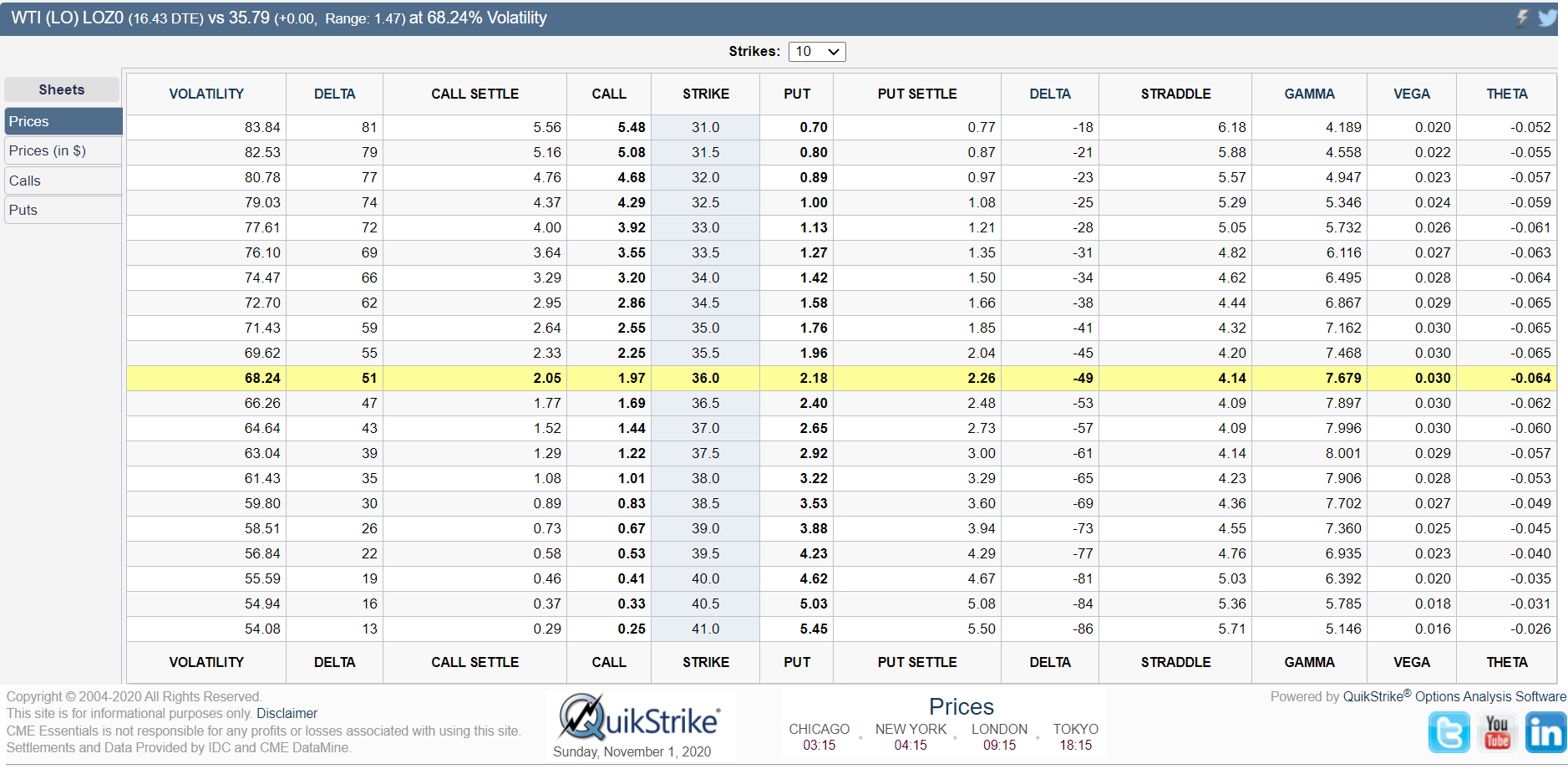

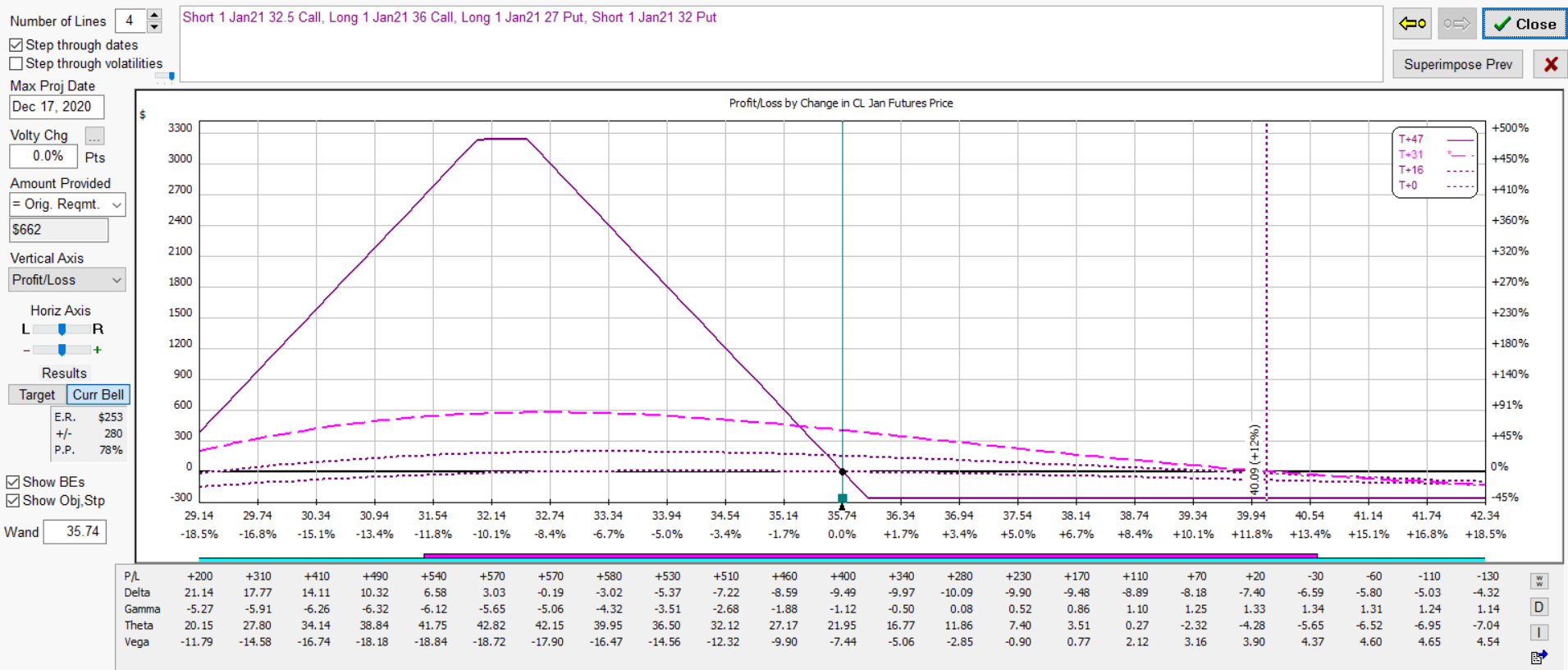

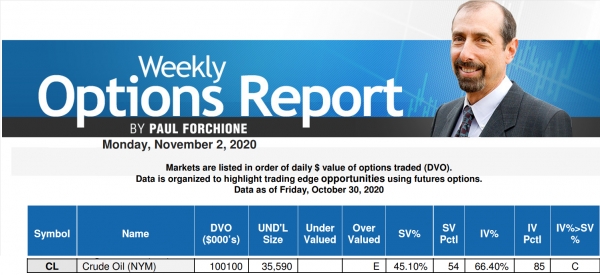

Below is an illustration trading futures options on Crude Oil. Our post shows bullish and bearish positions using a combination of call and put options.

