Get your copy of Paul Forchione's book, "Intro to Advanced Option Spreads" or "Trading Butterfly Spreads". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

|

|

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

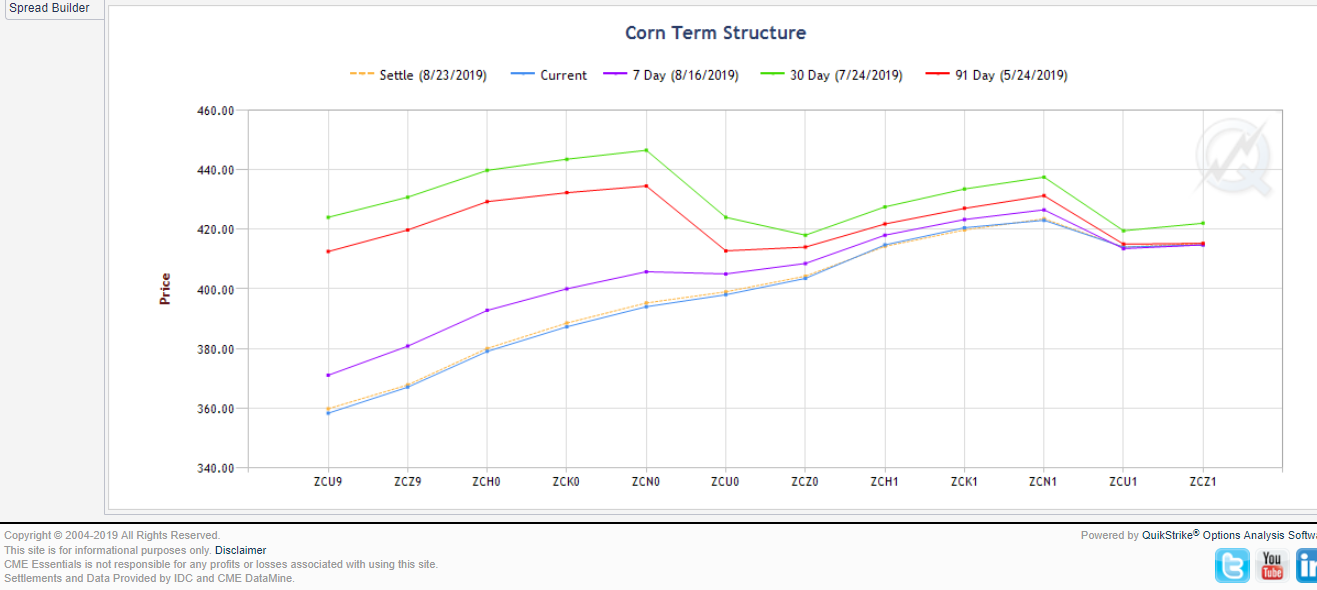

Term Structure

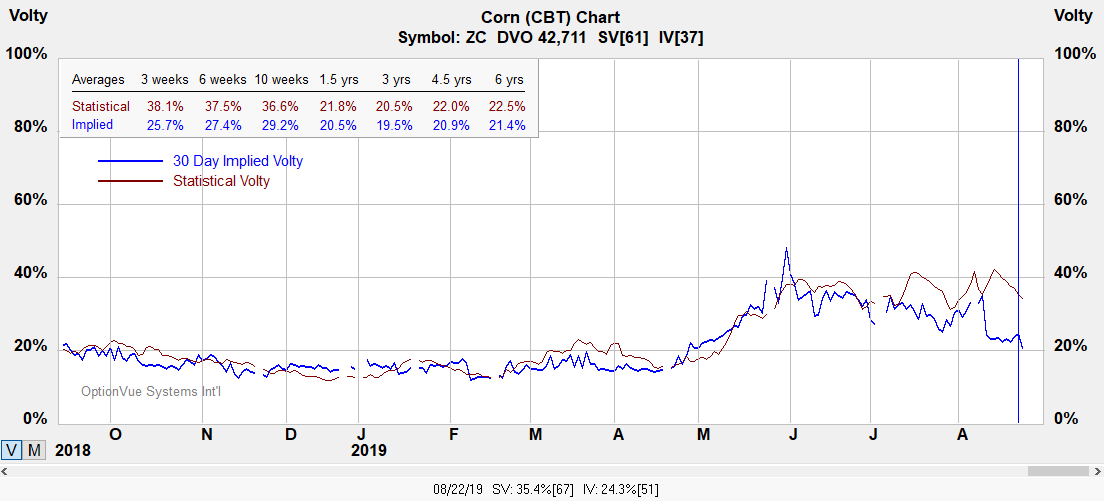

Volatility

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report.

Notes:

Contract Size - 5,000 bushels (~127 MT)

Tick Size: Cents per bushel. 1/4 of one cent per bushel ($12.50 per contract)

Trading Hours: Sunday – Friday, 7:00 p.m. – 7:45 a.m. CT and Monday – Friday, 8:30 a.m. – 1:20 p.m. CT.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Corn futures and options

