p>Below is an illustration trading futures options on 10 Year notes (ZN). Our post shows bullish and bearish positions using a combination of call and put options.

Trade Options on Futures

10 year Notes (ZN) * Directional & Neutral Positions

Get your copy of Paul Forchione's book, "Trading Iron Condors". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

Terms of Use & Disclaimer:

Entries shown in our Watchlist and MarketPlus do not include commissions and are based on listed settlement prices for reference only.

This publication is intended solely for information purposes and is not to be construed, under any circumstances, by implication or otherwise, as an offer to sell or solicitation to buy or sell or trade in any commodities or securities herein named. Information is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any publication is construed as an express or implied promise, guarantee or implication by or from Oahu Capital Group, LLC, Oahu Capital Group (Asia) Pvt. Ltd. that you will profit or that losses can or will be limited in any manner whatsoever. Past results are no indication of future performance. All investments are subject to risk, which should be considered prior to making trading decisions.

CFTC regulation 4.41 requires the following disclaimer:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT , THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCES RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELEY AFFECT ACTUAL TRADING RESULTS.

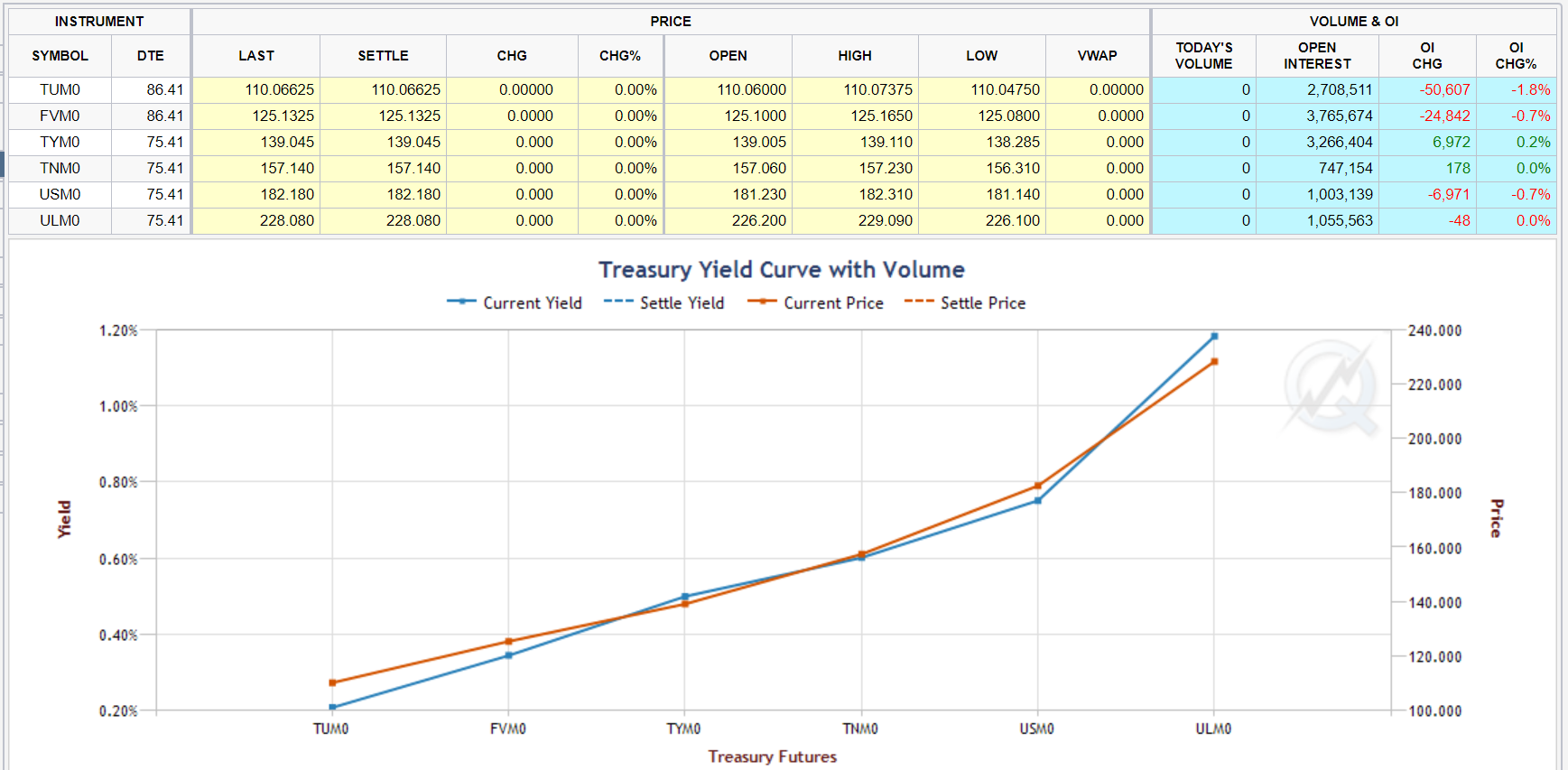

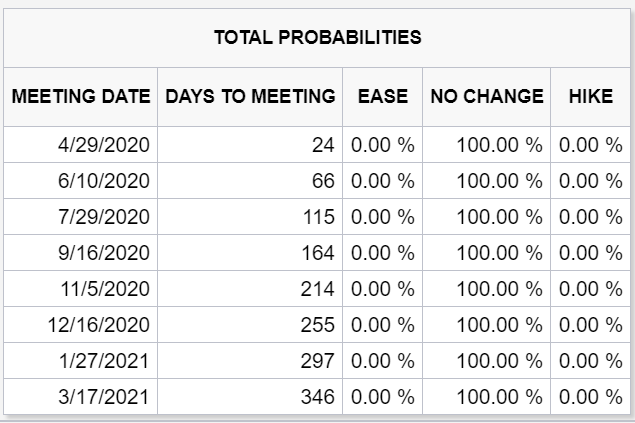

