Get your copy of Paul Forchione's book, "Trading Strangle Swaps". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

Highlights

- Employment report better than expected

- High of 123'22 Low of 123'08

- Wage number was weaker than expected

- Seller pressure has slowed to end last week

- Holding downtrend which is slowing

- Fed minutes next week with ECB

- News breaking on Brexit could impact rates

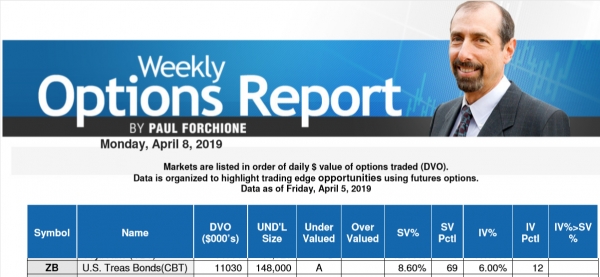

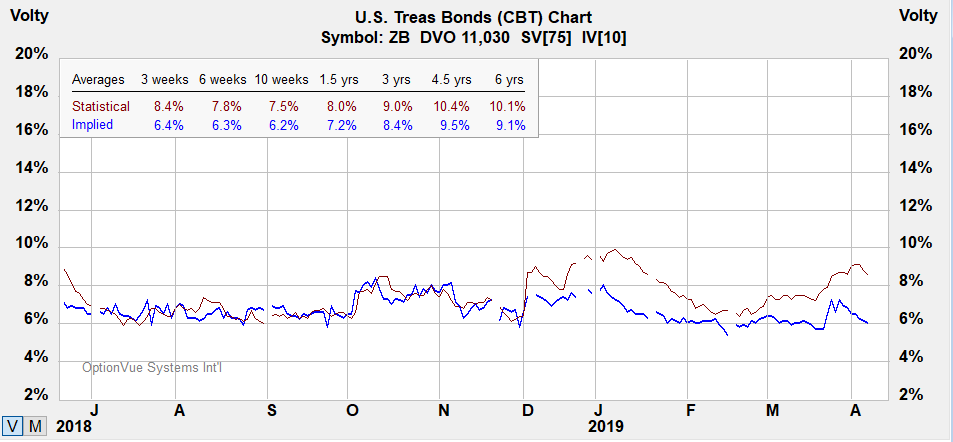

Volatility

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report.

Notes:

Contract Size - Points ($1,000) and 1/32 of a point. For example, 134-16 represents 134 16/32.

Tick Size: 1/64 of a point ($15.625/contract), rounded up to the nearest cent/contract.

Trading Hours: CME Globex: Sunday - Friday 5:00 p.m. - 4:00 p.m. Eastern Time (CST).

