Get your copy of Paul Forchione's book, "Trading Calendar Spreads" or "Strangle Swaps". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

|

|

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

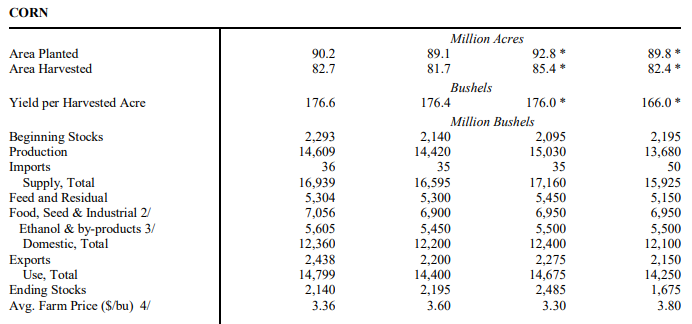

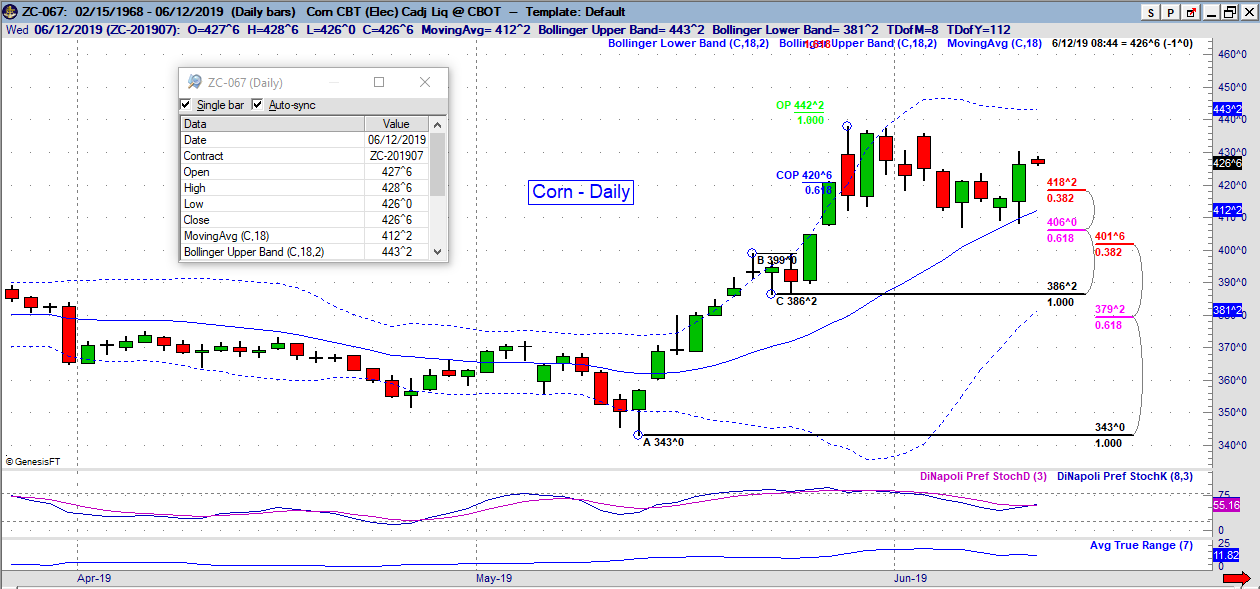

Corn prices are near highest levels in four years in China. All from the tense relationships with the country's trading partners. On corn, USDA unexpectedly cut acreage. Still have 17MM acres to plant. Mainly concentrated in midwestern states. As expected, yield, production and carryout estimates were lowered more than most thought.