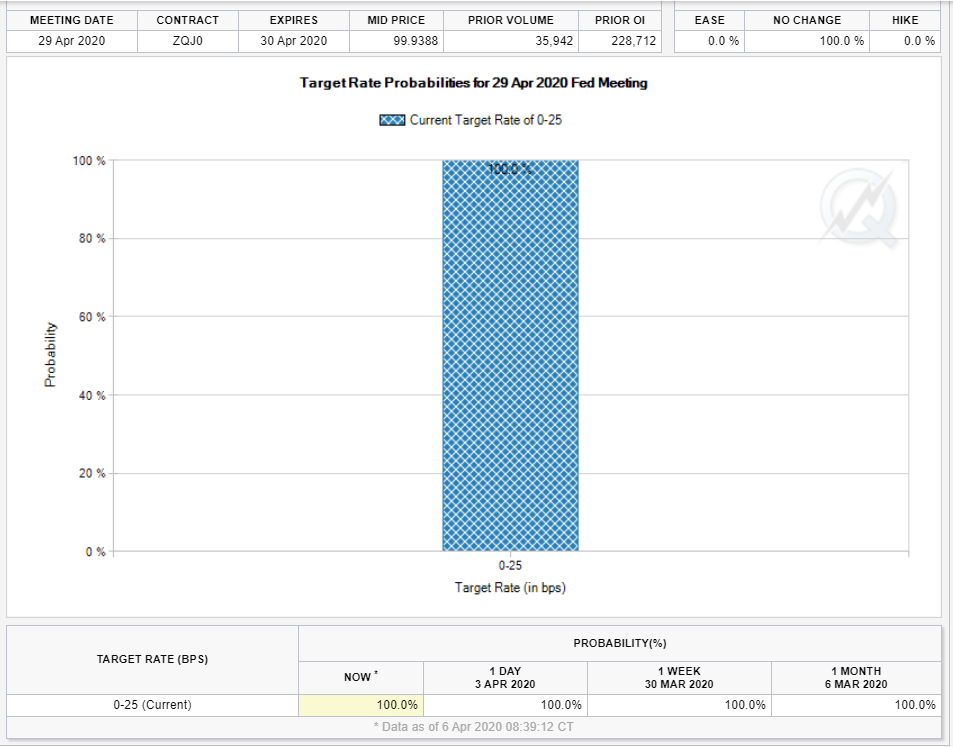

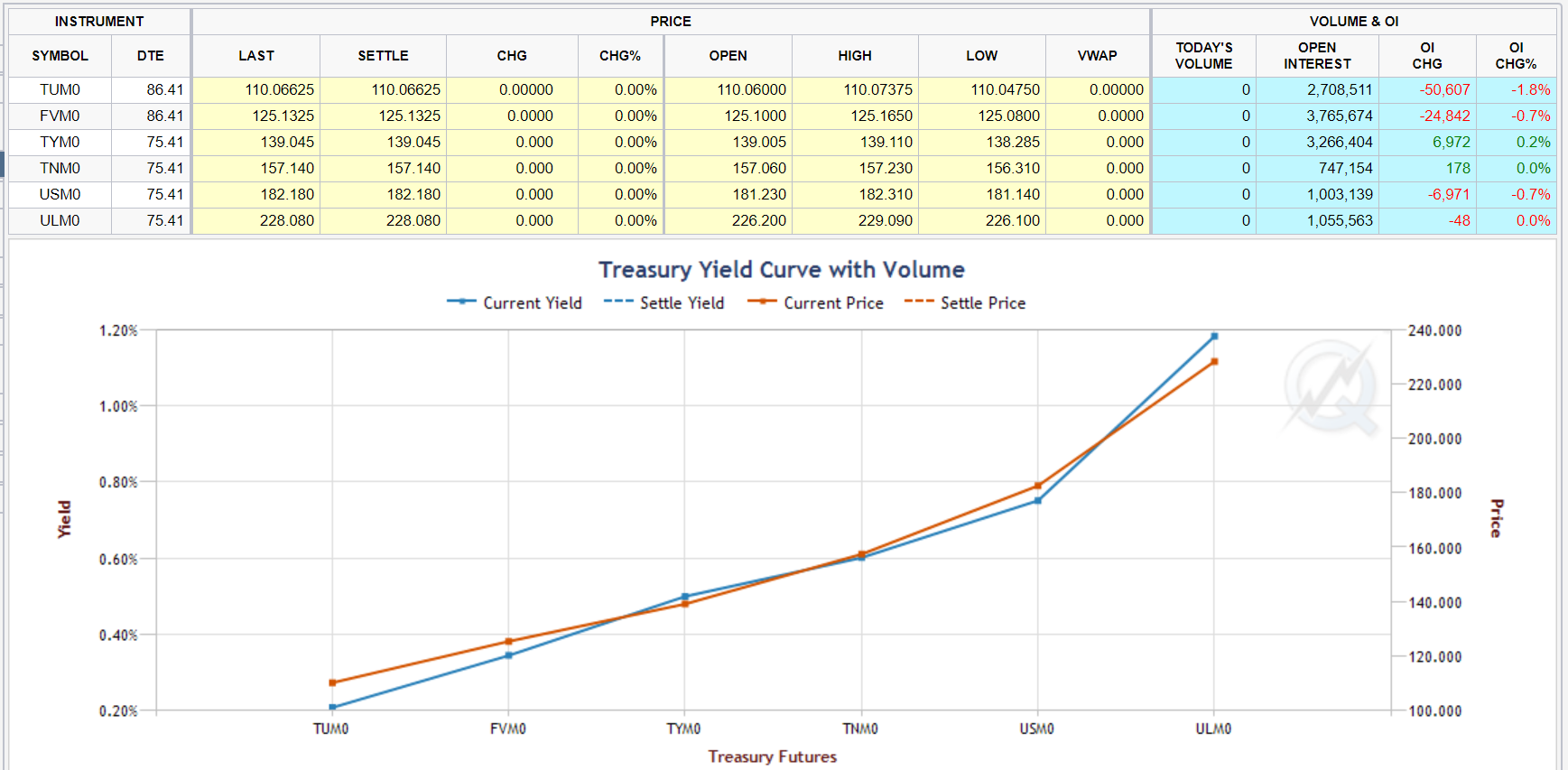

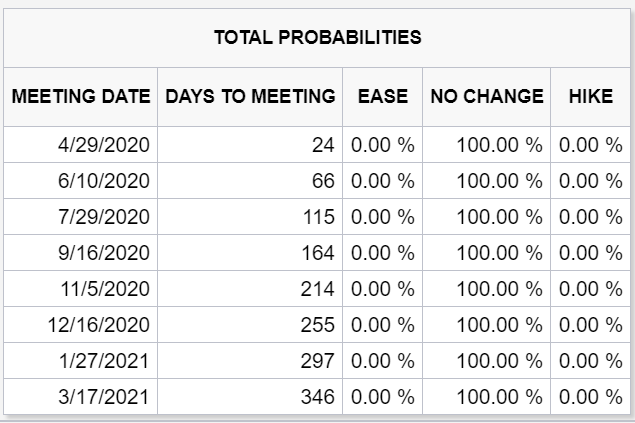

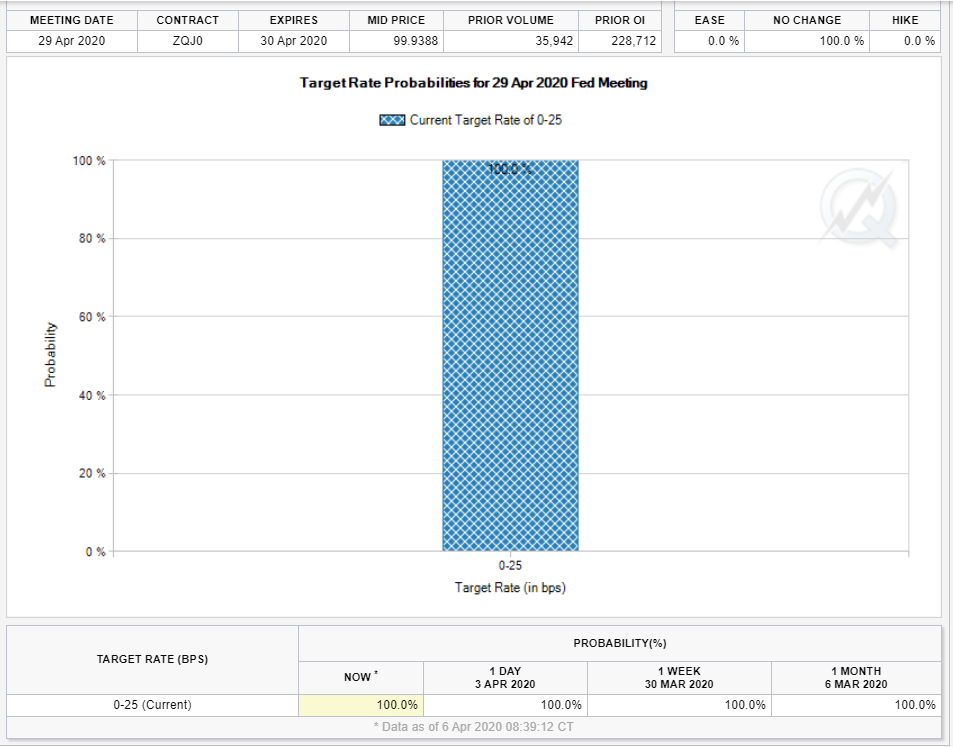

Term Structure

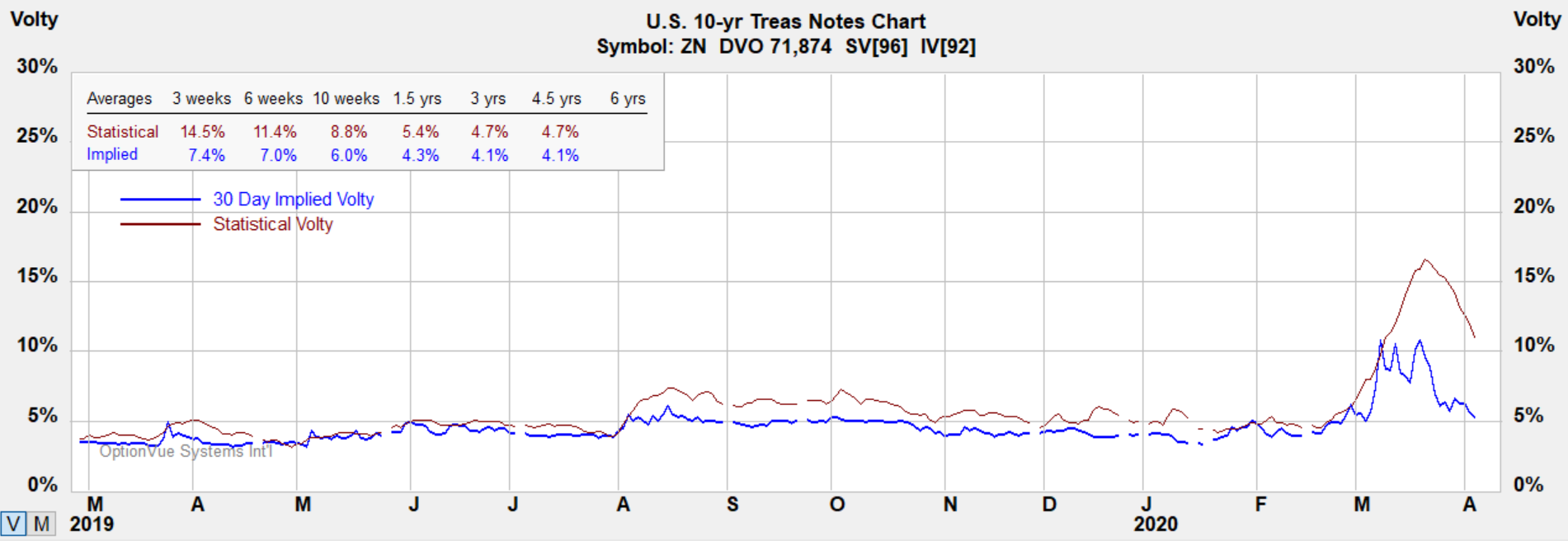

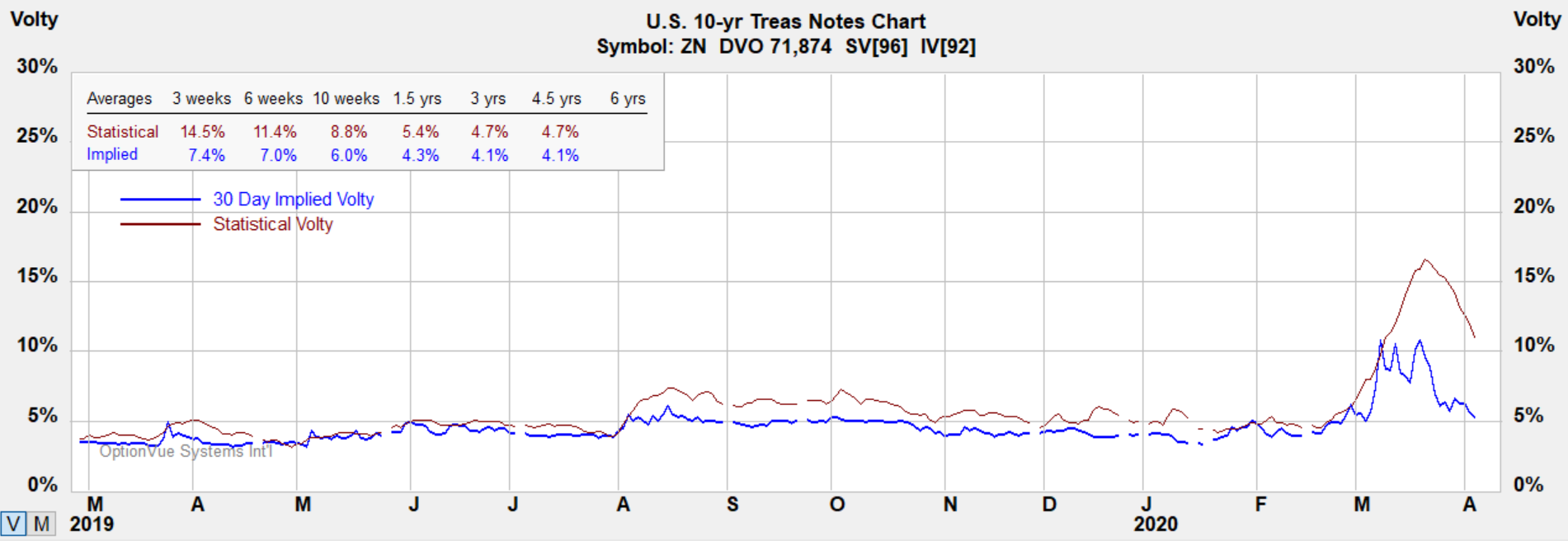

Volatility

Options fall into the category of being slightly undervalued in volatile markets in the weekly options report.

Notes:

Price Quotes: Points ($1,000) and 1/32 of a point. For example, 134-16 represents 134 16/32. Par is on the basis of 100 points.

