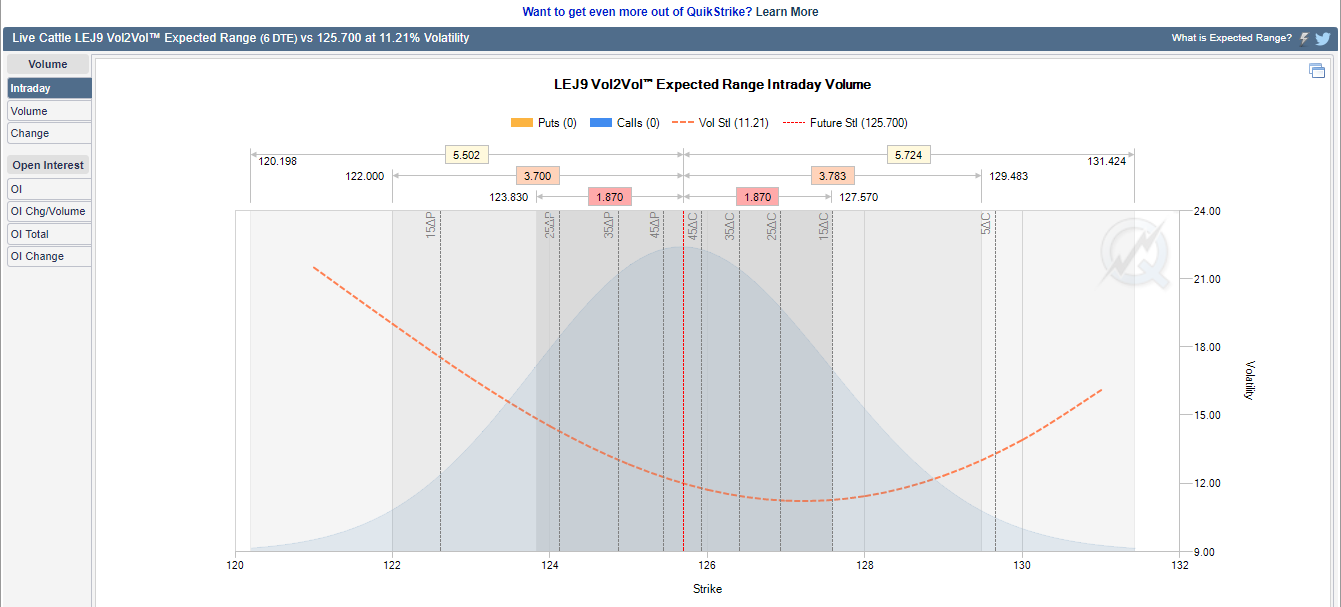

Volatility

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report.

Notes:

Contract Size - 40,000 lbs (~ 18 MT)

Tick Size: $.00025 per pound (=$10 per contract)

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (ET) with trading halt 4:15 p.m. - 4:30 p.m.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Live Cattle futures and options

