Get your copy of Paul Forchione's book, "Trading Calendar Spreads" or "Strangle Swaps". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

|

|

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

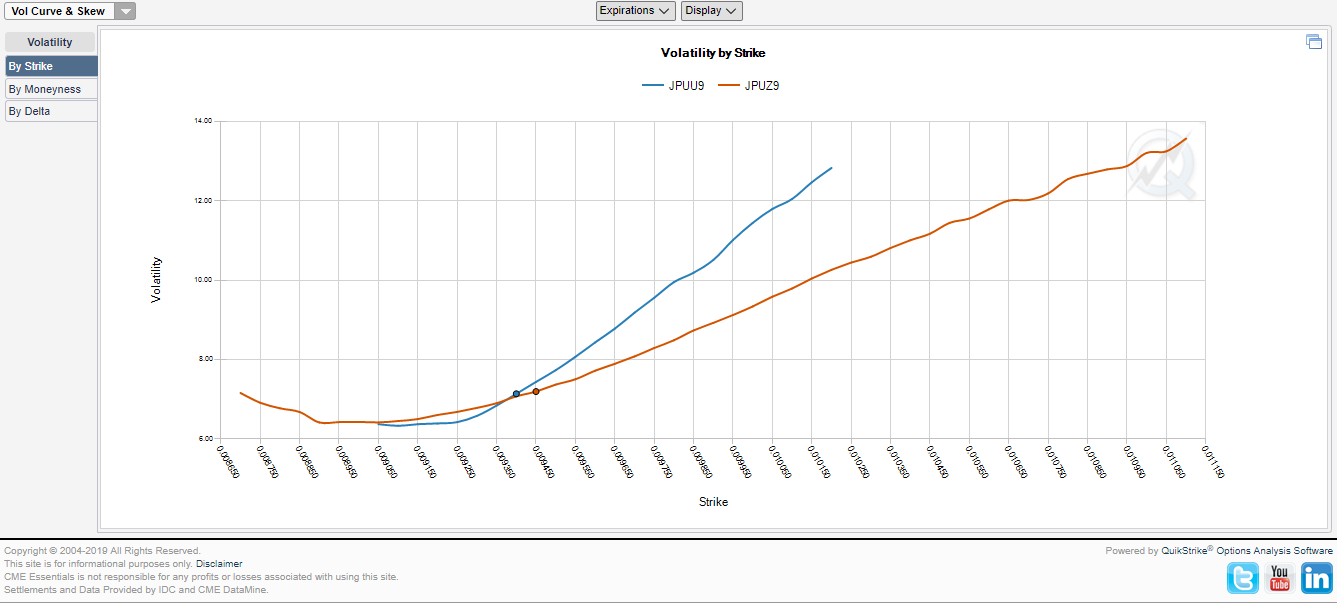

Volatility Curve & Skew

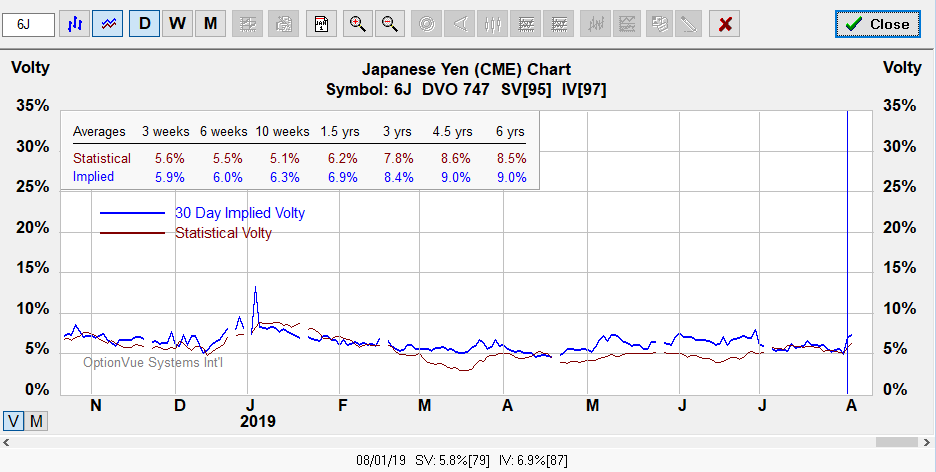

Volatility

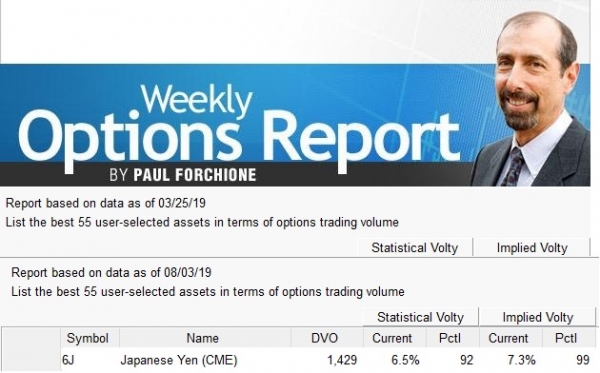

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report.