Trading Hours: SUN - FRI: 5:00 p.m. - 4:00 p.m.

* Tip: Understanding what the numbers mean when looking at 30 year bond prices. The quotation you see is in U.S. dollars and cents on the index. Points ($1,000) and 1/32 of a point. For example, 134-16 represents 134 16/32. Par is on the basis of 100 points. Options - 1/64 of a point ($15.625/contract), rounded up to the nearest cent/contract. Learn more on our tutorial.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Bond futures and options

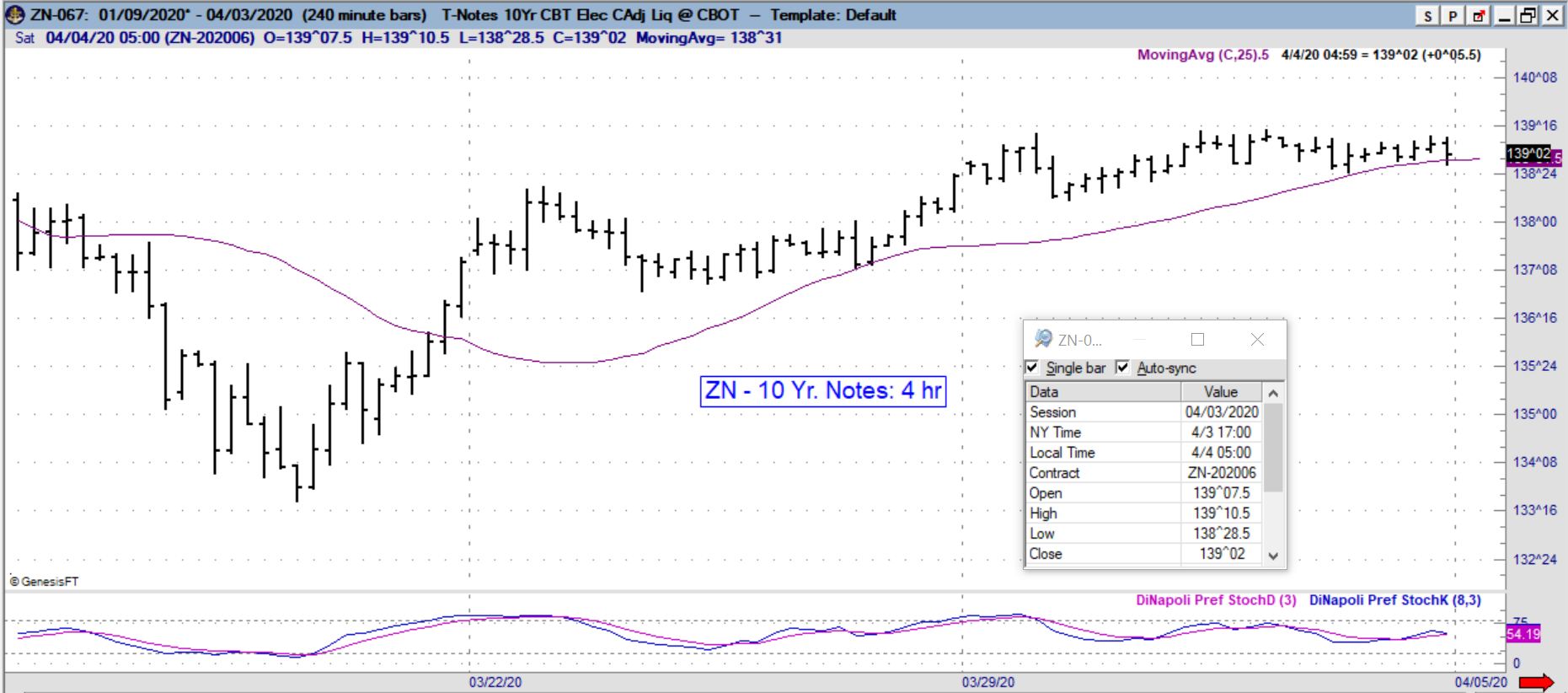

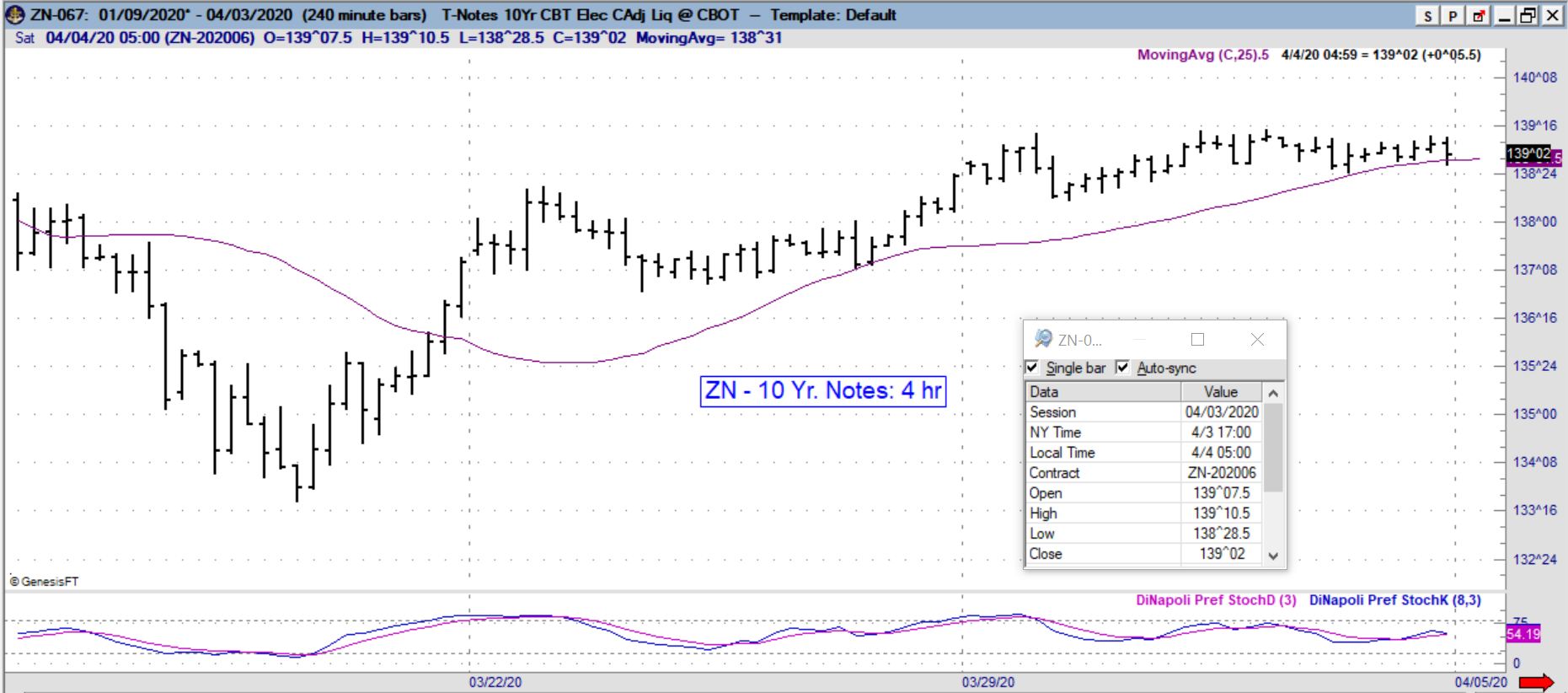

10 Year Notes

* Tip: To view a larger chart image, simply right click on the image with your mouse. Next, select view image. Be sure to click the back arrow on your browser to go back to the original page.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