Listen to our Podcast Nov 02, 2020

Email questions: This email address is being protected from spambots. You need JavaScript enabled to view it.

Back to Watchlist

Trade Options on Futures

Crude Oil * Directional & Neutral Positions

Get your copy of Paul Forchione's book, "Special Setups". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

Terms of Use & Disclaimer:

Entries shown in our Watchlist and MarketPlus do not include commissions and are based on listed settlement prices for reference only.

This publication is intended solely for information purposes and is not to be construed, under any circumstances, by implication or otherwise, as an offer to sell or solicitation to buy or sell or trade in any commodities or securities herein named. Information is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any publication is construed as an express or implied promise, guarantee or implication by or from Oahu Capital Group, LLC, Oahu Capital Group (Asia) Pvt. Ltd. that you will profit or that losses can or will be limited in any manner whatsoever. Past results are no indication of future performance. All investments are subject to risk, which should be considered prior to making trading decisions.

CFTC regulation 4.41 requires the following disclaimer:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT , THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCES RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELEY AFFECT ACTUAL TRADING RESULTS.

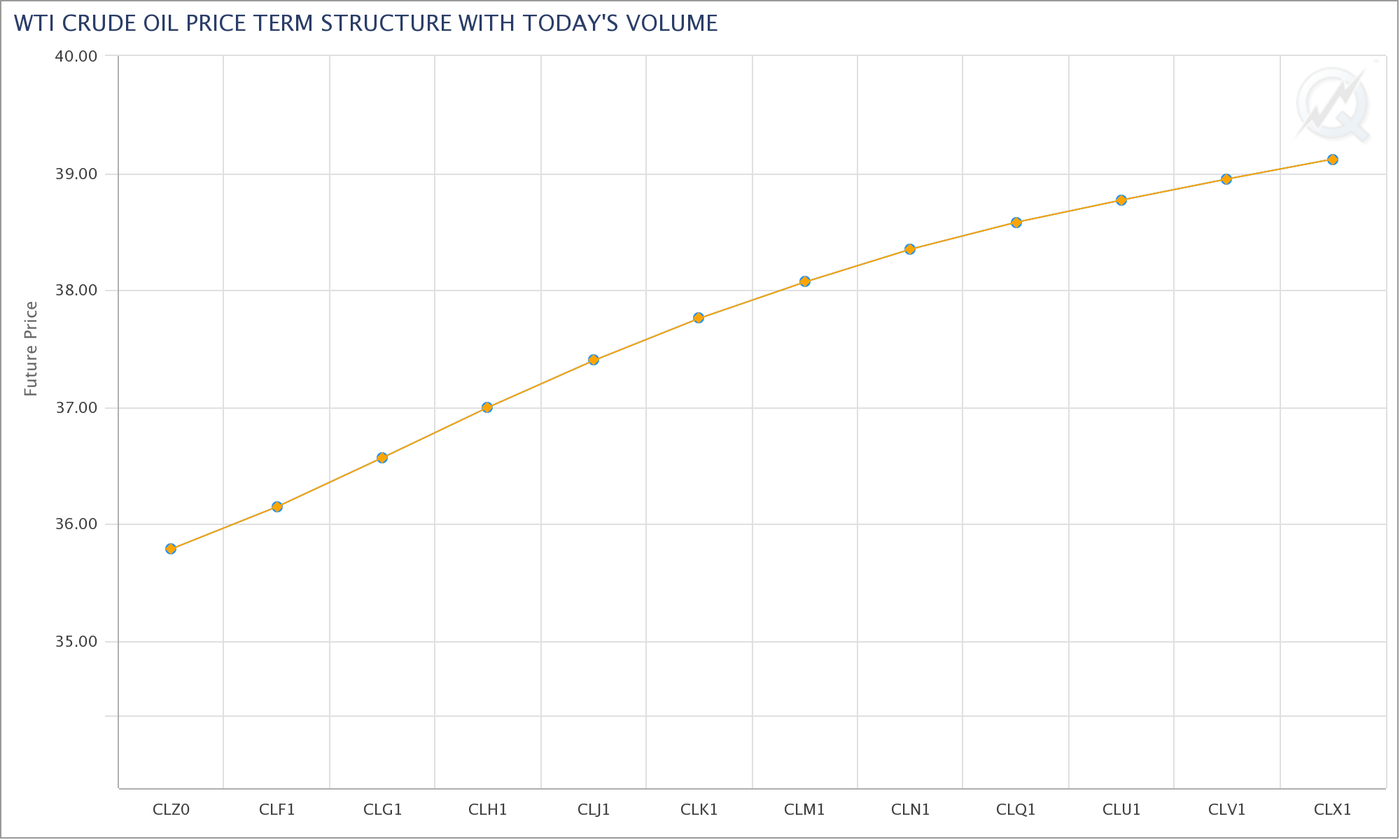

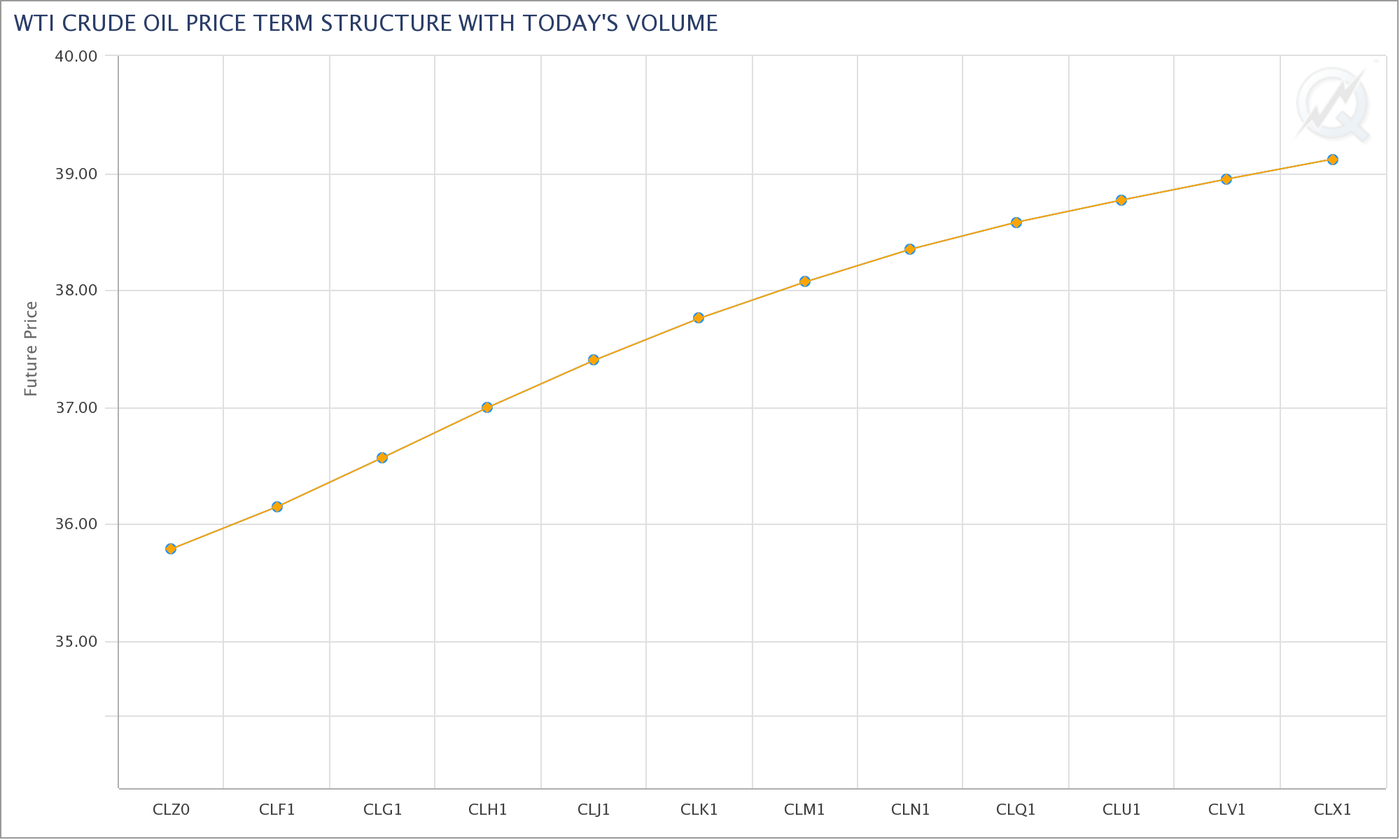

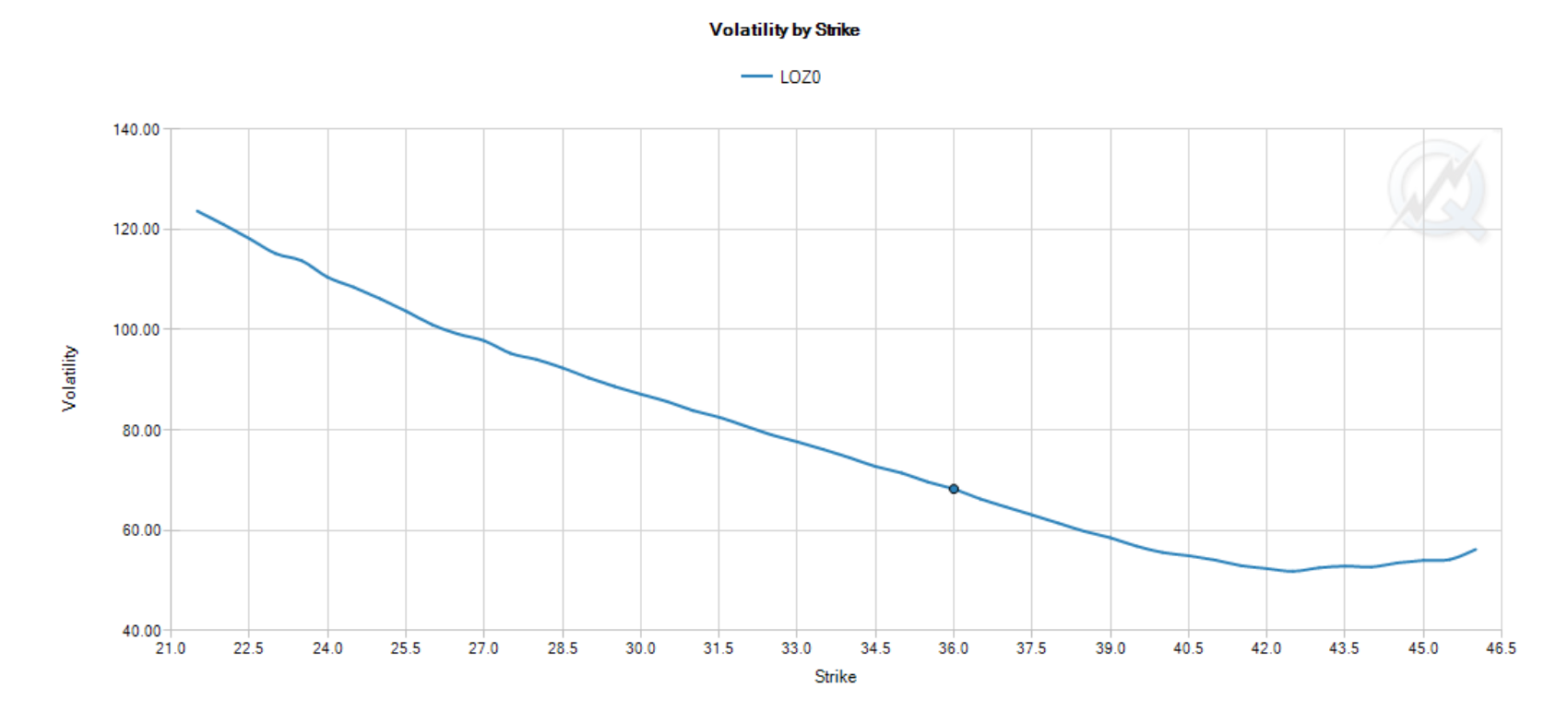

Term Structure

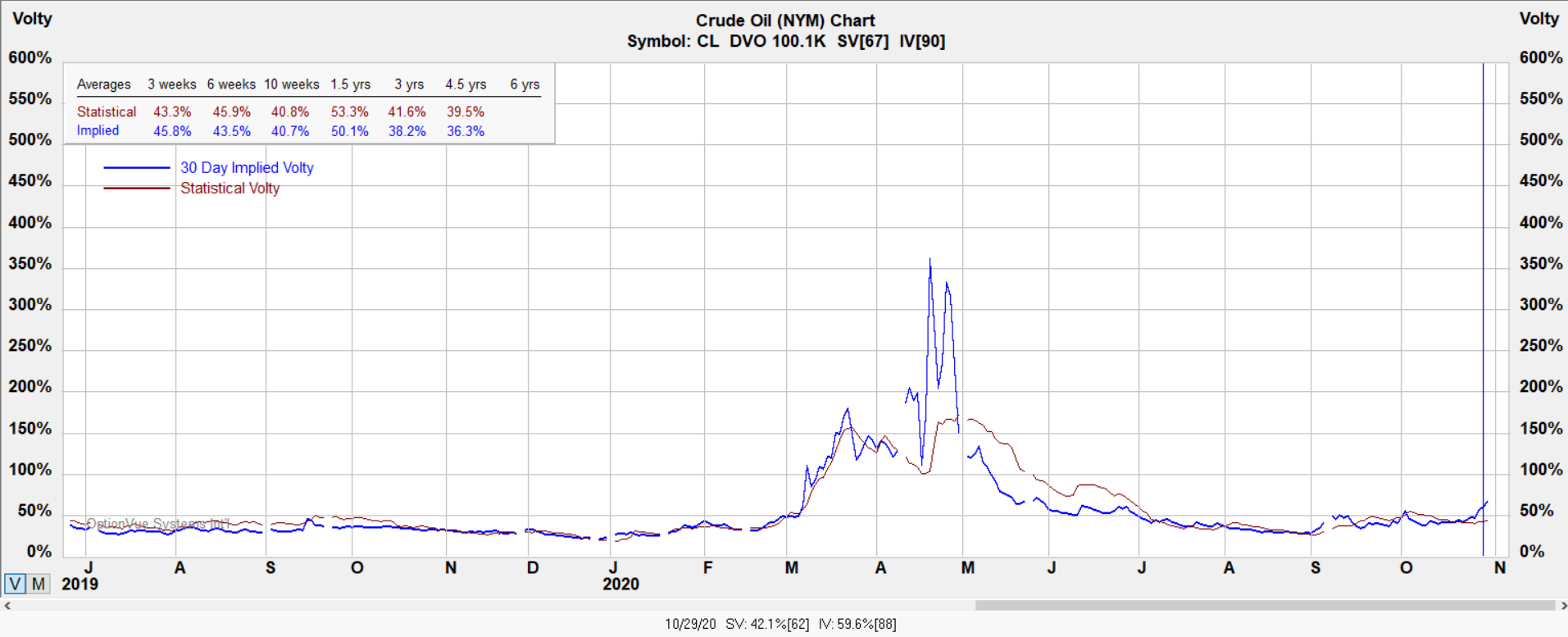

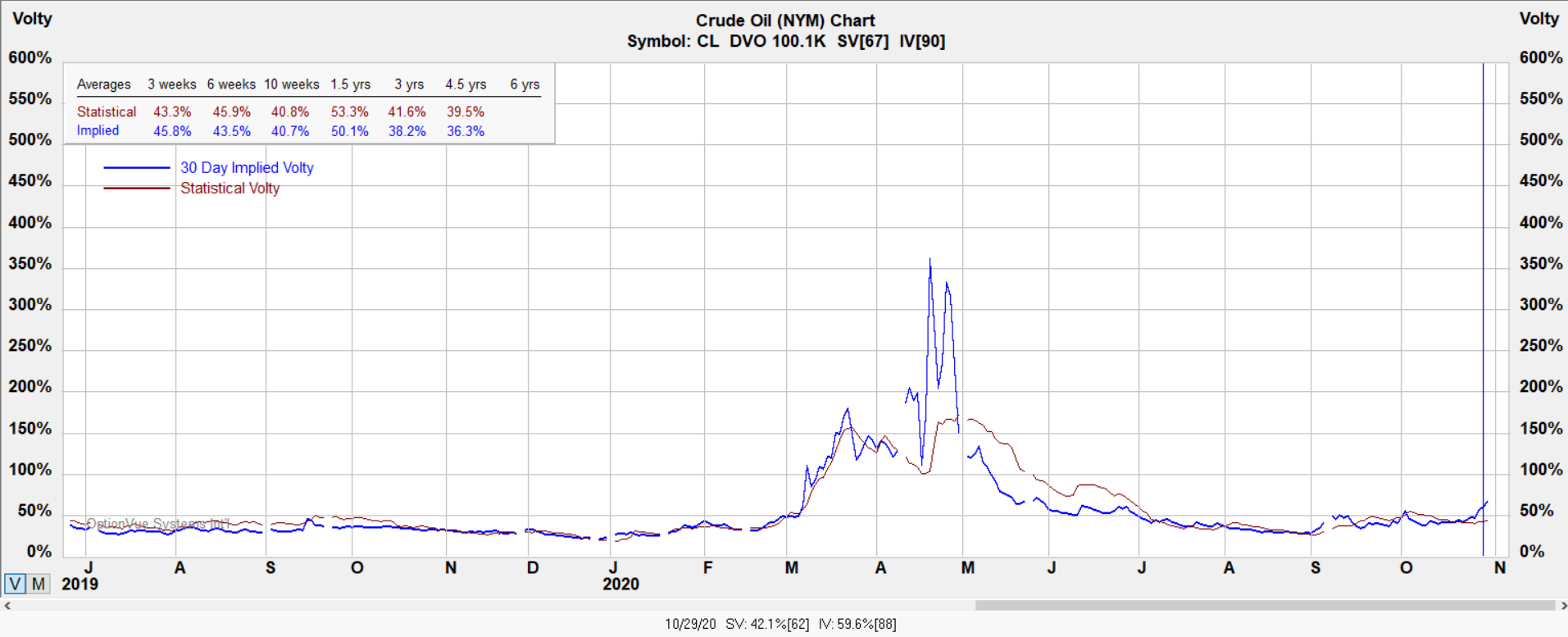

Volatility

Notes:

Contract Size - 1,000 barrels.

Tick Size: Outright: dollars and cents with 0.01 points=$10

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (CST).