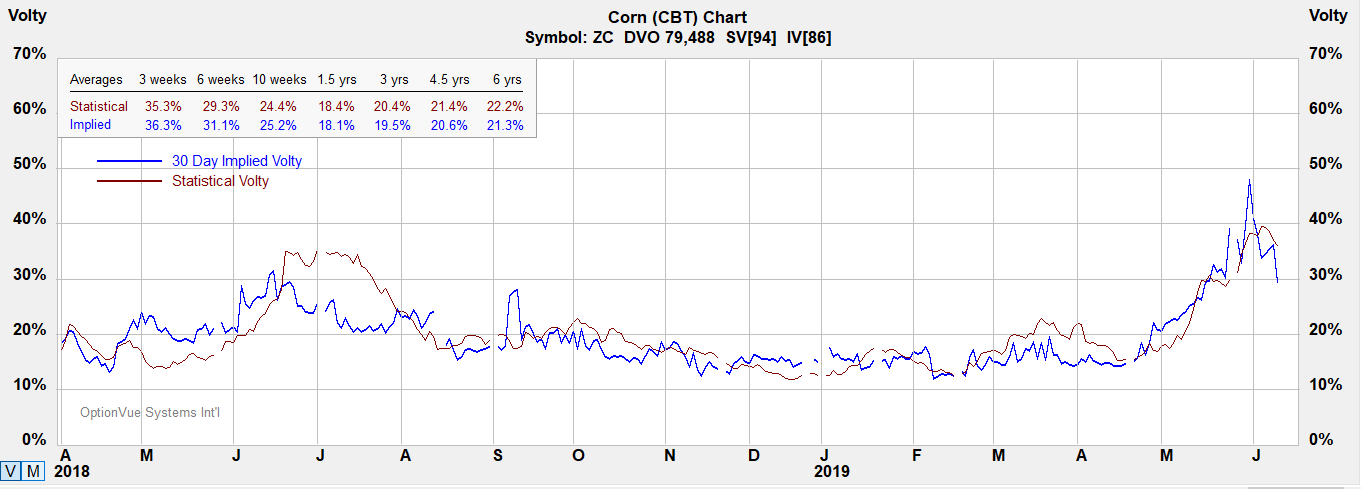

Volatility

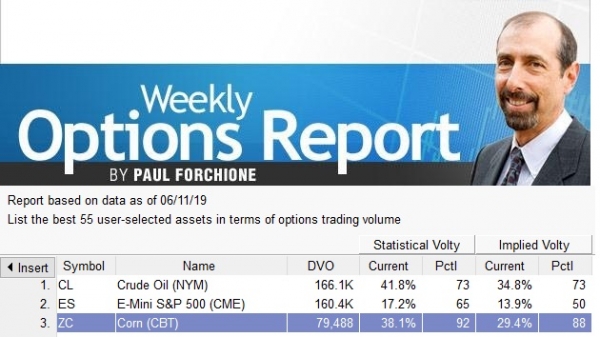

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report.

Notes:

Contract Size - 5,000 bushels (~127 MT)

Tick Size: Cents per bushel. 1/4 of one cent per bushel ($12.50 per contract)

Trading Hours: Sunday – Friday, 7:00 p.m. – 7:45 a.m. CT and Monday – Friday, 8:30 a.m. – 1:20 p.m. CT.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Corn futures and options

Corn

Below are charts for reference.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

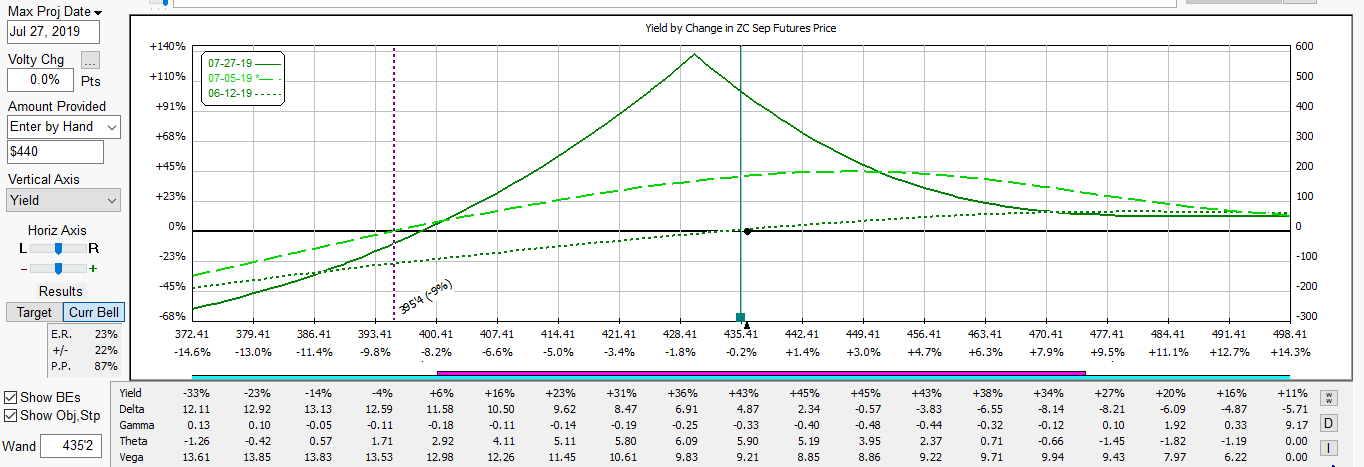

Below are illustration of options on futures strategies, a calendar spread. We'll discuss these during our upcoming podcast this week.