Get your copy of Paul Forchione's book, "Trading Iron Condors". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

Straits Financial Daily Market Commentary

CME Morning Cattle - 04-01-2019

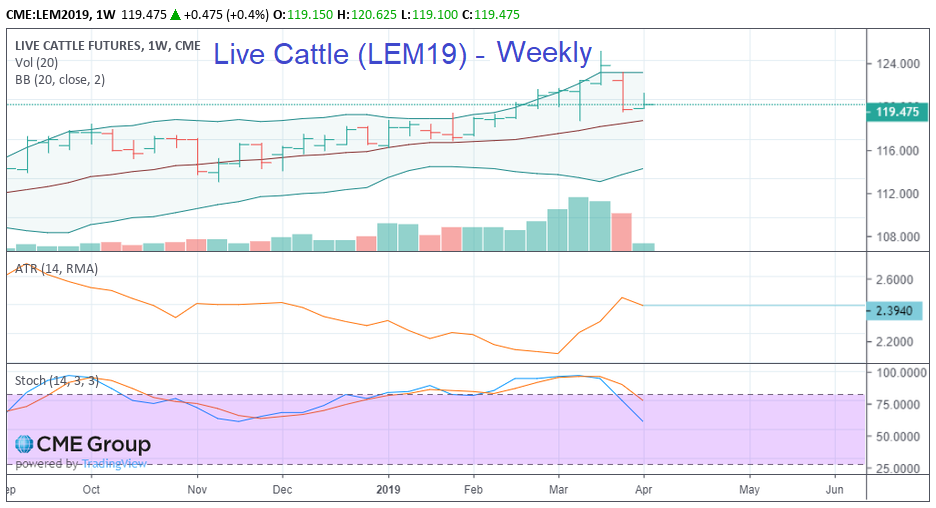

Livestock: There was a small fill-in trade on Friday in the north that actually printed a new high for the week in western NE at 126.50 cents, but for the most part the live and dressed trade repeated the prices already seen on the week. We will call last week’s live trade 2.00-3.00 lower for the most part and the dressed trade 1.00-3.00 lower with the electronic auction not available. For this week, we start out thinking 1.00 lower into what should be a seasonally firmer first week of April, but for now that looks hard to ask for. The further into the month we go the weaker the cash trade appears to get.

Beef: Friday’s boxed beef trade was lower but on the week it looked like the market ended mixed to weaker as the select cutout managed a very small gain Friday-to-Friday (+0.25), while the choice cutout was down 3.05 cents. For this week we are coming in thinking mixed with a slightly better chance to manage a small gain as the weather does not look overly threatening and an east coast storm looks to stay just far enough off-shore to keep the bad weather away from the larger northeast population center from getting hit hard.

