Get your copy of Paul Forchione's book, "Intro to Advanced Option Spreads" or "Trading Butterfly Spreads". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

|

|

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

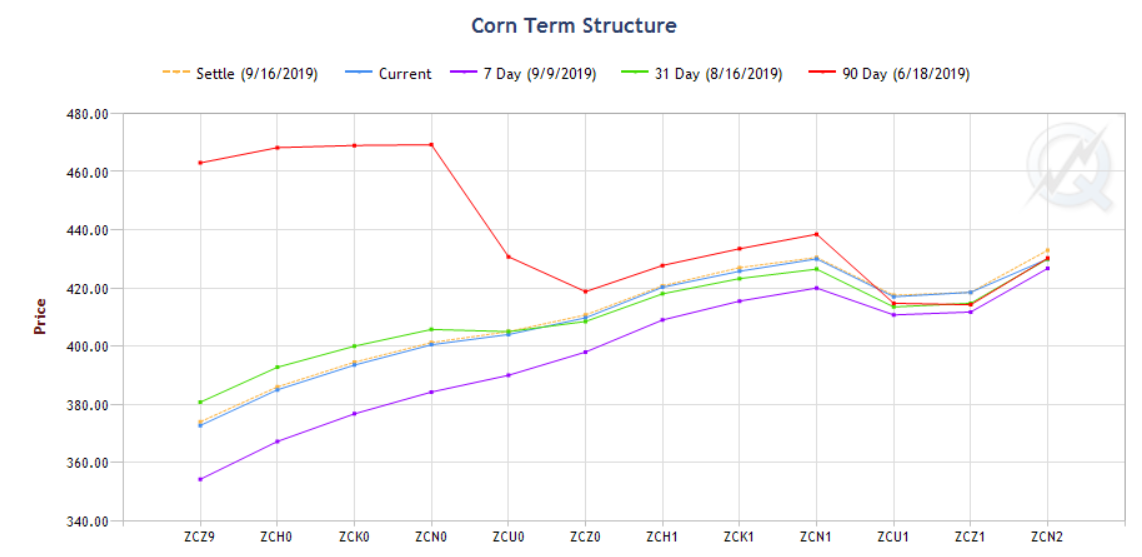

Term Structure

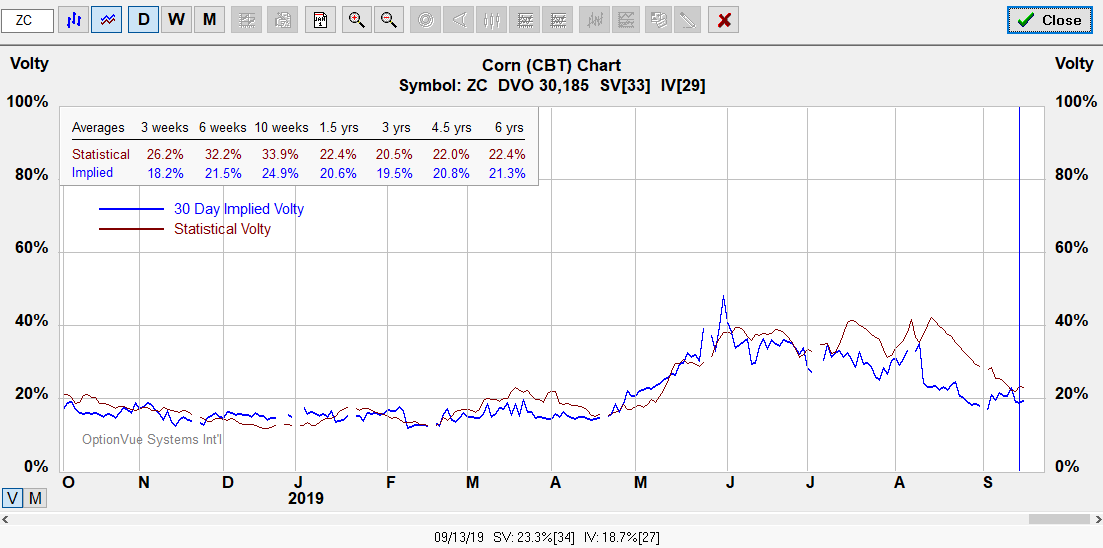

Volatility

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report.

Notes:

Contract Size - 5,000 bushels (~127 MT)

Tick Size: Cents per bushel. 1/4 of one cent per bushel ($12.50 per contract)

Trading Hours: Sunday – Friday, 7:00 p.m. – 7:45 a.m. CT and Monday – Friday, 8:30 a.m. – 1:20 p.m. CT.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Corn futures and options

Corn

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

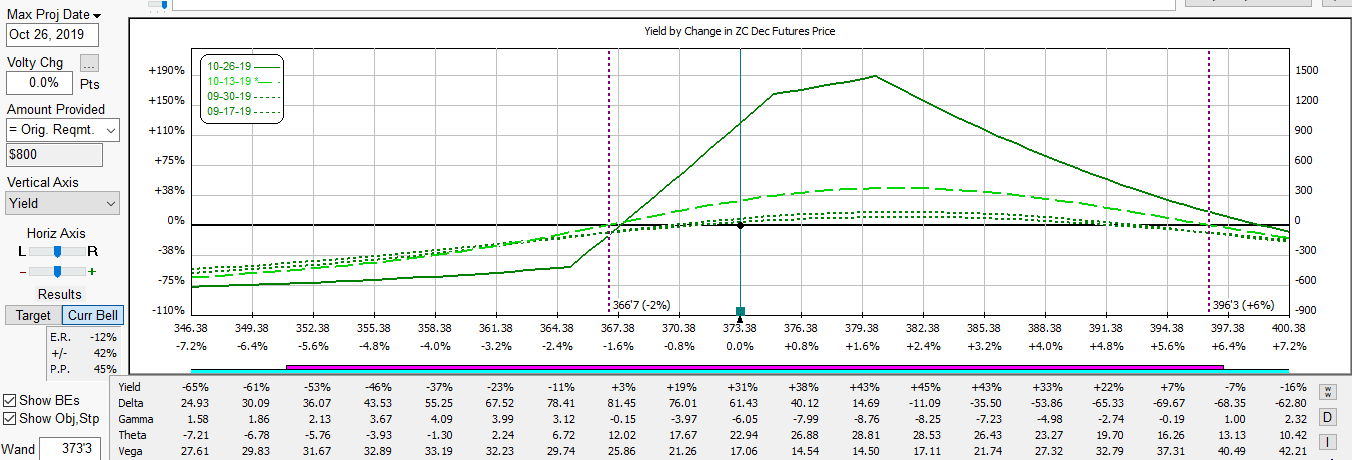

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below. The structure has positive time decay which is an advantage over holding outright options.

Bullish calendar

Below is an illustration of a calendar spread. It has positive time decay and Vega if implied volatility were to pick up moving into October.

A continuation of the prior corn trade I last posted given 350's were close to all time lows with thought of waiting to see if potential late Sep frost or trade war related concerns would make a difference. At this point in time, a lot of funds are short so perhaps if they start covering there could be a rally up. In the short term, keeping an eye on 383 - 93 on the prior gap could be something to watch. The position has positive Vega with implied volatility being below historic levels in the 27th percentile so there could possibly be a favorable theoretical edge.

Below is a 1 LOT for illustrative purposes.