Get your copy of Paul Forchione's book, "Trading Vertical Swaps". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

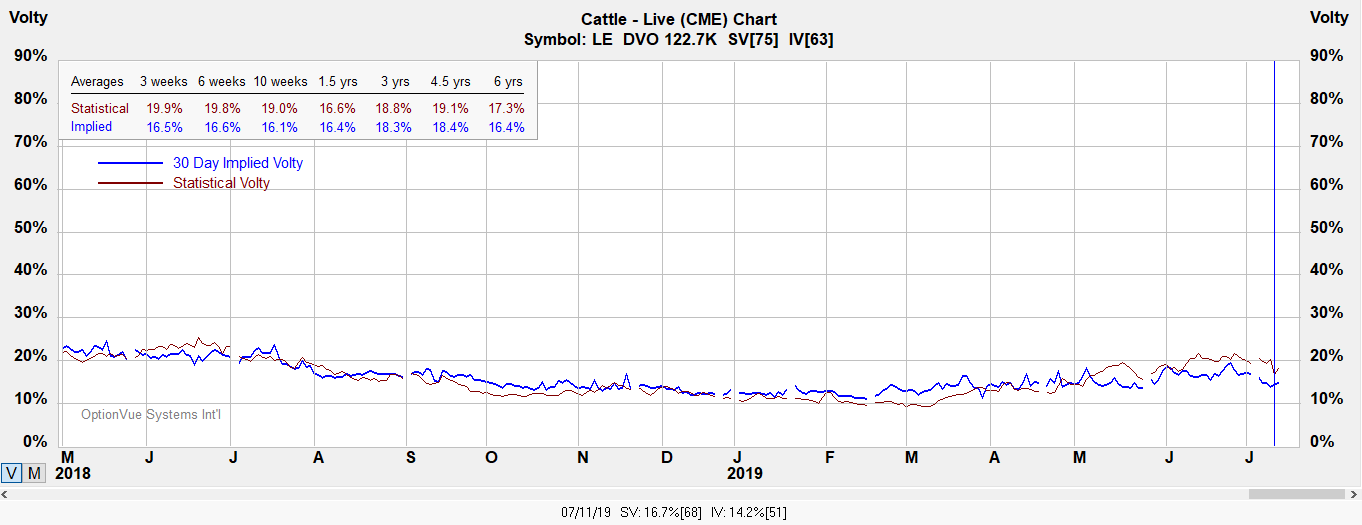

Volatility

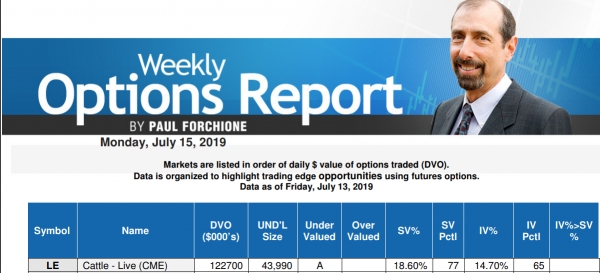

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report. Ask about the Weekly Option's Report for more information or watch our video.

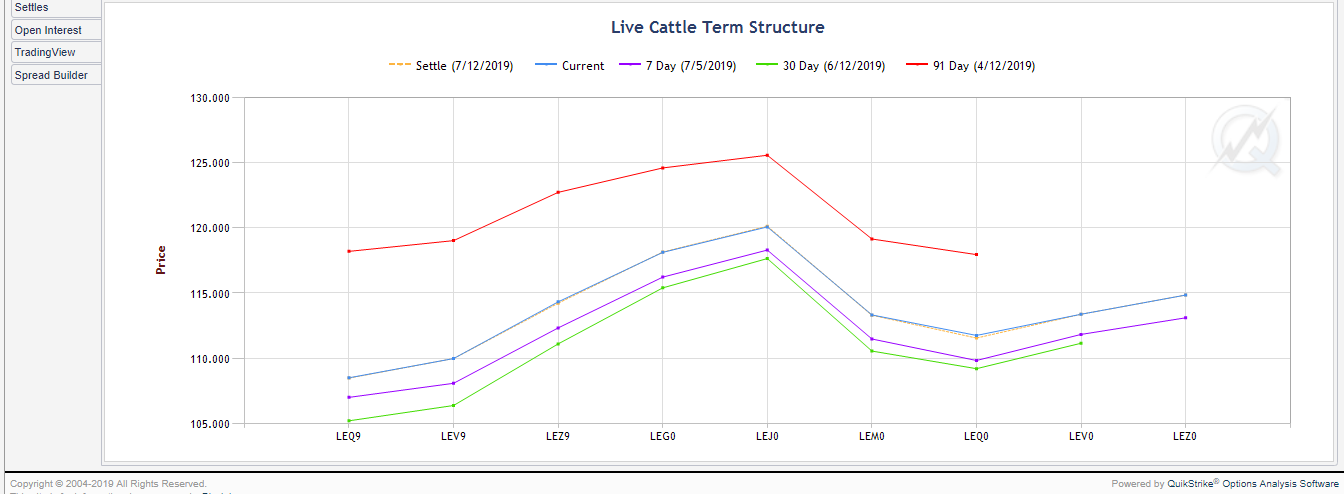

Term Structure

Notes:

