Get your copy of Paul Forchione's book, "Trading Calendar Spreads" or "Strangle Swaps". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

|

|

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

CMEGroup Comments: "Flood Havoc"

Watch Video

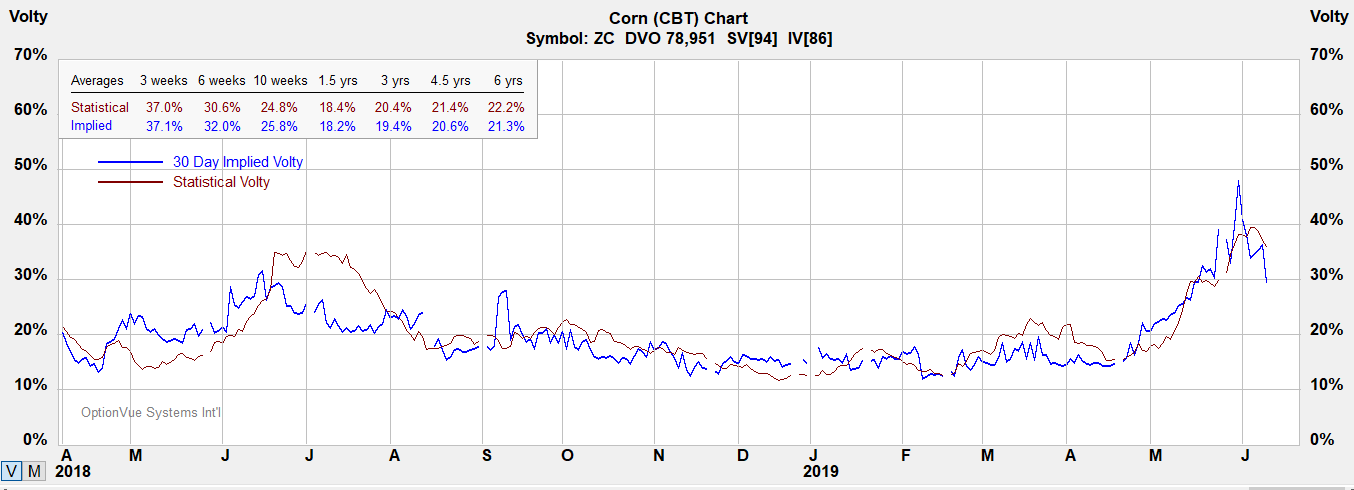

Volatility

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report.

Notes:

Contract Size - 5,000 bushels (~127 MT)

Tick Size: Cents per bushel. 1/4 of one cent per bushel ($12.50 per contract)

Trading Hours: Sunday – Friday, 7:00 p.m. – 7:45 a.m. CT and Monday – Friday, 8:30 a.m. – 1:20 p.m. CT.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Corn futures and options

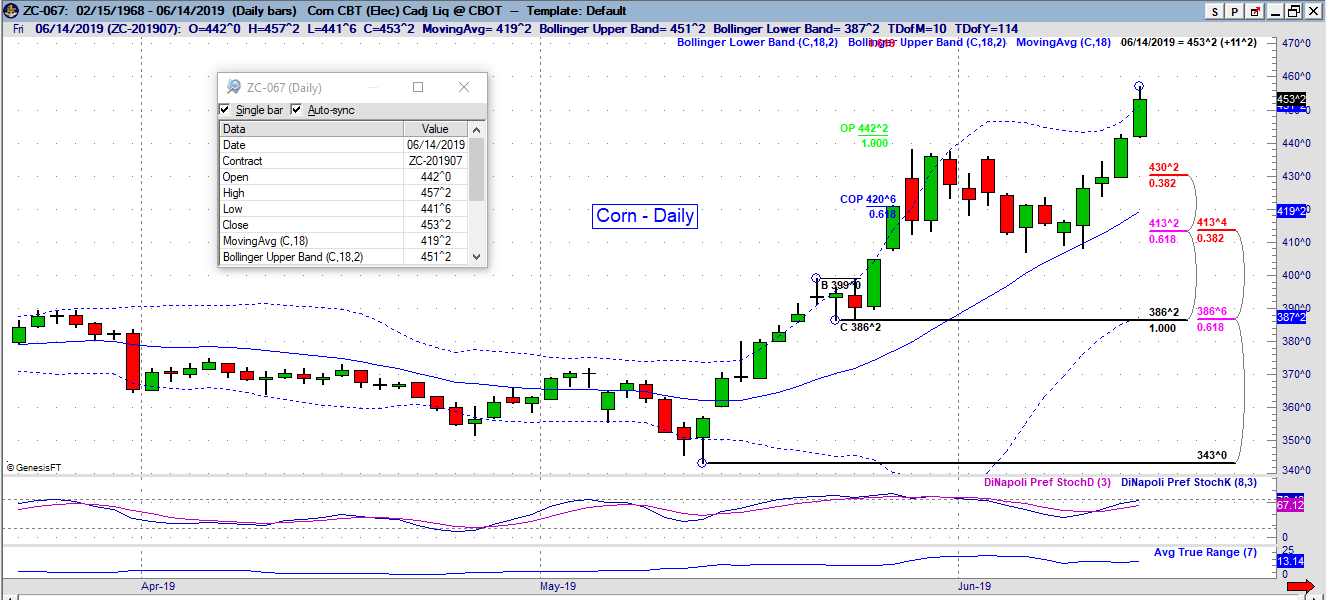

Corn

Below are charts for reference.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