* Tip: Click here to read a helpful tip about Crude Oil futures and options

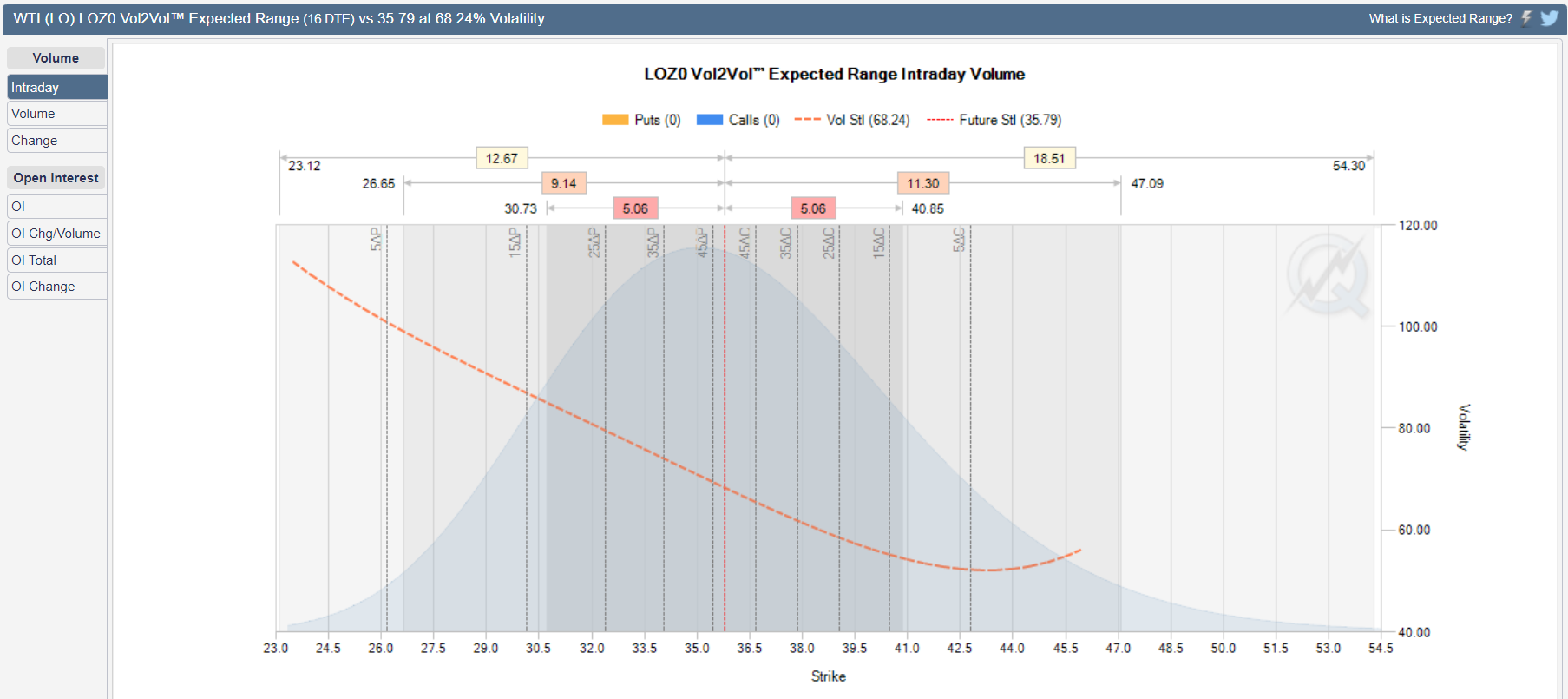

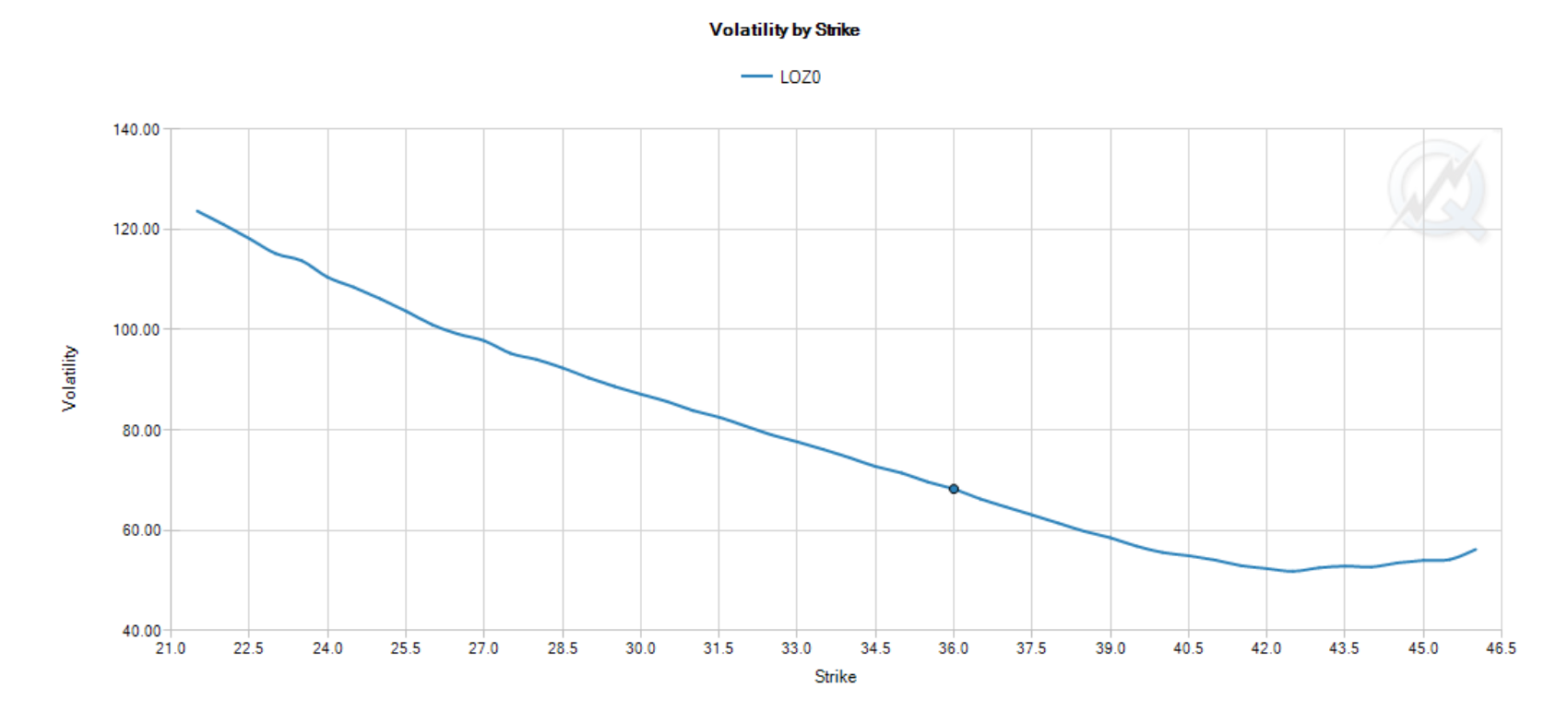

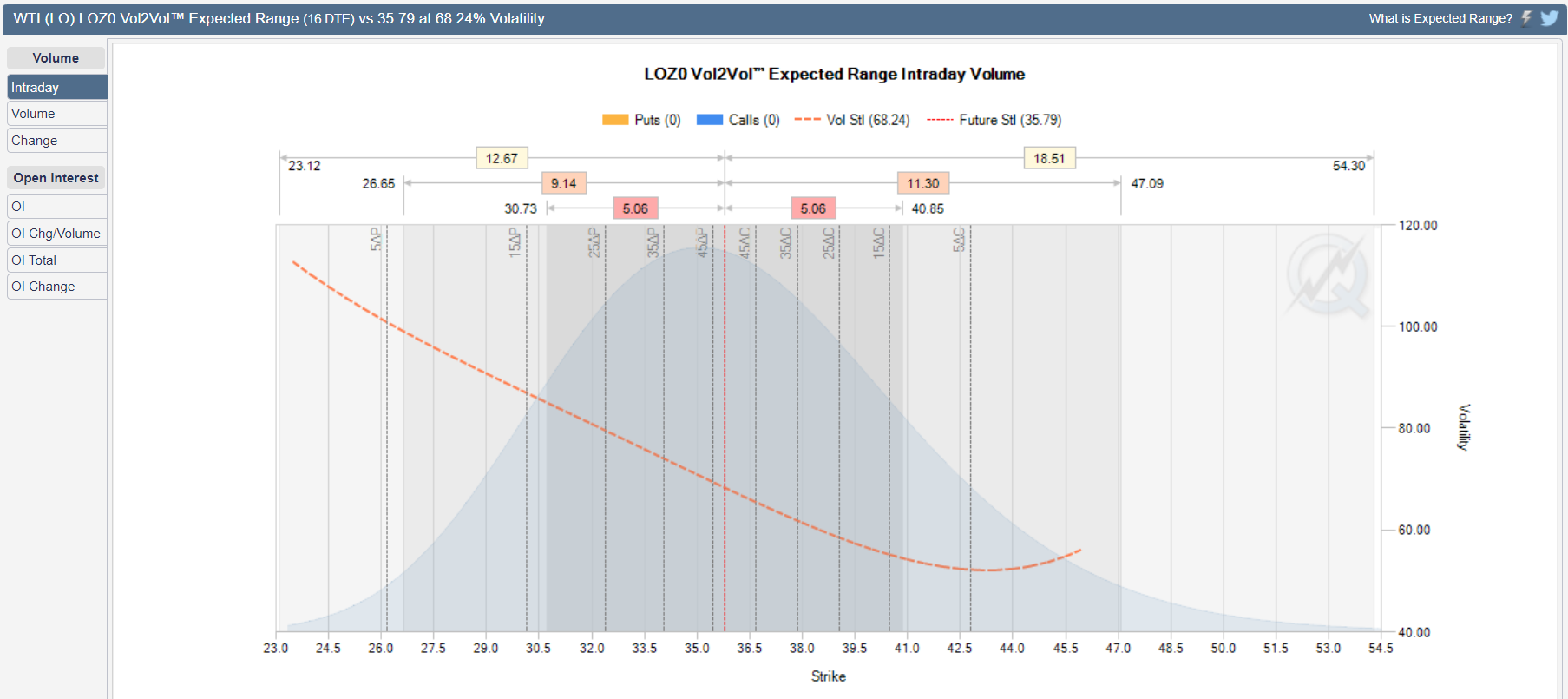

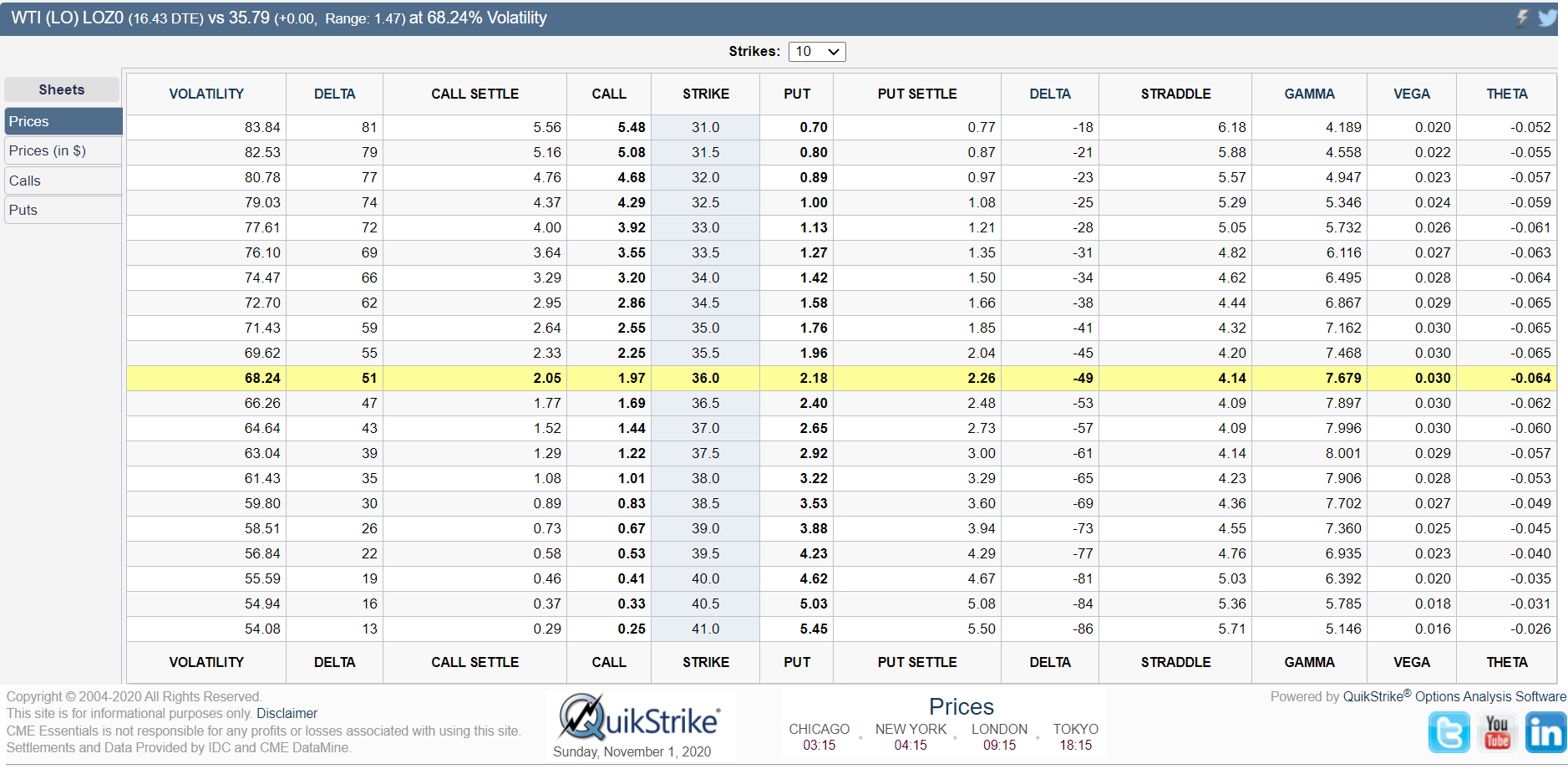

Charts

* Tip: Understanding what the numbers mean when looking at Crude Oil prices. The quotation you see is U.S. dollars and cents per barrel (42 gallons). Each contract you are buying or selling is 1,000 barrels. A 1 tick move is $10 USD calculated as $0.01 x 1,000 barrels.

* Tip: Click here on enlarging images

Strategies

* Tip: To view a larger chart image, simply right click on the image with your mouse. Next, select view image. Be sure to click the back arrow on your browser to go back to the original page.

