Get your copy of Paul Forchione's book, "Trading Iron Condors". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

Commentary

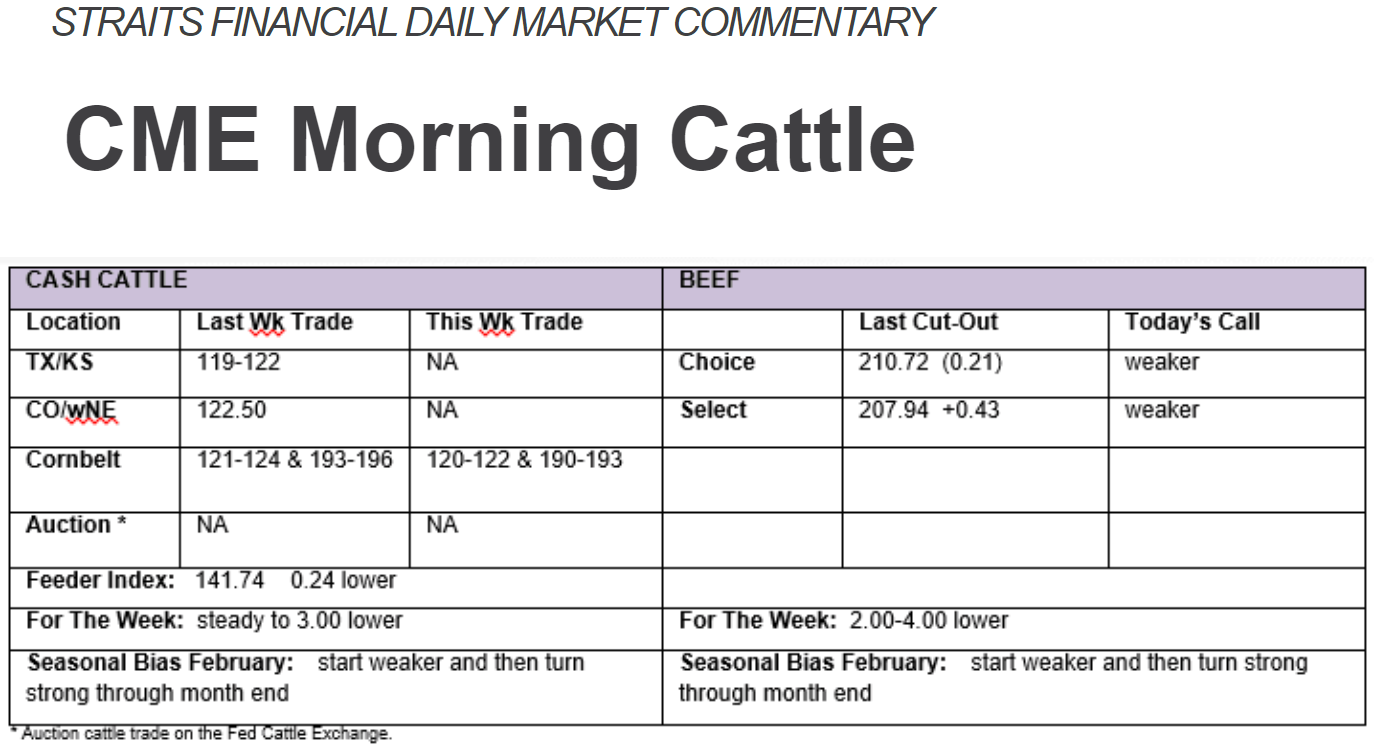

Livestock: Wednesday was another (typical) slow trading day on the cash cattle side of things. Sure, some Wednesday’s kick off the weekly trade and can be stimulated by trades in the Fed Cattle Exchange, but that was not the case yesterday. Minimum levels were set at 122 cents on the few cattle for sale electronically and none were bid on. What few packer bids that we available looked to be 120 cents live north and south. Cattle feeders might be waiting for the cattle market to play catch up to the equity markets, but so far this week that just is not happening and we have lowered our cash expectation from steady to 1.00 lower to now up to 3.00 cents lower on the low side of the spread. So far the northern trade that has been reported is 1.00-2.00 cents down on the live and 3.00 cent down on the dressed side of things.

Beef: On the week so far, the cutouts started out Monday sharply lower, then we had Tuesday mixed and Wednesday mixed. Today we will settle in at slightly weaker and the same for Friday to ensure the beef trade on the week is in the 2.00-4.00 cent lower range. Through three slaughter days, the kill is running 3k head below last weeks pace and the expectation for this week is pretty close to that level…slightly less than the 640k head production run of last week. Remember that last week’s total kill was revised up from 637k to 640k head.