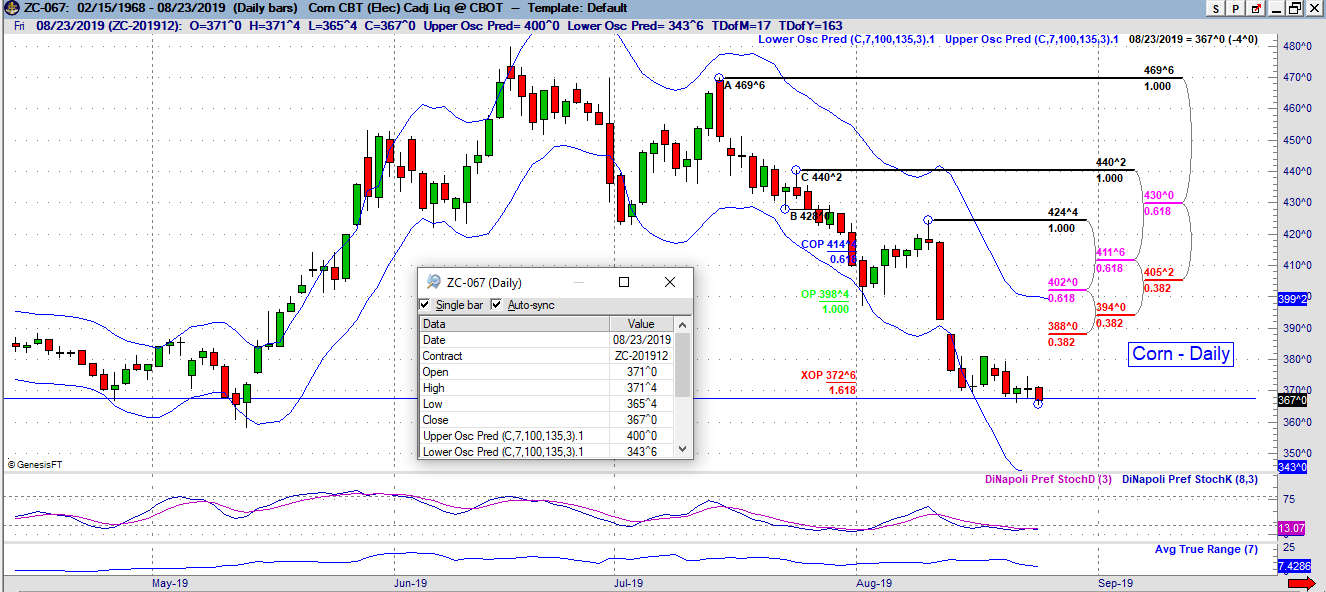

Corn

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

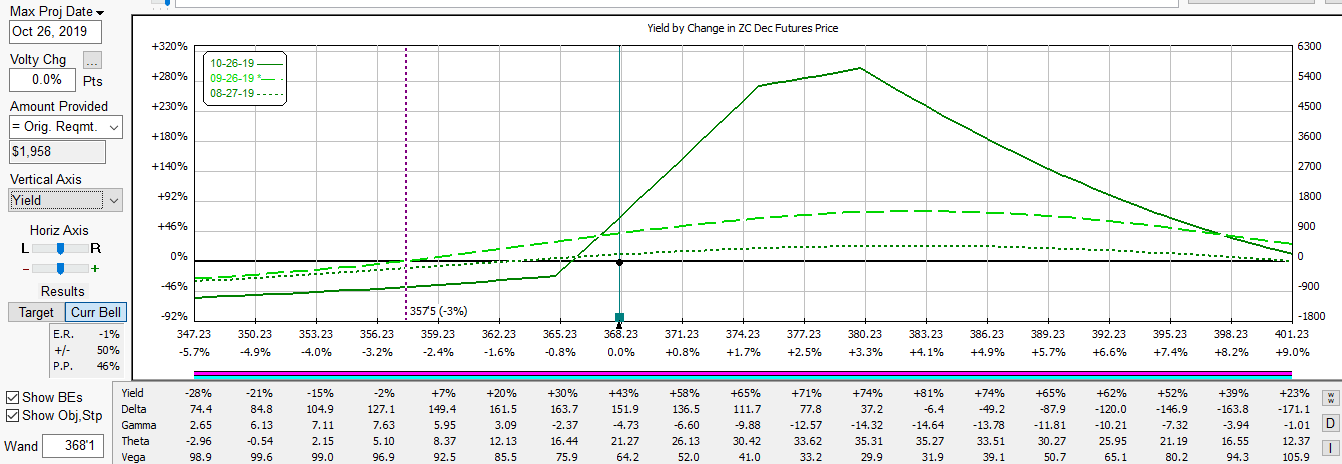

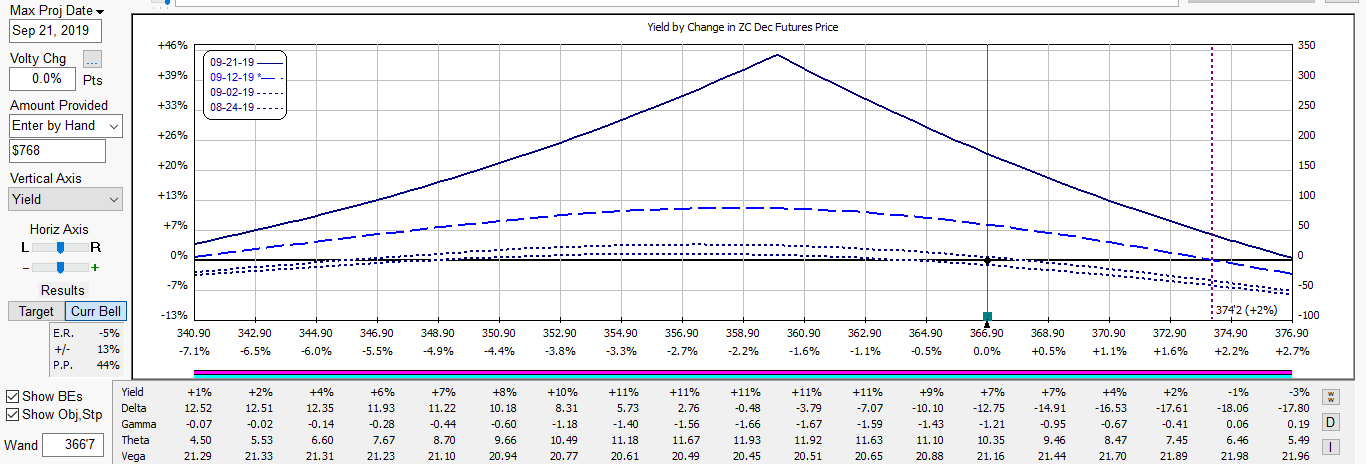