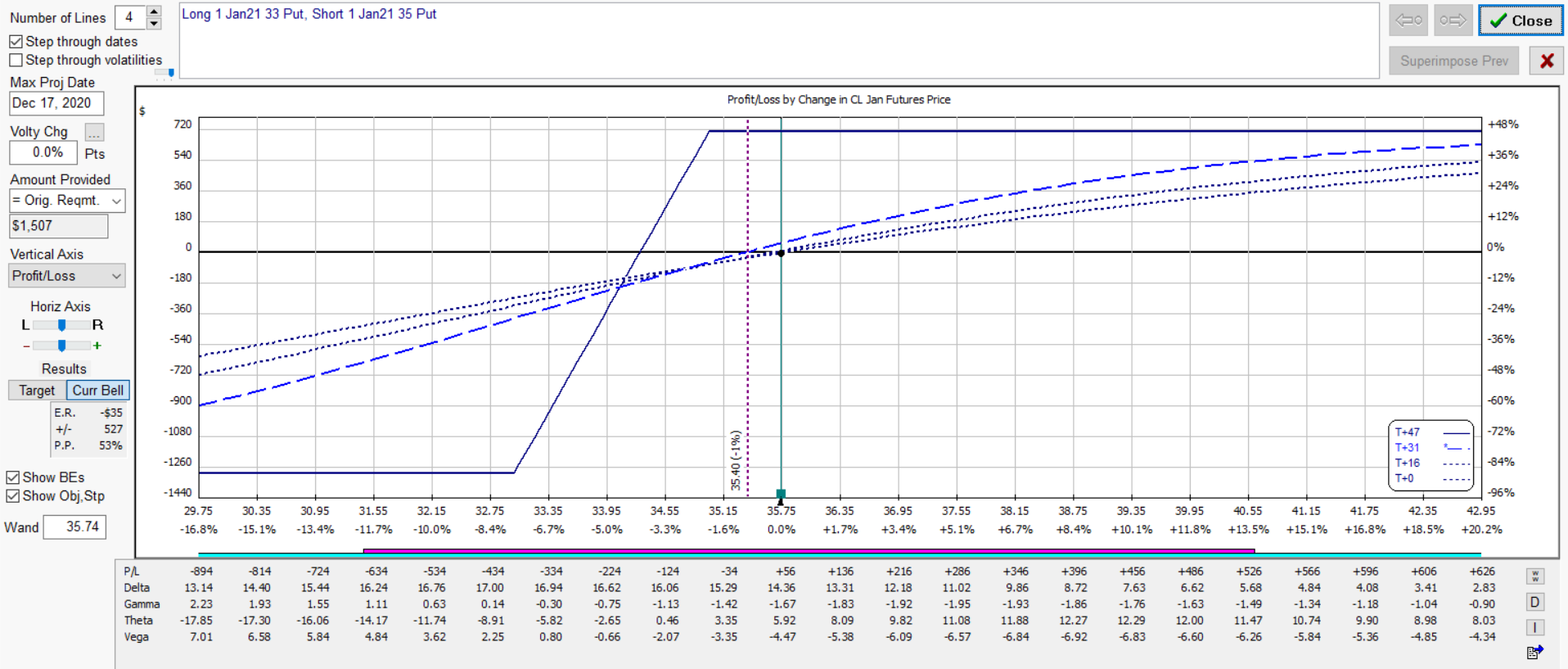

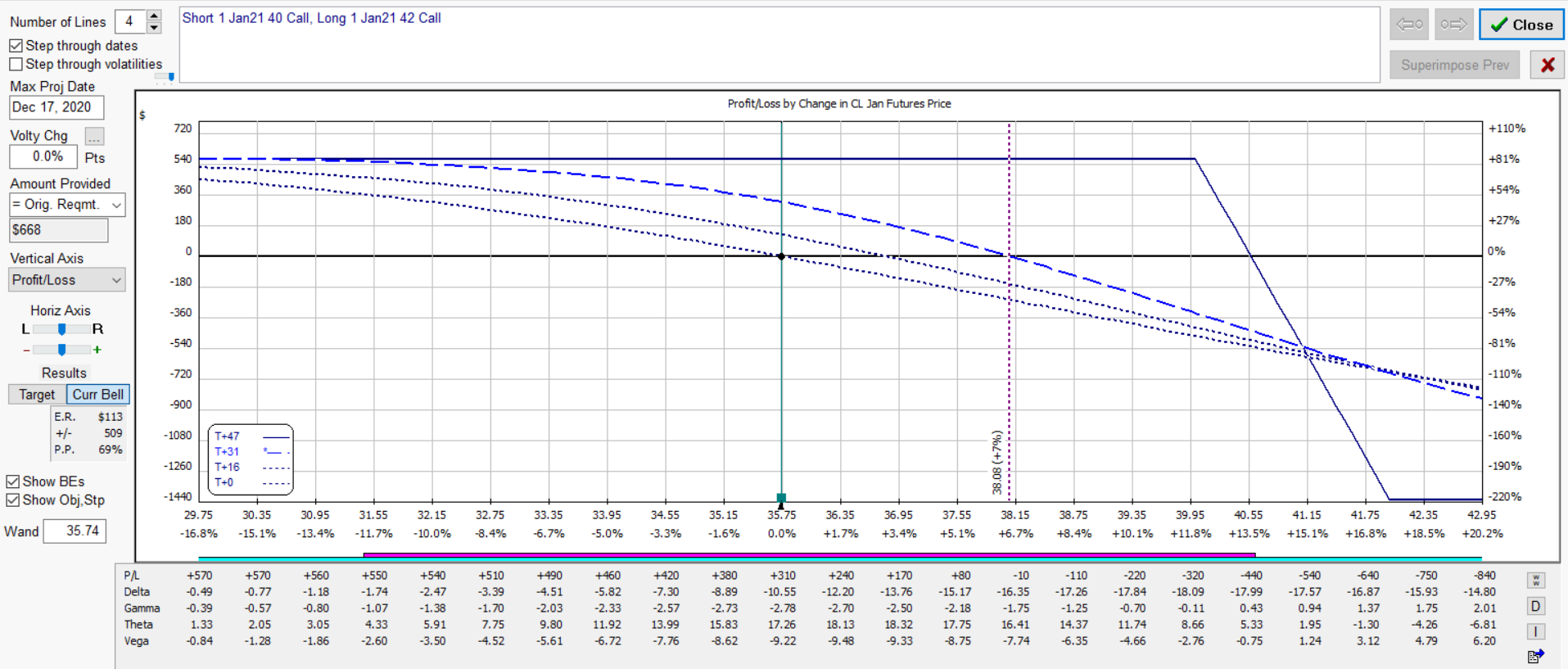

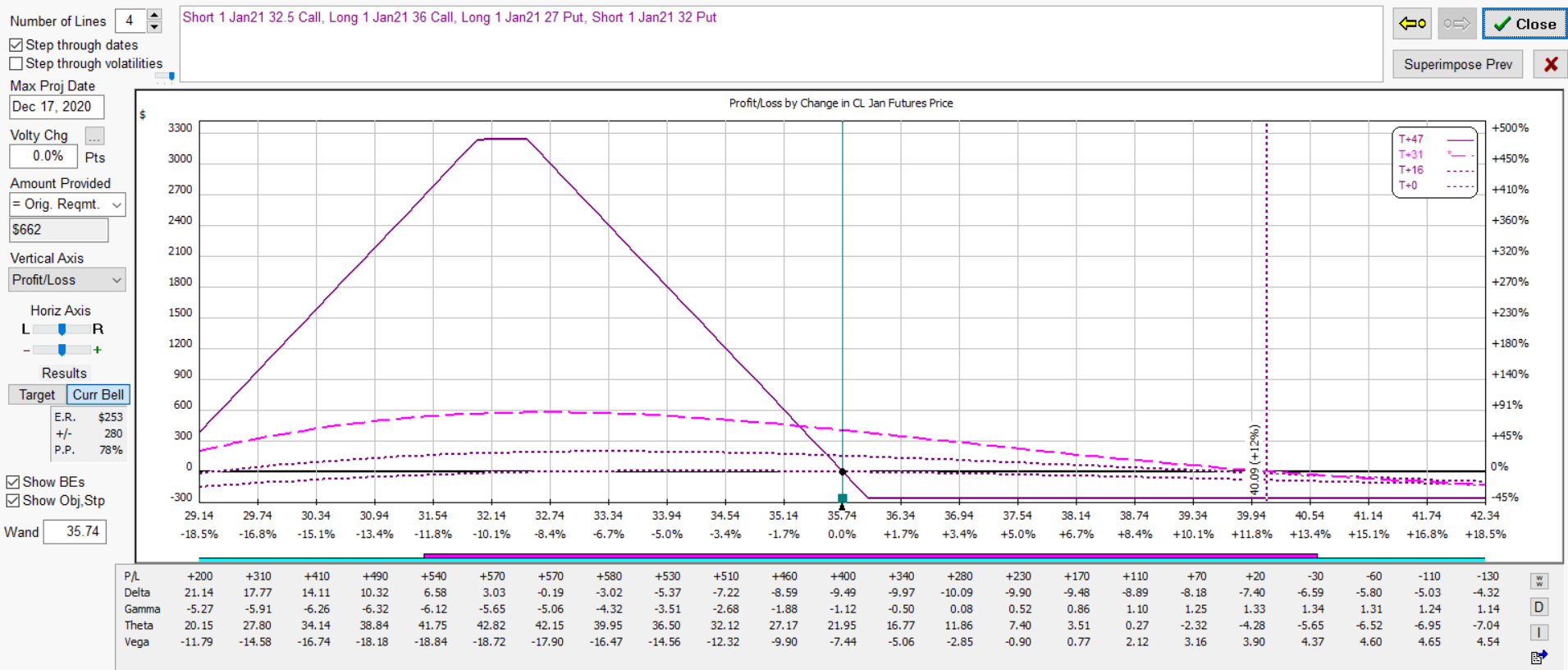

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below. The structure has positive time decay which is an advantage over holding outright options.