Live Cattle

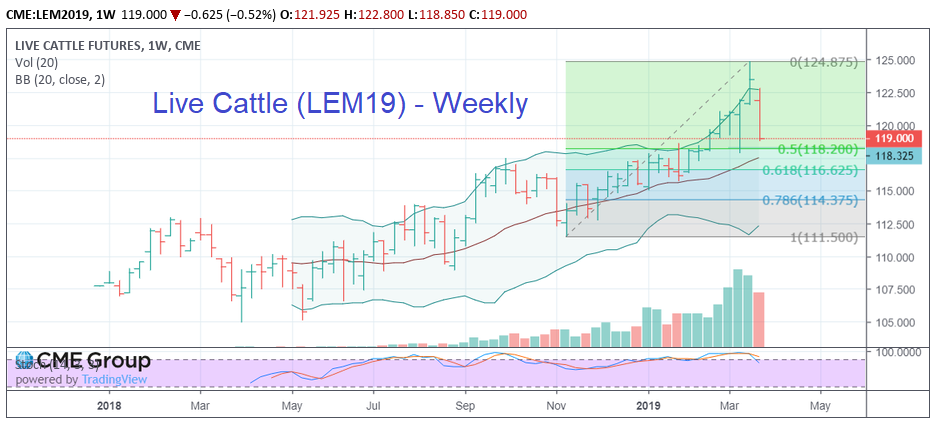

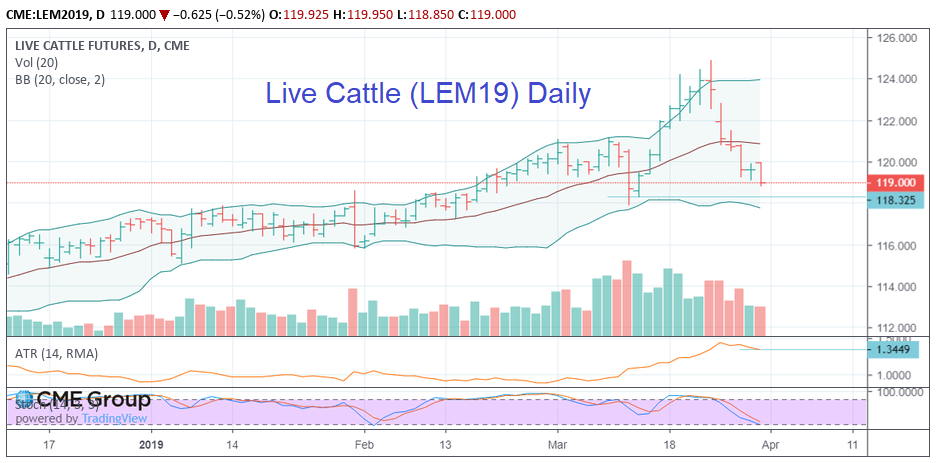

Below are weekly & daily charts for reference.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

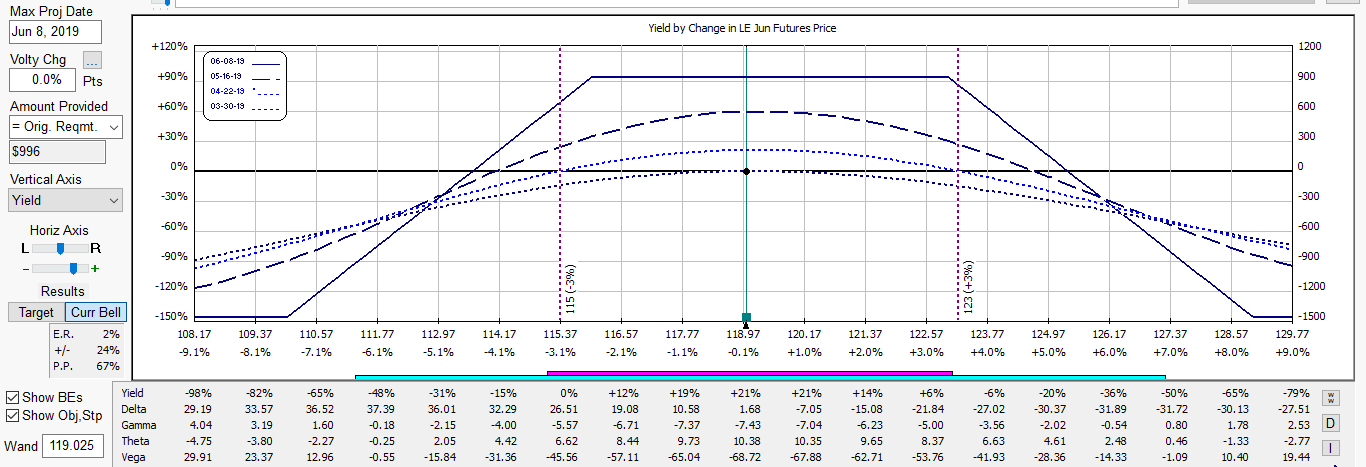

Below is the starting position for an iron condor which falls in line with Paul's weekly report based on looking at implied in relation to statistical volatility levels. The spread can be adjusted as the market reaches extremes.