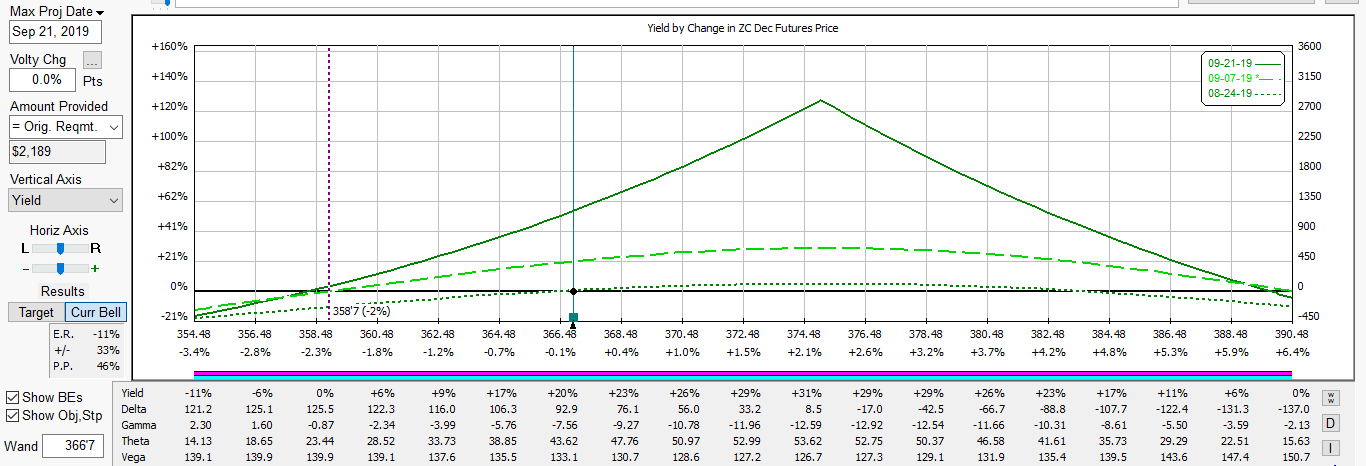

Below is an illustration of a calendar spread. It has positive time decay and Vega if implied volatility were to pick up moving into September.