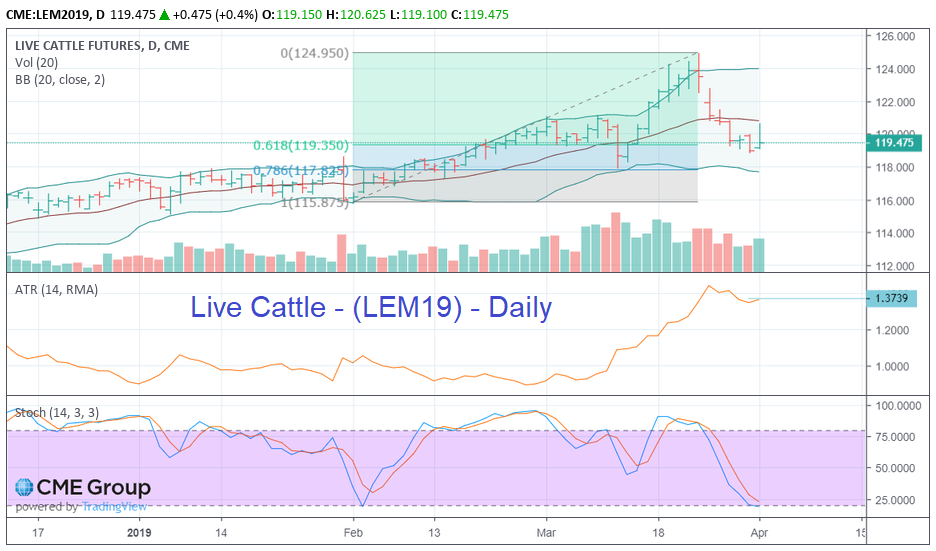

Futures: Friday’s live cattle futures trade started out trying to firm on ideas the cash trade was completed and the futures market had fairly priced in the cash weakness. Ultimately the board fell off and closed near the low of the trading session as expectations for this week certainly did not end last week in any kind of a positive mood. DTN has an opening call of mixed. We would be slightly firmer but just like late last week thinking firm early and weak late. The COT report on Friday which showed data through last Tuesday’s session had the large spec trader group adding more longs than shorts to increase their net-long position even on the early portion of the futures turn down as the total open interest started to turn down also. Friday’s session was a lighter trading volume day (52k caks) with open interest declining (down 4k caks) to follow the current new trend…of a market in liquidation. We continue to think the cash cattle market has topped, the live cattle futures market has topped, and the beef market is a question mark. There should still be a one good rally left in the beef before the summer doldrums, but whether we see new high trading levels is questionable. Grain Stocks and Prospective Planting numbers came out Friday morning and crushed the corn market. Early this week we should get a try at rebounding a bit in the corn as users buy the hard break on ideas it is a long way before we see what kind of flooding actually reduces the corn acreage.

Basis: Last week’s cash cattle trade at the feedyard was a range from 124 to 130.50 cents with the bulk of the cattle trading 126 cents. Compared to last Friday’s futures close at 125.65 cents this shows a small positive basis, which is not uncommon. That said, we still feel a negative 0.50 cent basis is more normal for the average this time of the year. There is one more week of futures trading before April delivery and as long as the basis stays tight to only slightly negative, which is our expectation for now, we should not see a repeat of the last delivery cycle.

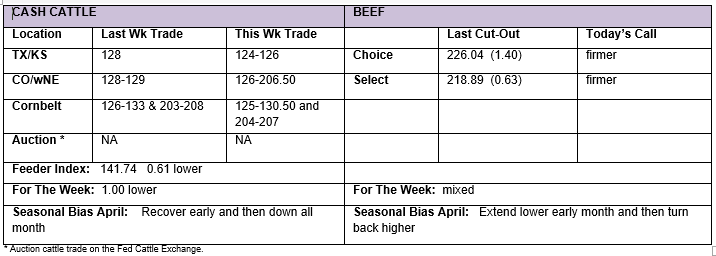

Volatility

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report.

Notes:

Contract Size - 40,000 lbs (~ 18 MT)

Tick Size: $.00025 per pound (=$10 per contract)

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (ET) with trading halt 4:15 p.m. - 4:30 p.m.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Live Cattle futures and options

Live Cattle

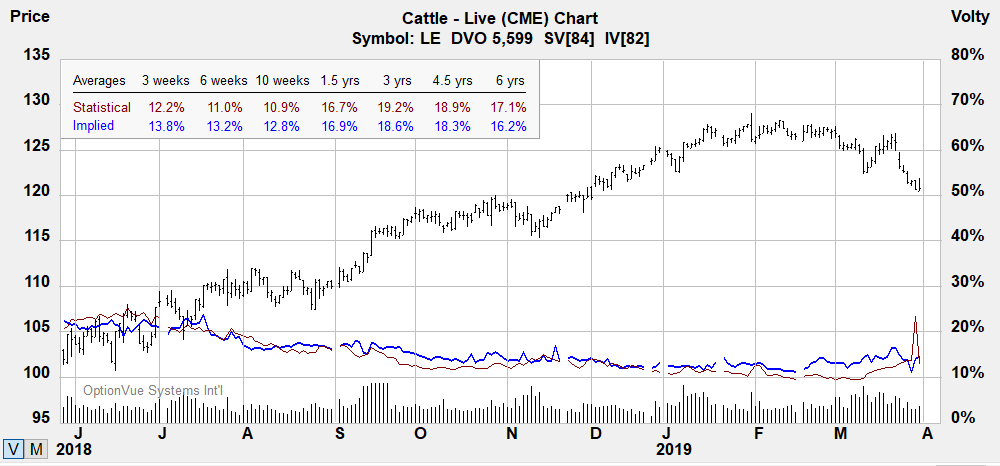

Below are weekly & daily charts for reference.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