Notes:

Contract Size - 12,500,000 Japanese Yen

Tick Size: Outrights: .0000005 USD per JPY increments (6.25 USD)

Trading Hours: Sunday - Friday 6:00 p.m. - 5:00 p.m. (5:00 p.m. - 4:00 p.m. Chicago Time/CT) with a 60-minute break each day beginning at 5:00 p.m. (4:00 p.m. CT).

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about JPY futures and options

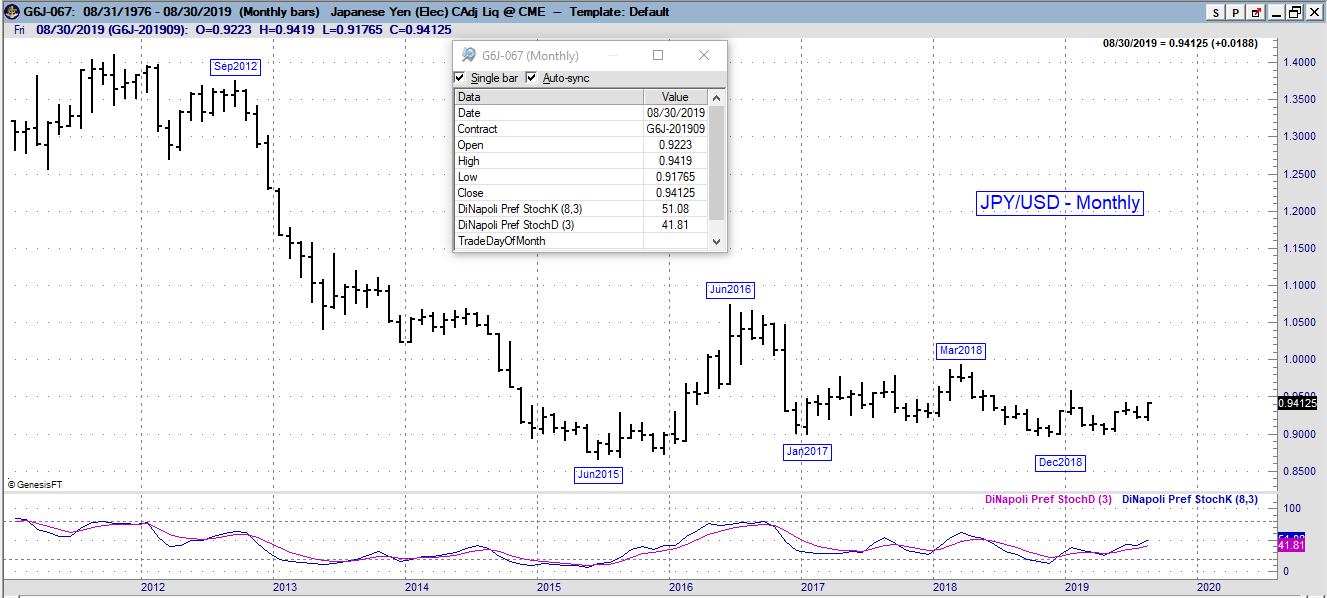

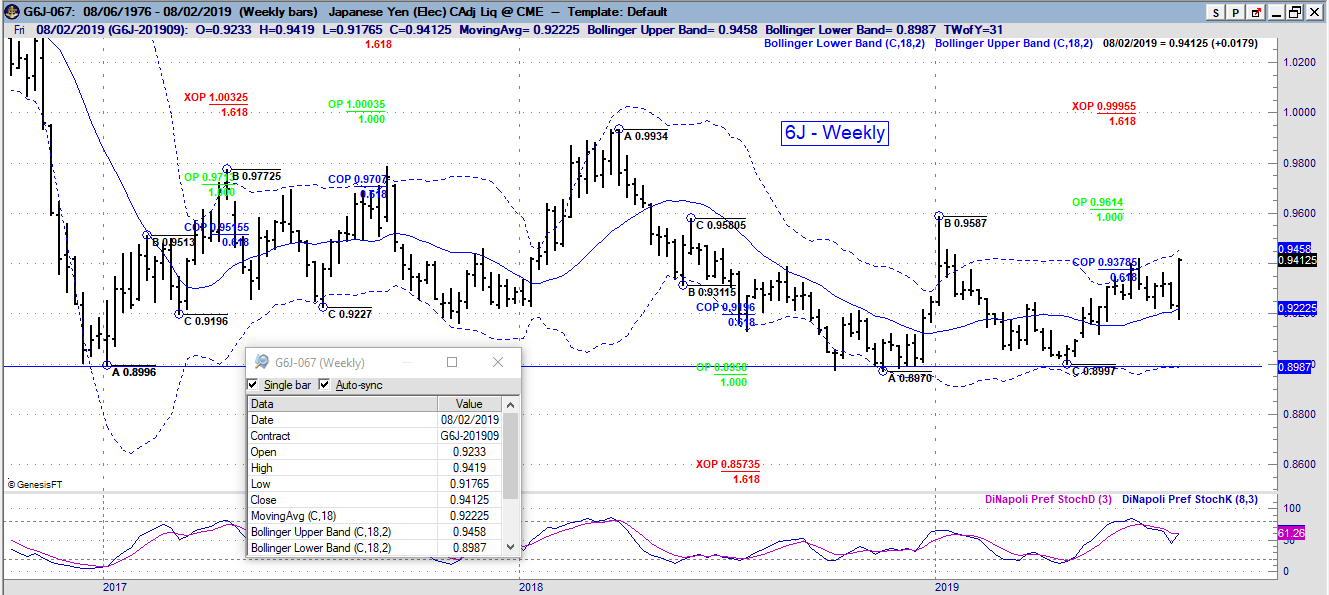

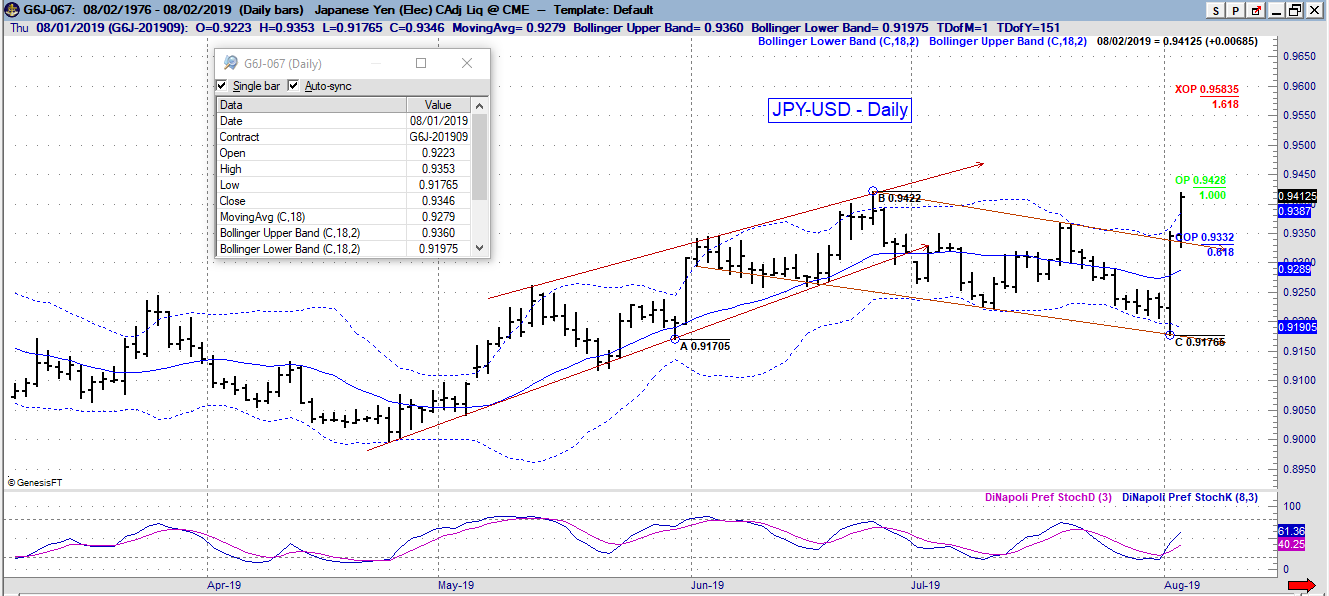

JPY-USD Charts

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

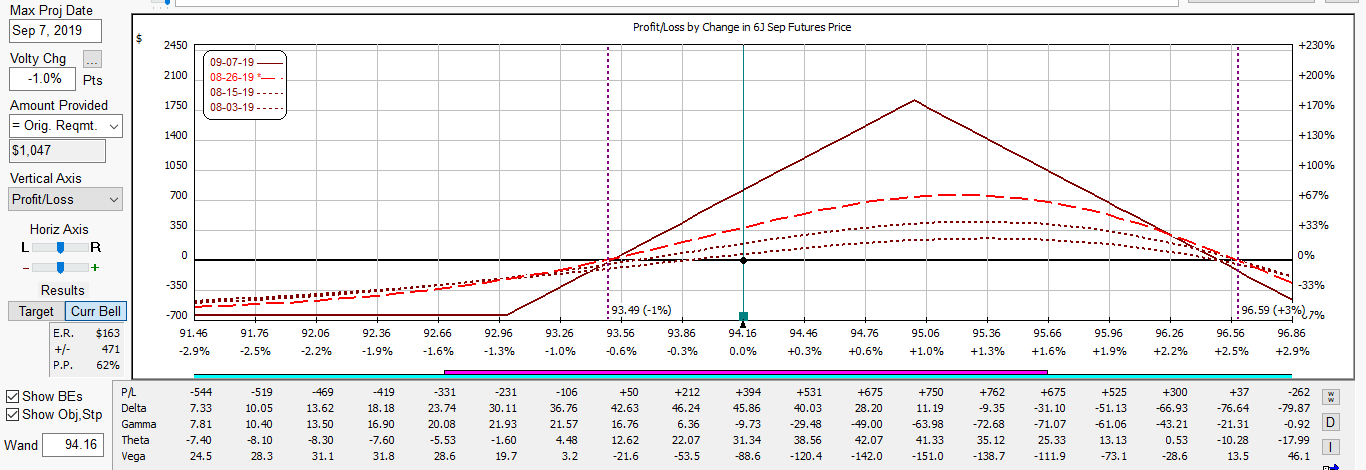

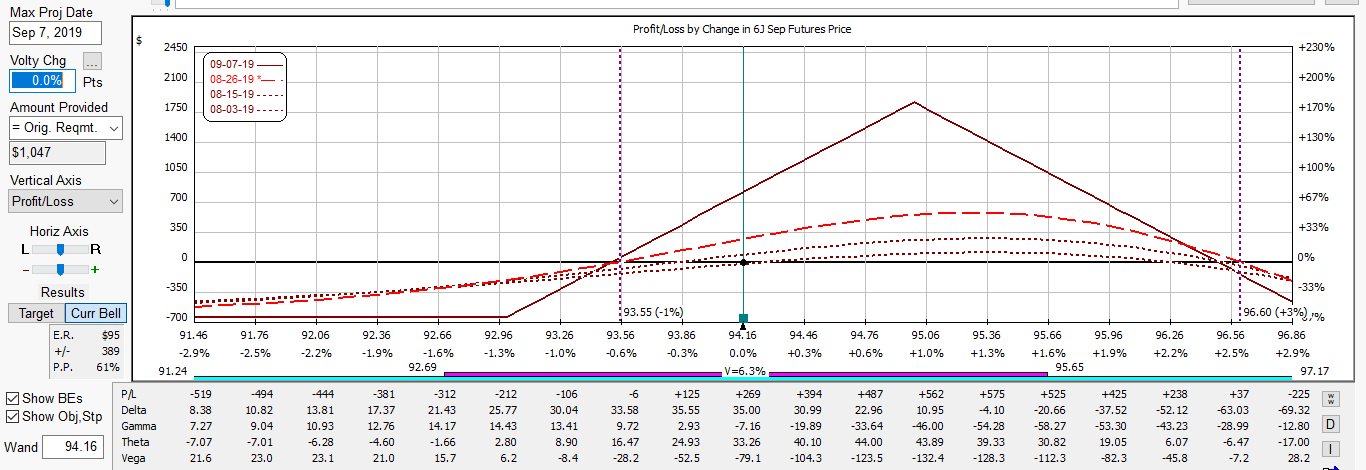

Below is a broken wing butterfly with bias to the upside. The position will benefit if the yen continues a slight trend higher and implied volatility were to drop slightly reverting towards historic levels.

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below.

Below is an illustration of the position with a -1% drop in implied volatility.