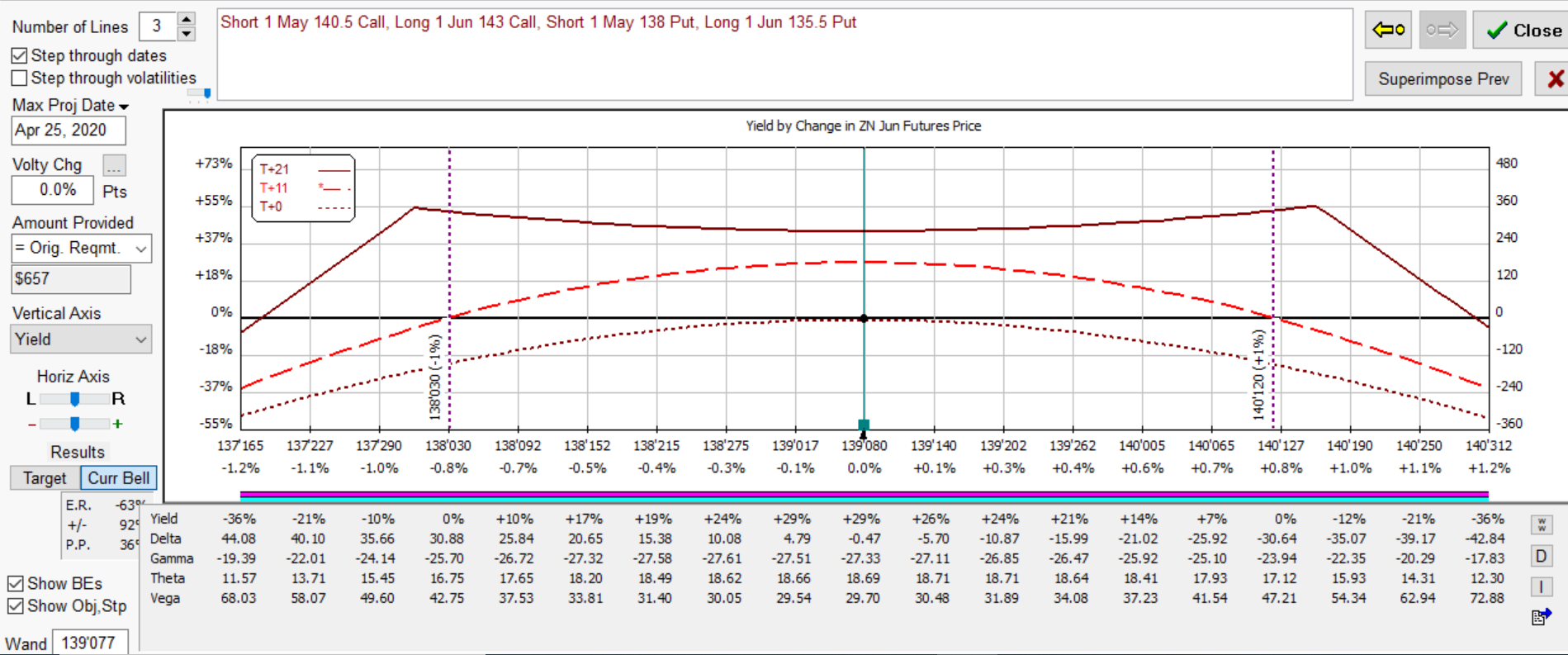

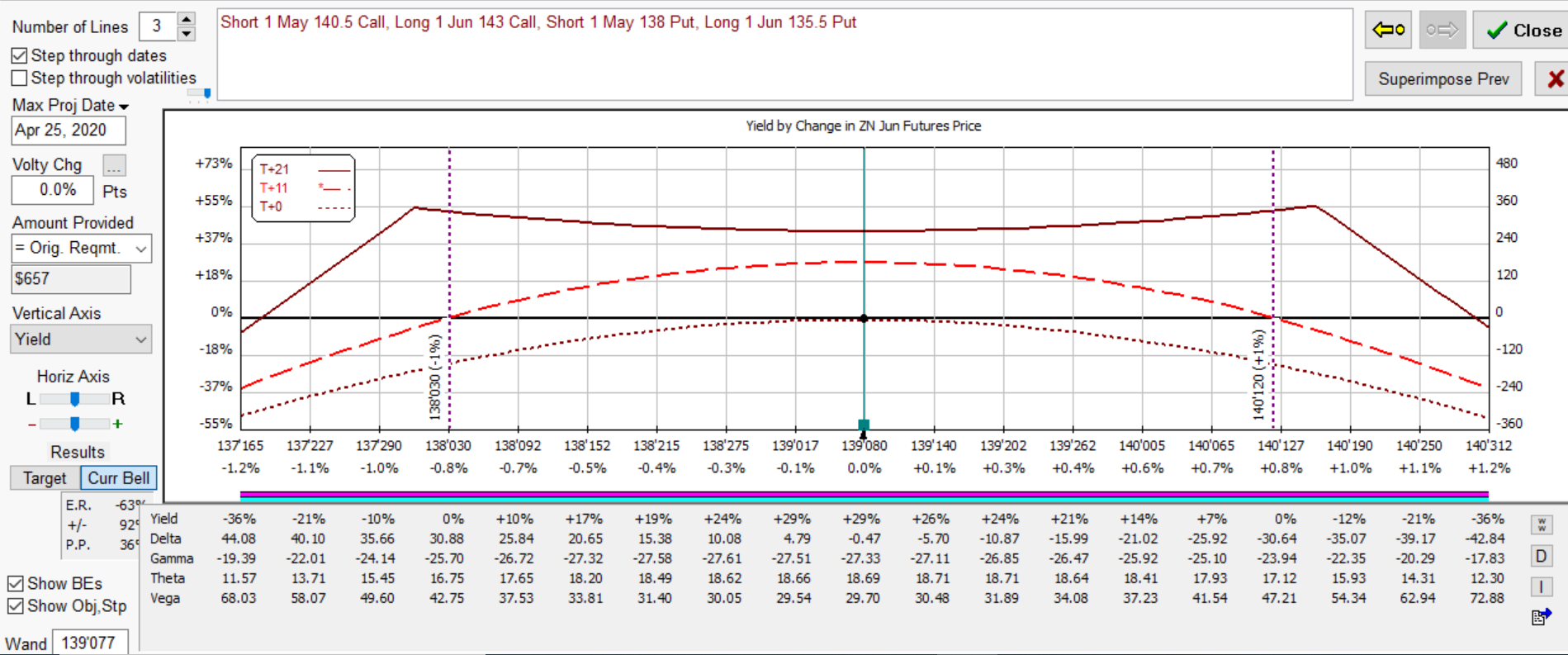

Strategies

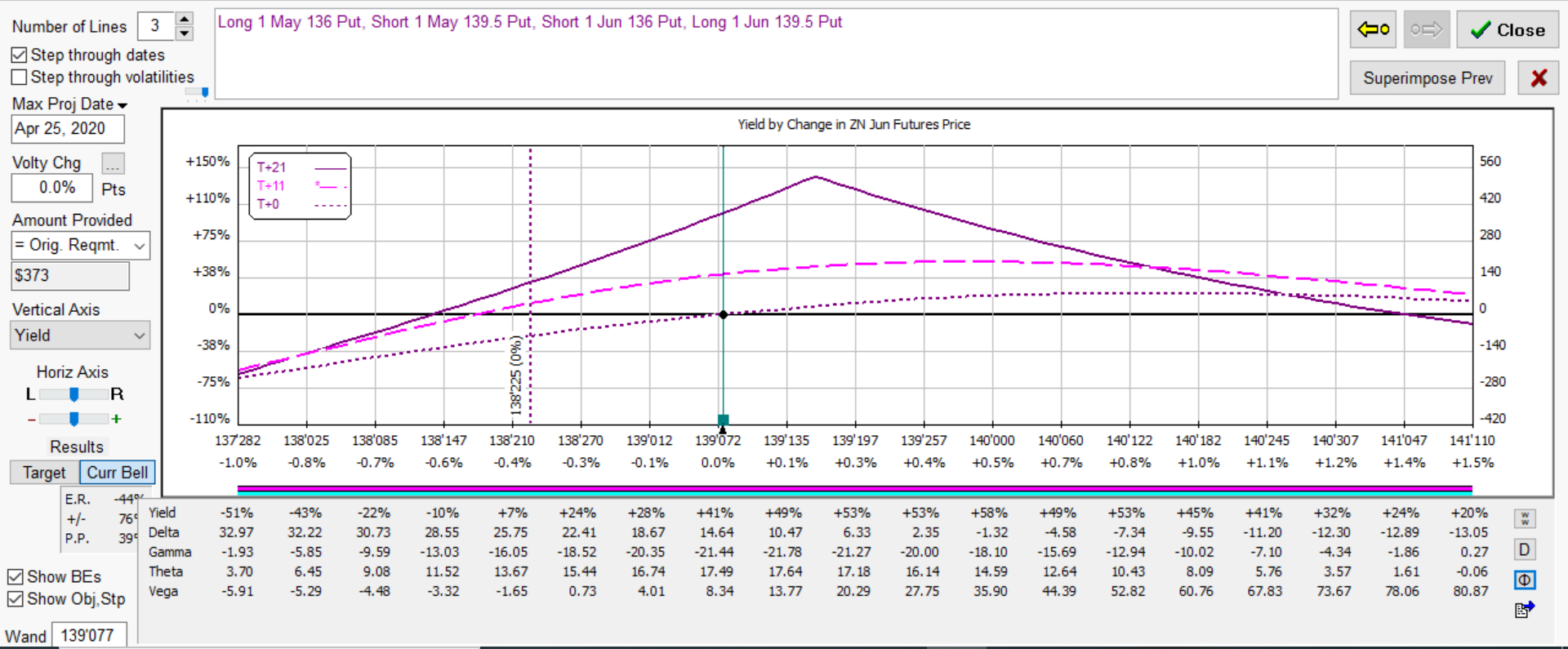

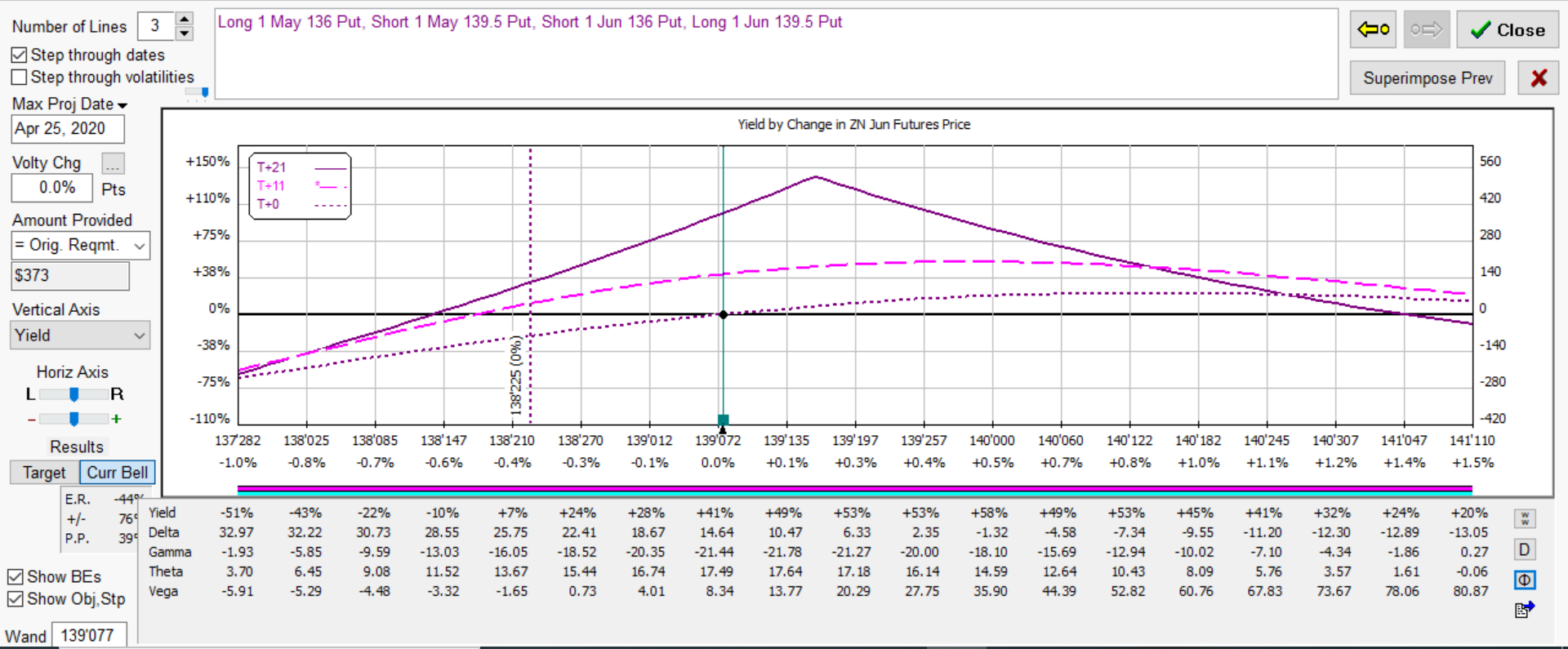

Below is the starting position for a strangle swaps. It's a variation to a standard iron condor structure which benefits from an increase in implied volatility and time decay. It allows for time to adjust the spread structure if necessary as price moves within a reasonable range.

Below is a put credit spread transitioned to a vertical swap with rate assumptions above.