Contract Size - 40,000 lbs (~ 18 MT)

Tick Size: $.00025 per pound (=$10 per contract)

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (ET) with trading halt 4:15 p.m. - 4:30 p.m.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Live Cattle futures and options

Live Cattle

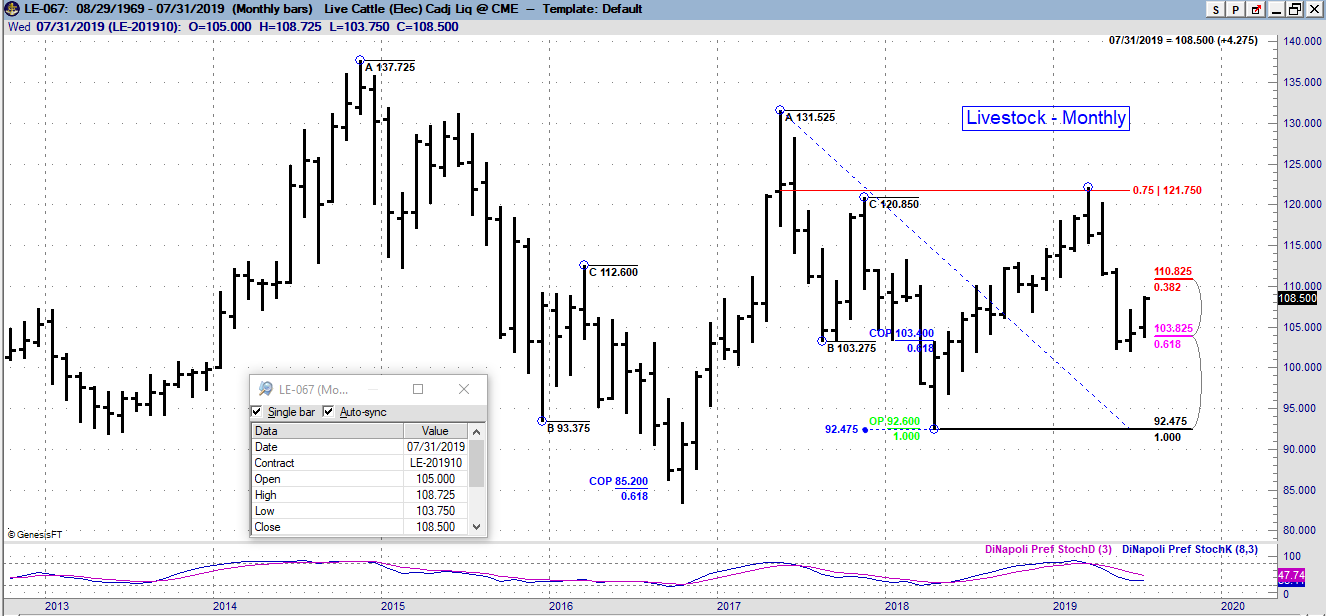

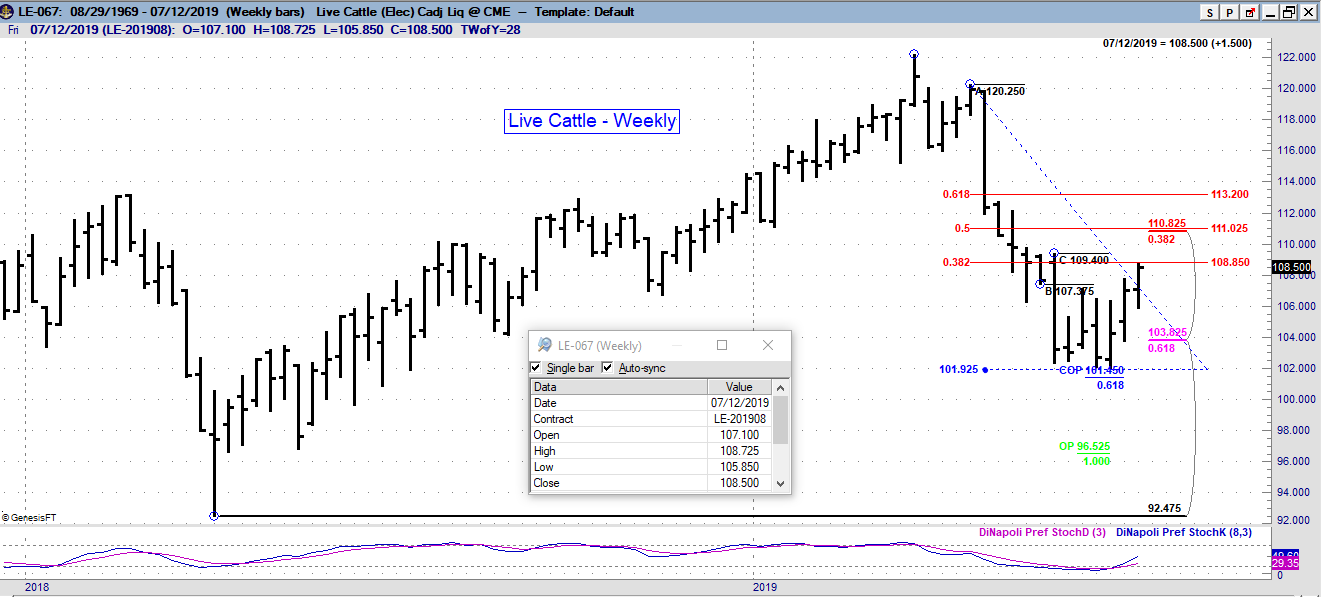

Below are weekly & daily charts for reference. F3=38.2 ; F5 = 61.8 retracements ; BB = Bollinger Bands

Current price @ 108.50

Trends on weekly, daily up.

Cross above MACDP weekly on Monday

Resistance

114.300 OB week

113.200 F5 week

111.025 50% retrace week

109.700 F3 daily

108.950 F3 daily

108.850 F3

108.725 prior high week

108.125-275 agreement daily