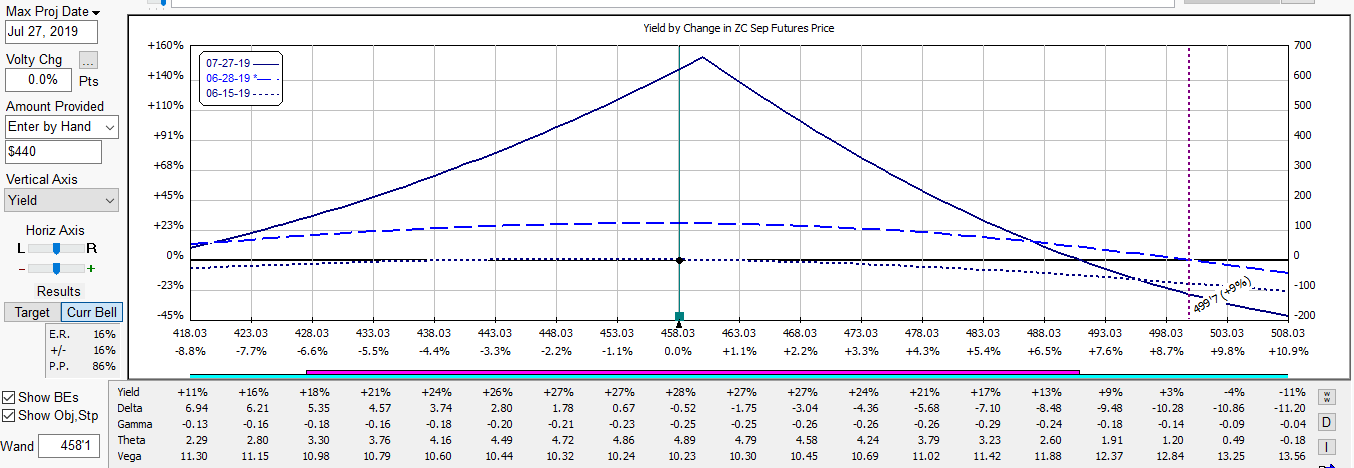

Strategies

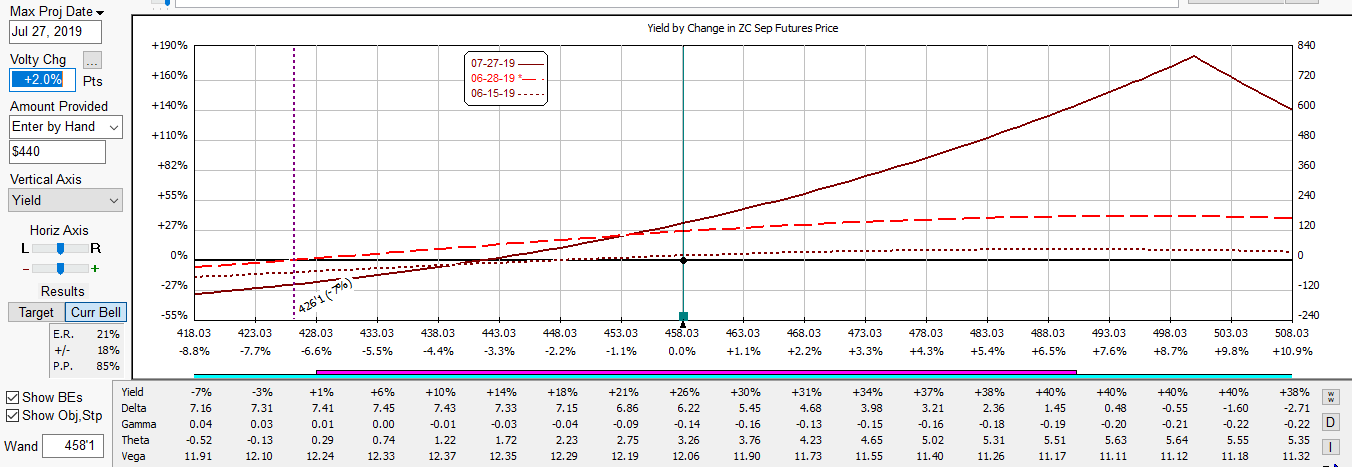

Below are illustration of options on futures strategies, a calendar spread.

Below is a higher calendar spread

News