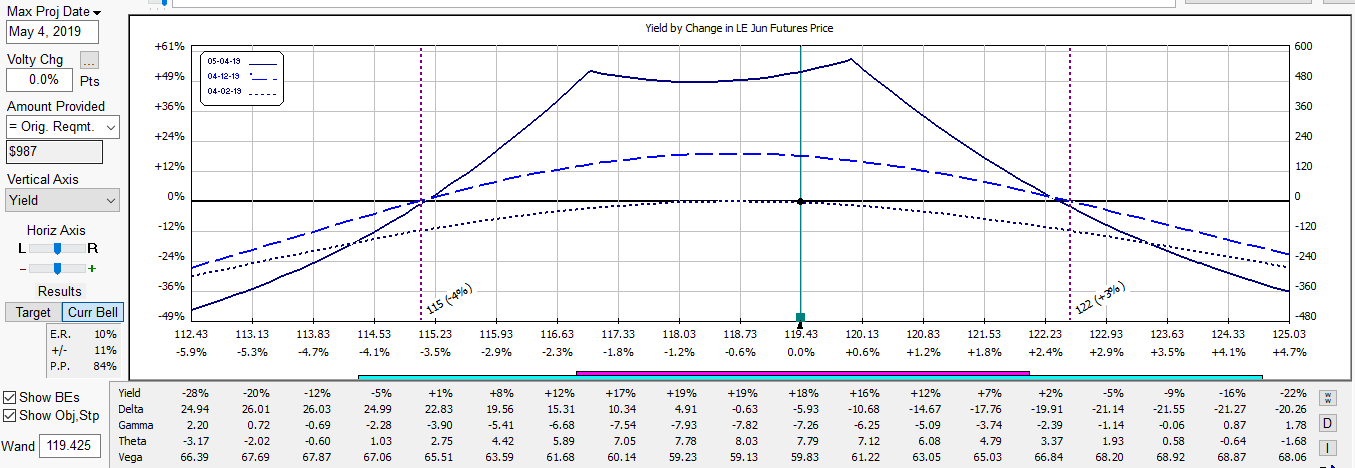

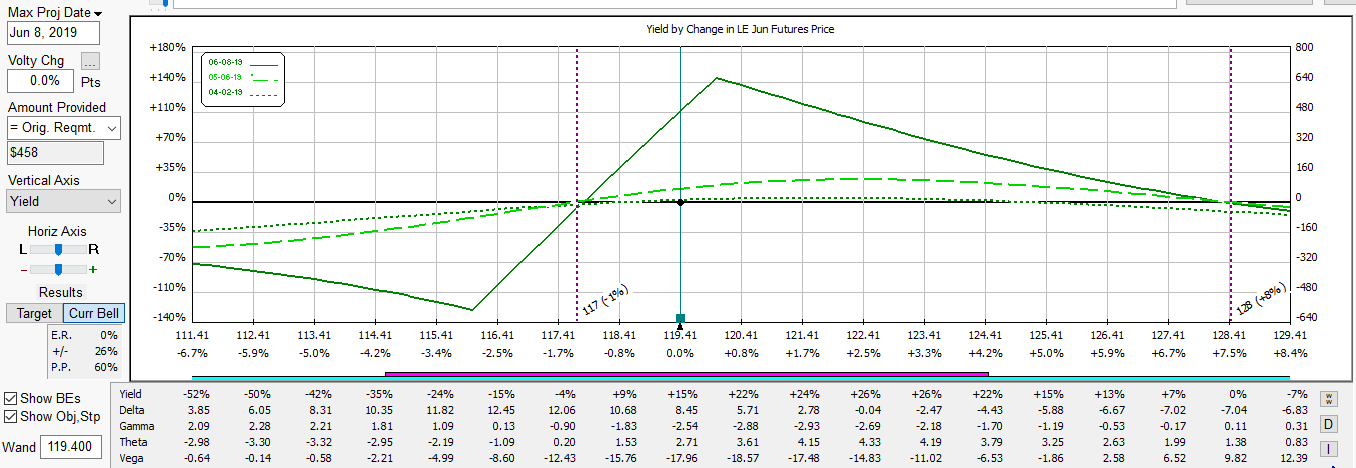

Below is the starting position for calendar swaps. These are directional plays where both Theta and Vega are negligible. The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below. The structure has positive time decay which is an advantage over holding outright options.

Below is a slightly bullish bias with positive time decay should prices recover within a slightly higher range.

Below is a strangle swap with a slightly bearish bias