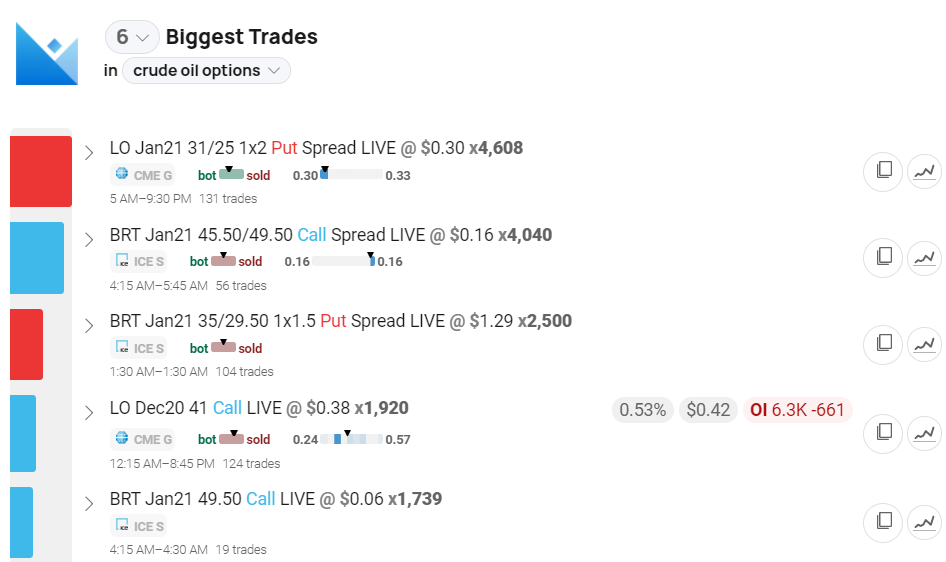

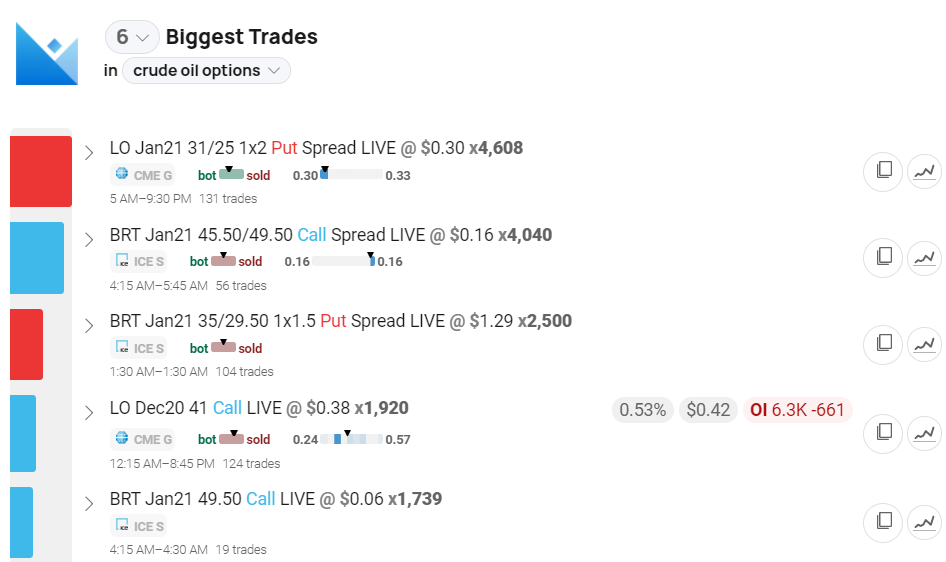

Option Spreads in the Market

Below is a quick glimpse on particular spreads that stand out in the markets. You can see this from the number of bid - offer activity and open interest as we explain in our podcast.

