Get your copy of Paul Forchione's book, "Trading Calendar Spreads" or "Strangle Swaps". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

|

|

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

New crop corn had traded upwards at $4.54 with soybeans around $9.18 a bushel. Planting in general is far behind with corn just over half complete with soybeans around a third on acreage with the week leaving prices consolidating in a range.

The recent market reaction was due to planting delays while the next upcoming focus will be on yield and where we stand on global stocks. South America is picking up a lot of the export business of the U.S. and global demand for feed in light of ASF will probably be lower. The planting updates in the upcoming week will establish a reference point for acreage in the upcoming year.

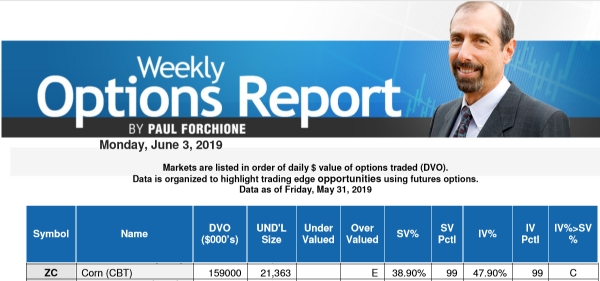

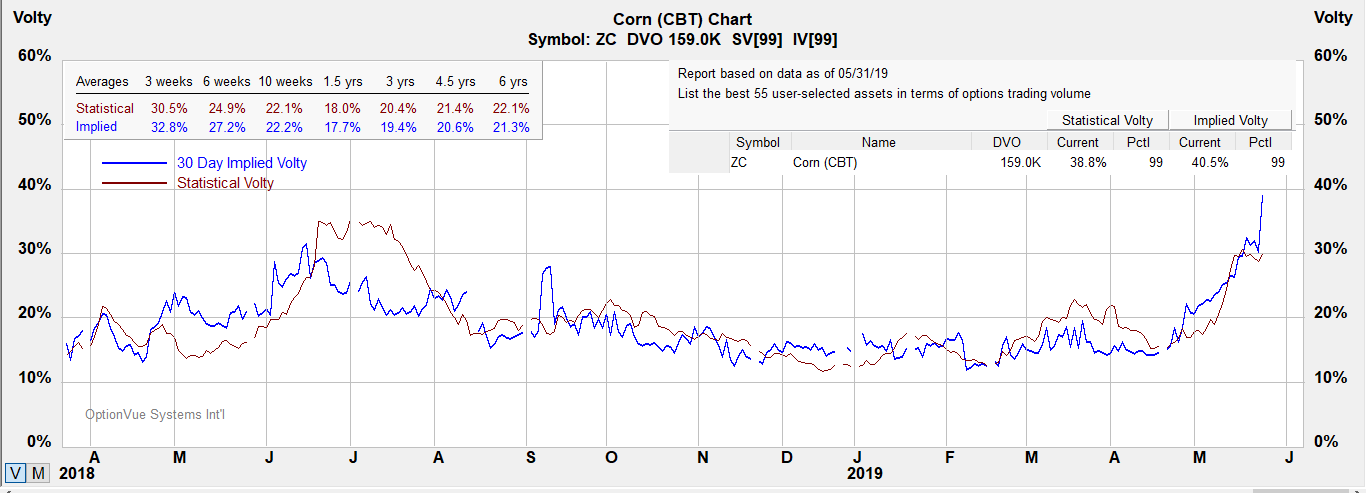

Volatility

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report.

Notes:

Contract Size - 5,000 bushels (~127 MT)

Tick Size: Cents per bushel. 1/4 of one cent per bushel ($12.50 per contract)

Trading Hours: Sunday – Friday, 7:00 p.m. – 7:45 a.m. CT and Monday – Friday, 8:30 a.m. – 1:20 p.m. CT.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Corn futures and options