Support

103.825 F5 month

101.975 prior low month

101.450 COP week

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

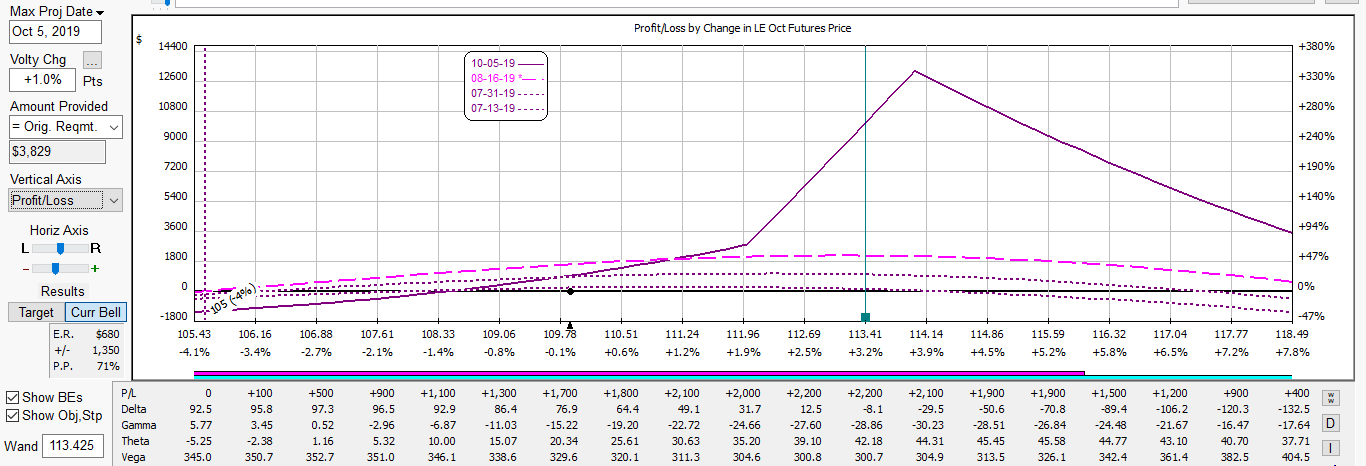

Strategies

Below is a calendarized Fly. It has positive time decay and benefits from an increase in volatility. Transitioning from summer into fall months, the option spread has the potential to benefit from both an increase in price and implied volatility with positive vega. It would lose if price declined or volatility declined.

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below. The structure has positive time decay which is an advantage over holding outright options.

Join our Free Webcast each month and learn how these strategies can benefit your trading.