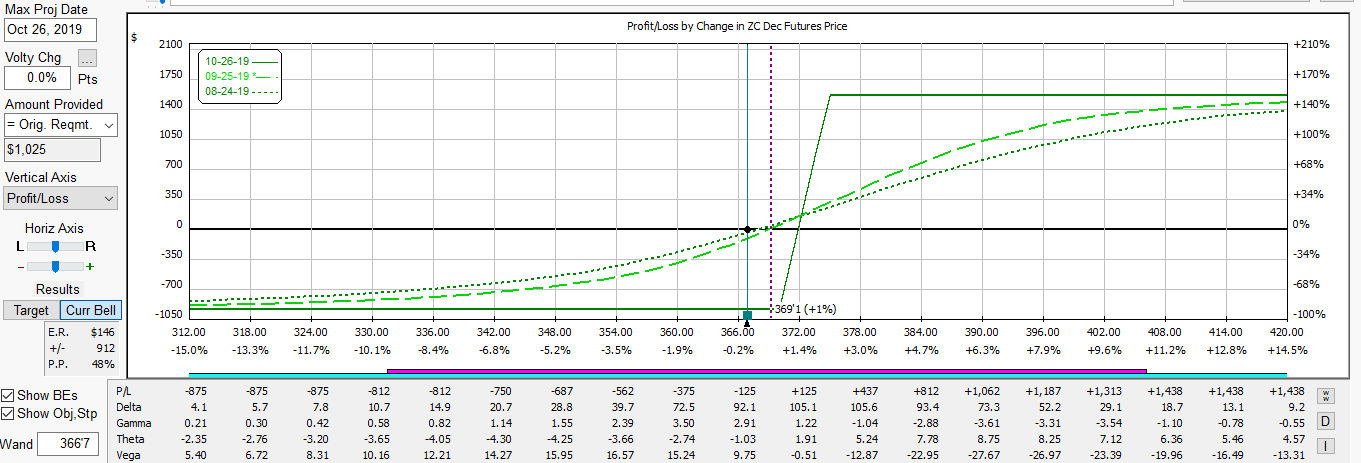

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below. The structure has positive time decay which is an advantage over holding outright options.

Bearish Calendar supposing the demand side of the equation doesn't pick up.

Bullish calendar if the trade deal with Japan materializes from the G7.

Bullish vertical spread.

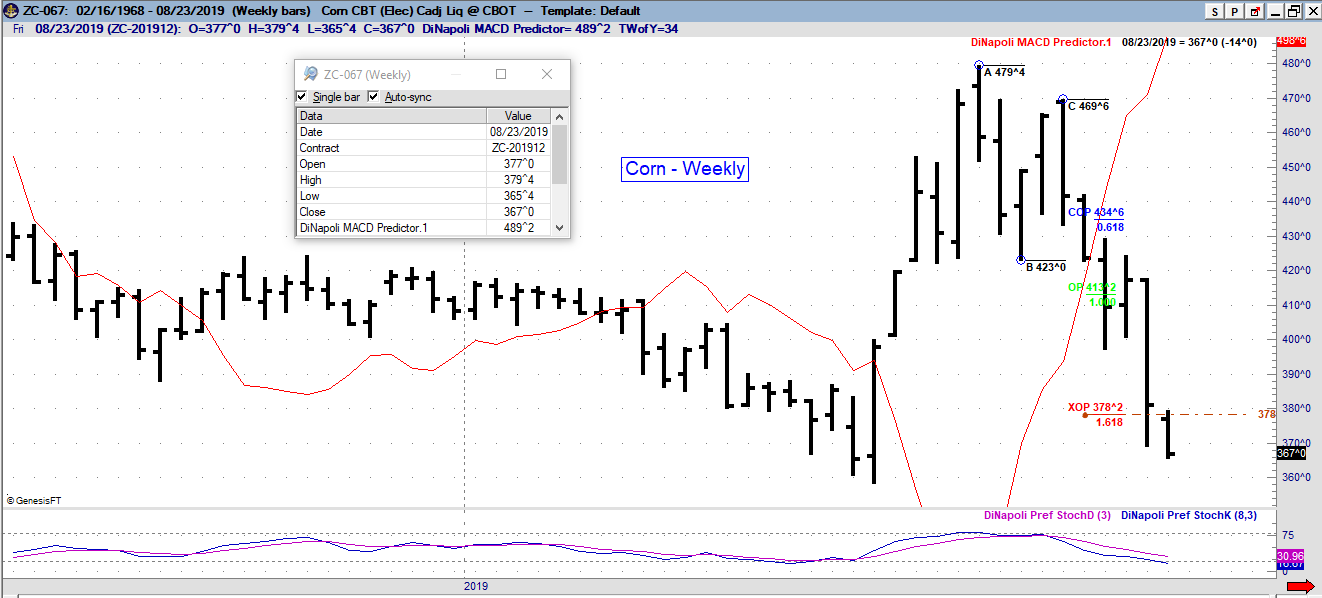

Modified combo per 1 LOT. This combines both a vertical and calendar giving a positive Vega since implied volatility is below historic levels at around a 30 IV percentile. The spread has positive time decay. If corn prices spike down to $3.56 / bu. into Oct., the impact on the position is small where the bias is towards the upside if deals from the G7 come into fruition for the demand side of the equation.