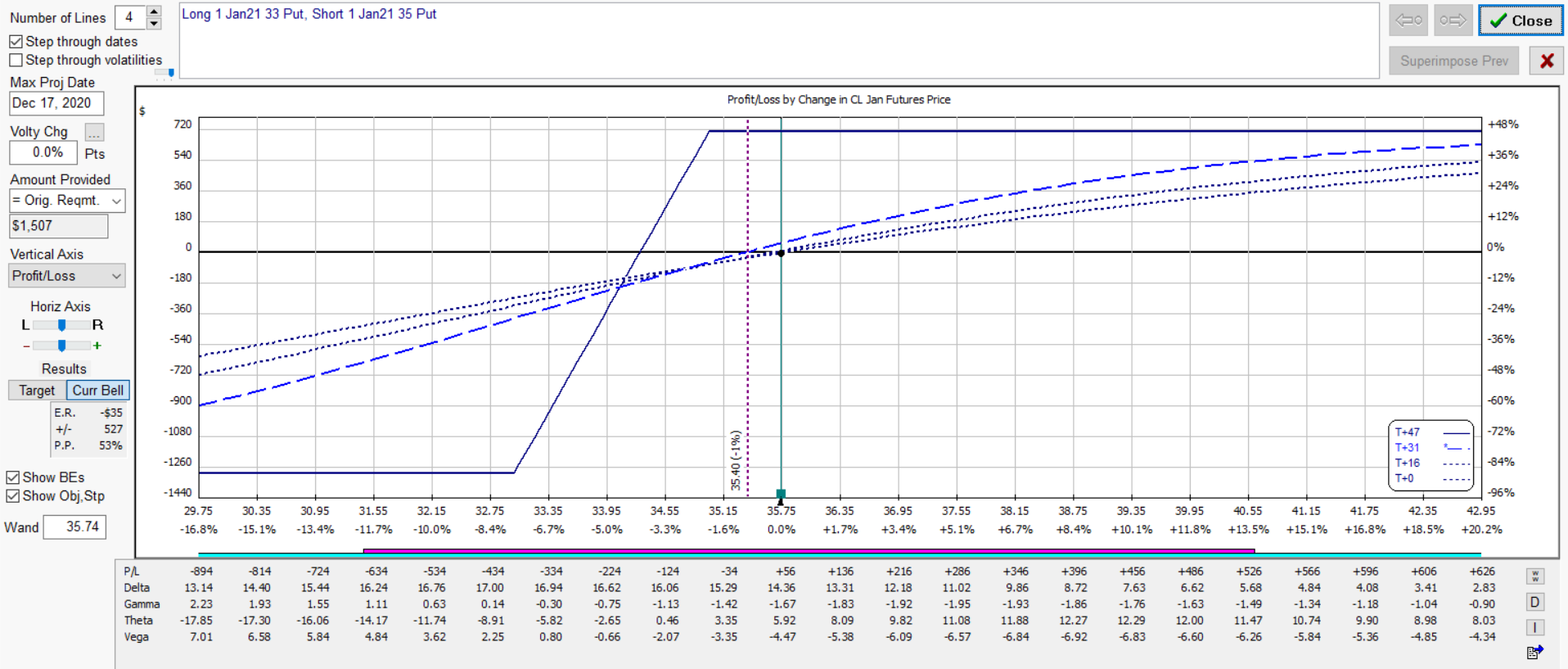

Bull Put

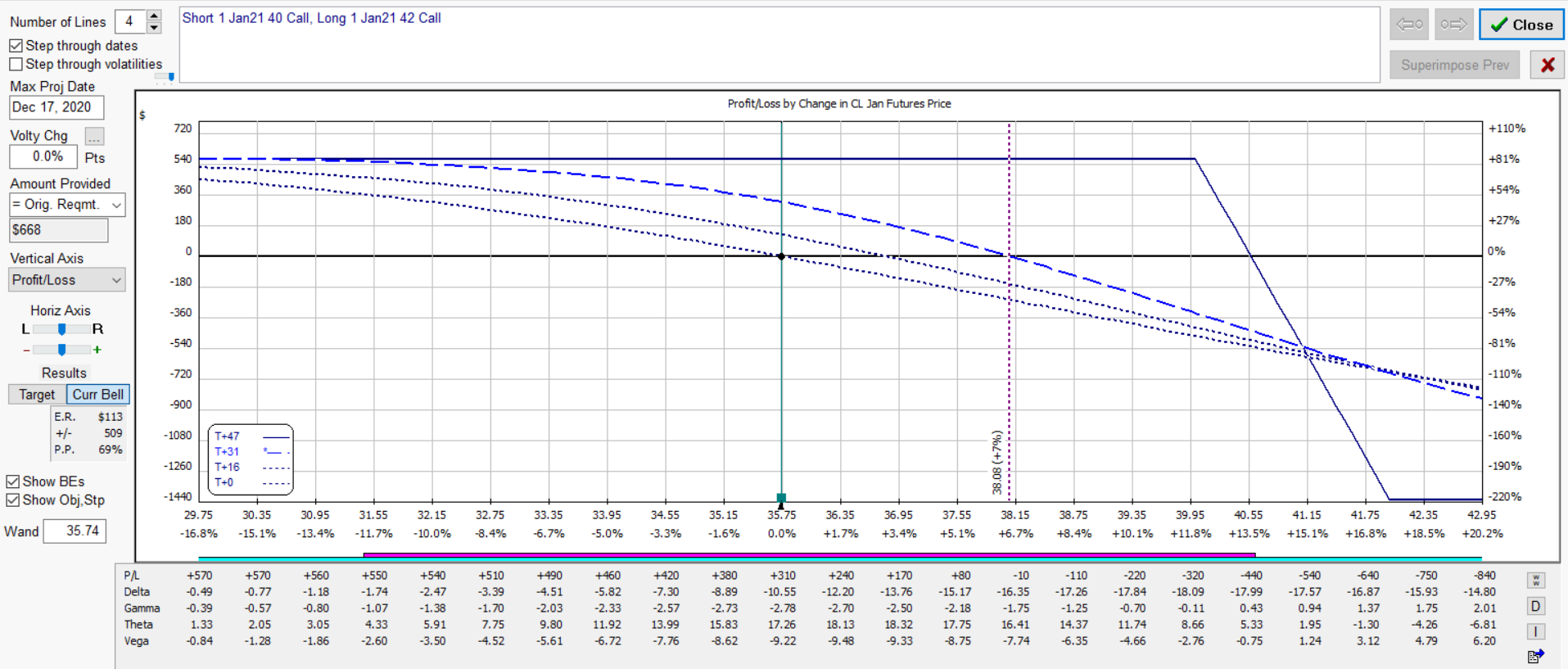

Bull Call

Broken Wing Butterfly

Webcast

Join our Free Webcast each month and learn how these strategies can benefit your trading.

Sign Up Now