Corn

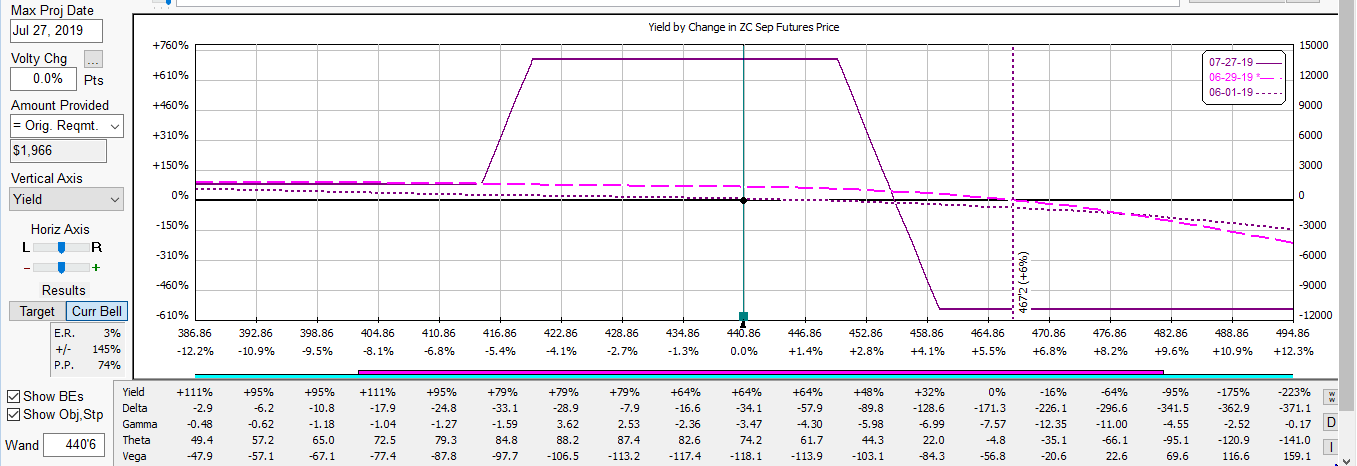

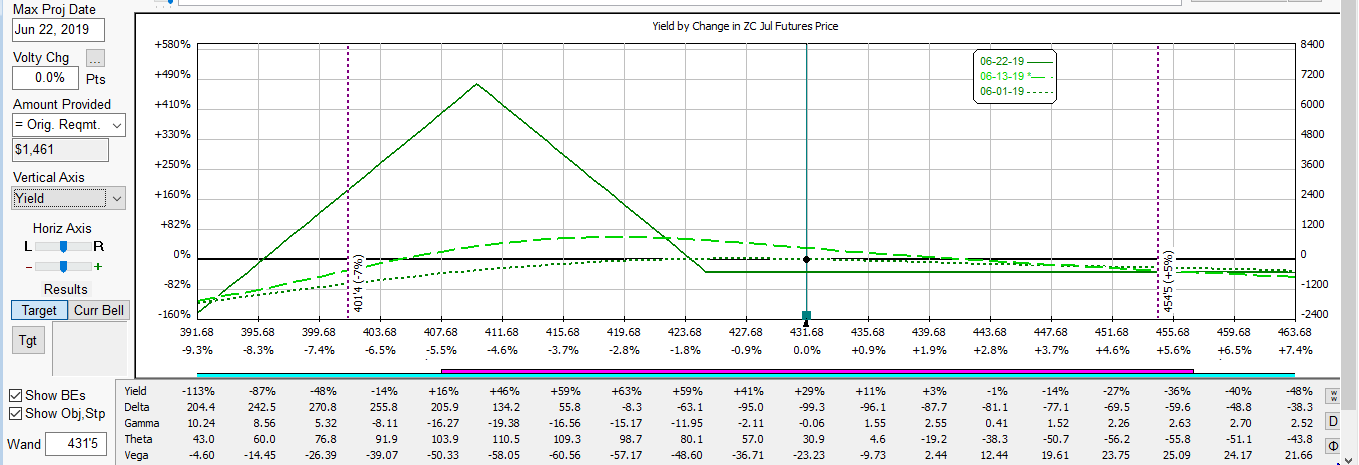

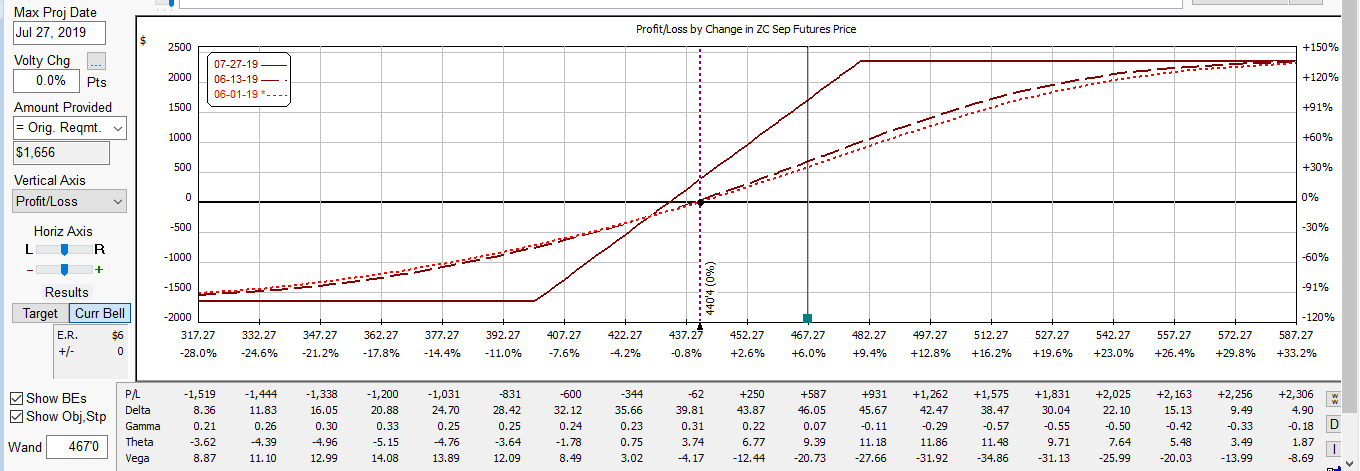

Below are charts for reference.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

Below are illustration of options on futures strategies, an iron condor, broken wing butterfly and vertical call spread. We'll discuss these during our upcoming webcast this week.