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Bond futures and options

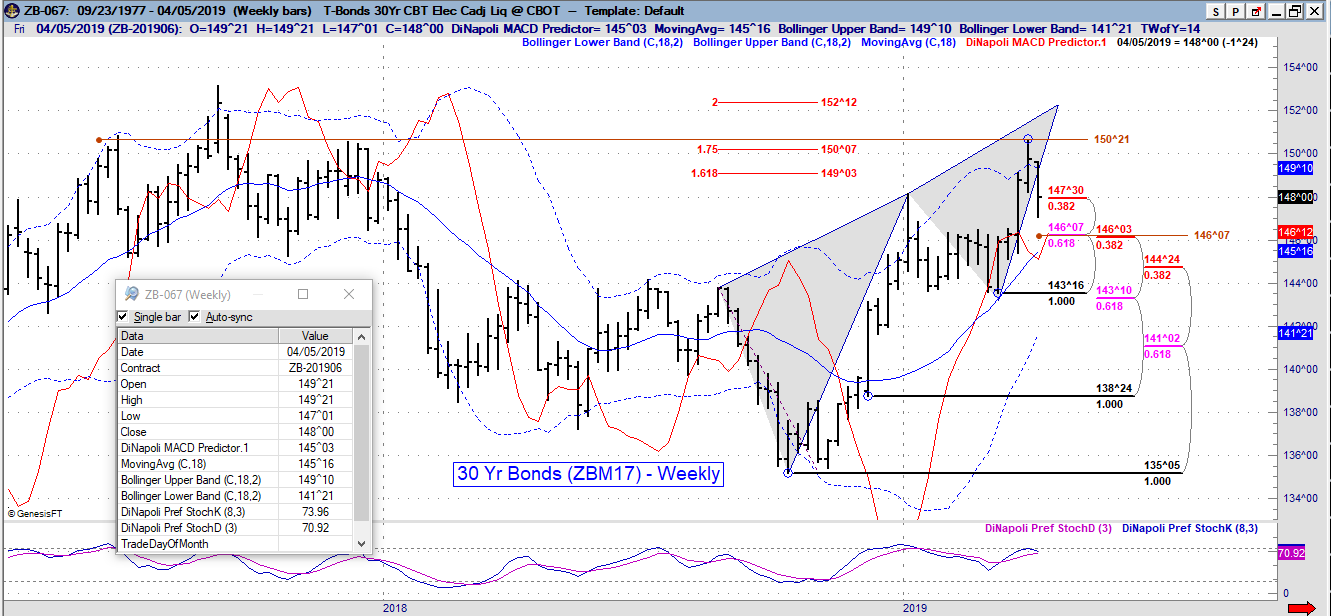

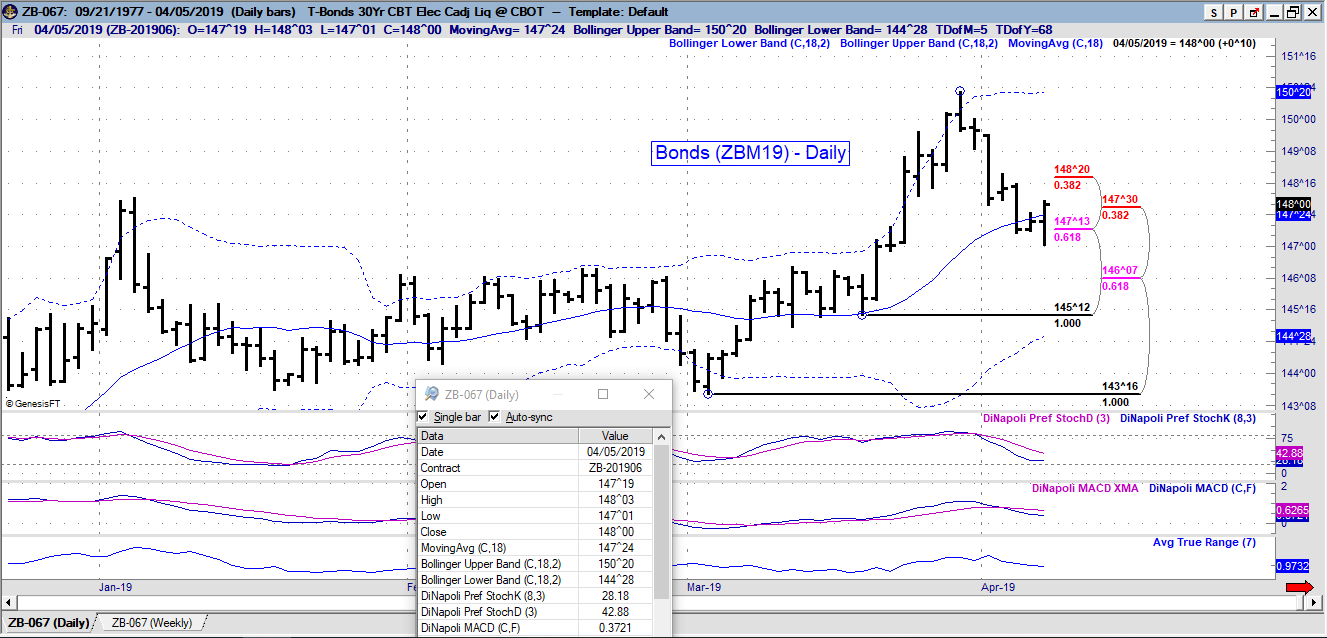

30 Year Bonds

Below are weekly & daily charts for reference.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

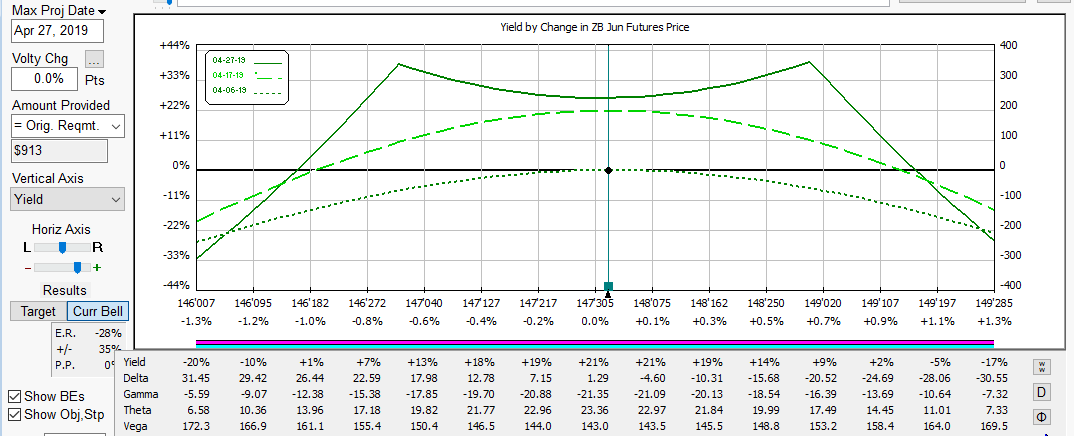

Below is the starting position for an strangle swaps. It allows for time to adjust the spread structure if necessary as price moves within a reasonable range of daily volatility. If prices rebound slightly near technical support levels (Fibonacci and Bollinger Band center) remaining above at 146 range, the structure will profit.

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below. The structure has positive time decay which is an advantage over holding outright options.