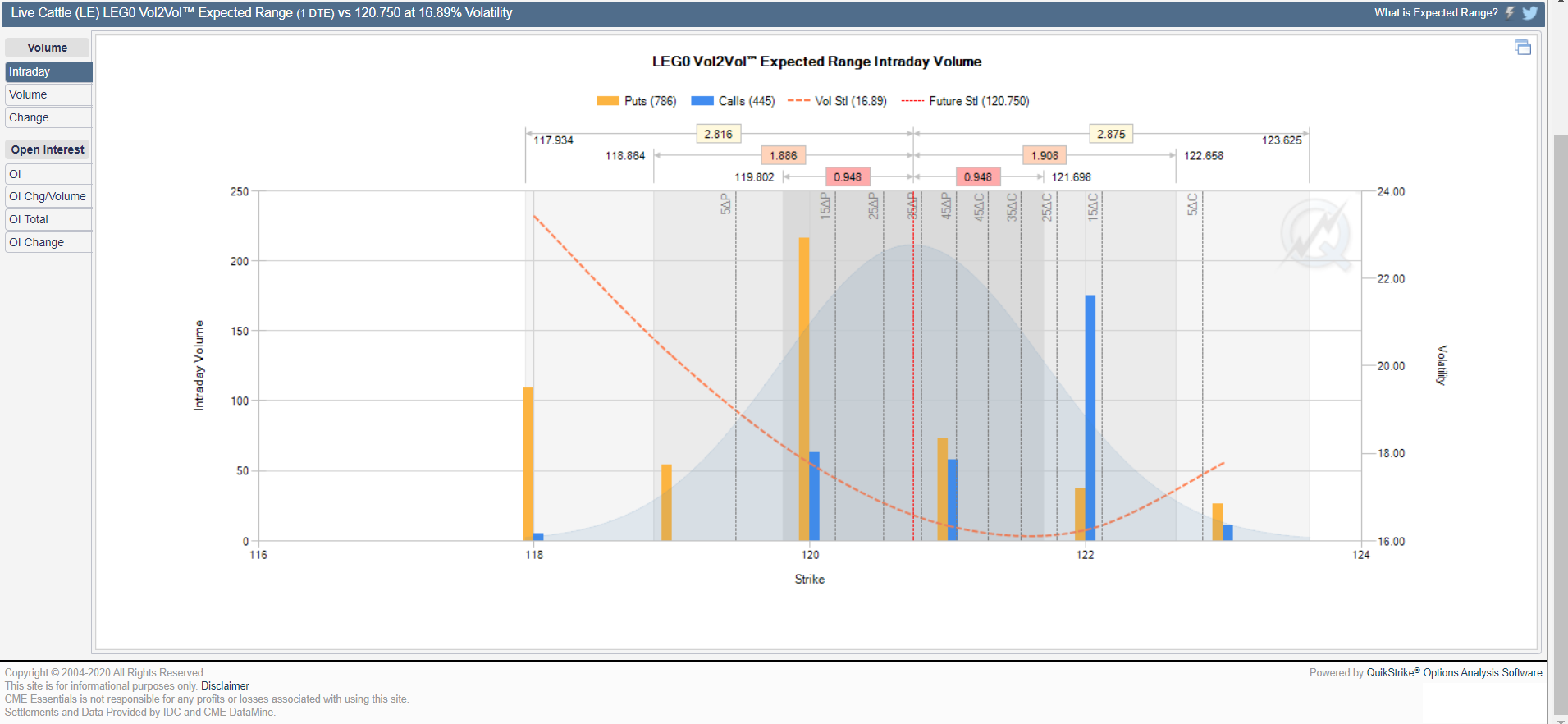

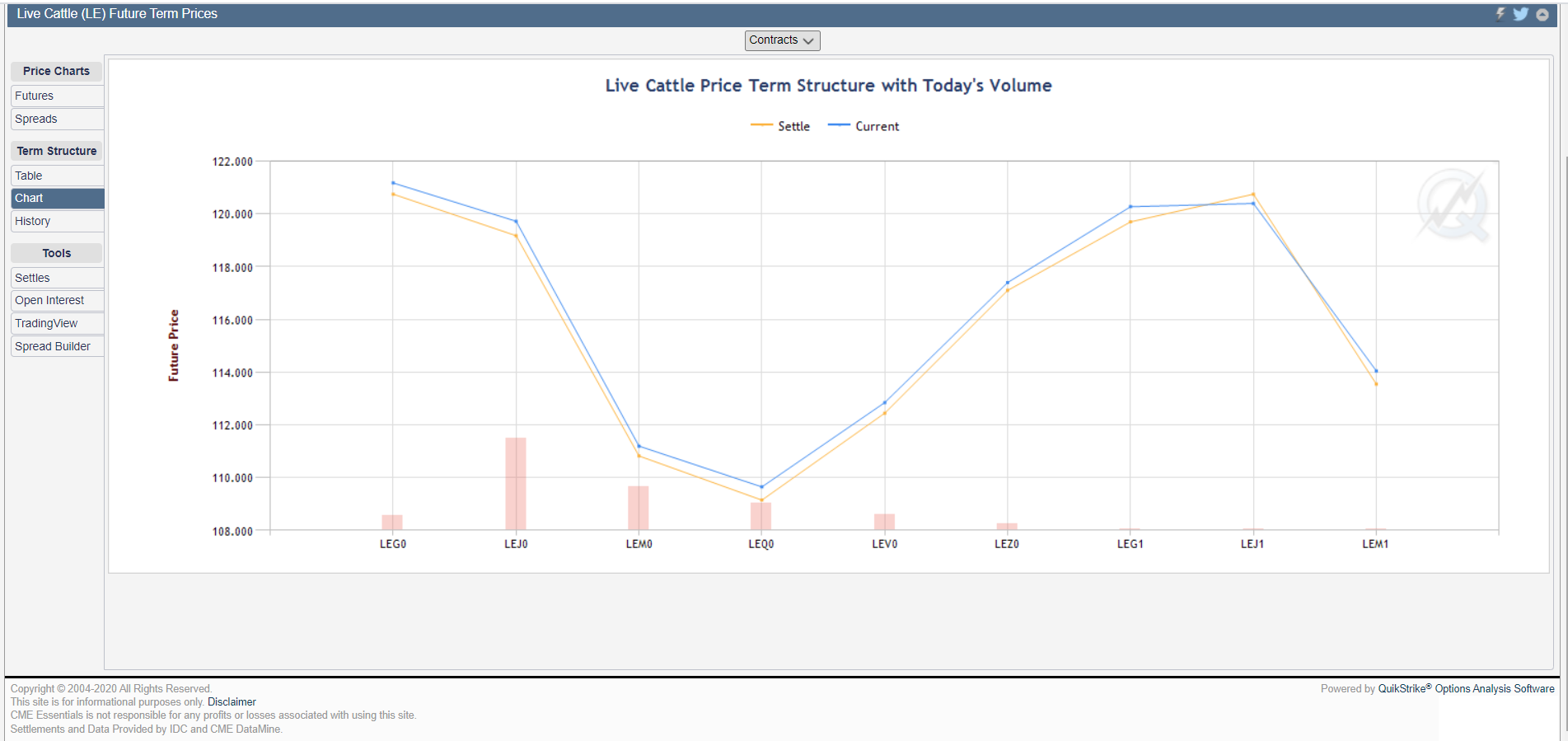

Futures: Yesterday’s live cattle trade might have made an initial try at firm, but basically spent the trading day selling off and closing near the low of the day…and also placing a new low for the selloff on all contract months going out to the end of the year where the December has held above the its recent trading lows. Wednesday’s trade saw good trading volume on 75k contracts traded and open interest once again liquidated a good 4k contracts. DTN has a lower opening call. Given the big setback yesterday and very weak close relative to the traded ranges, we could look for the bulls to defend here and force a slightly firmer opening in trying to halt the onslaught, but eventually the market cracks and we trade new lows for the selloff to ensure there is no higher cash trade. This has nothing to do with what I want, everything to do about how I see the market and what I think. Tomorrow is Option Expiration for the February live cattle futures and then Monday is First Notice. Next week on Tuesday, February 11th, we will get the next monthly crop report and the S&D.

Basis: Last week saw the February live cattle futures settle at 121.37 cents to end the week 3.47 cents lower than the prior Friday close. The live trade was basically 2.00 cents lower at 122 cents to provide a basis slightly positive with the cash cattle trade not quite a penny over the board. So far, the small live trade in the north (120-122), which is the only live trade so far, has been showing an implied basis of about even money. The front month February is pricing in a steady to 1.00 cent lower live trade on the close yesterday and if the futures can’t hold any early firmness and start to break below 120 cents, the implication for the cash gets worse in our opinion, not the basis gets real strong.

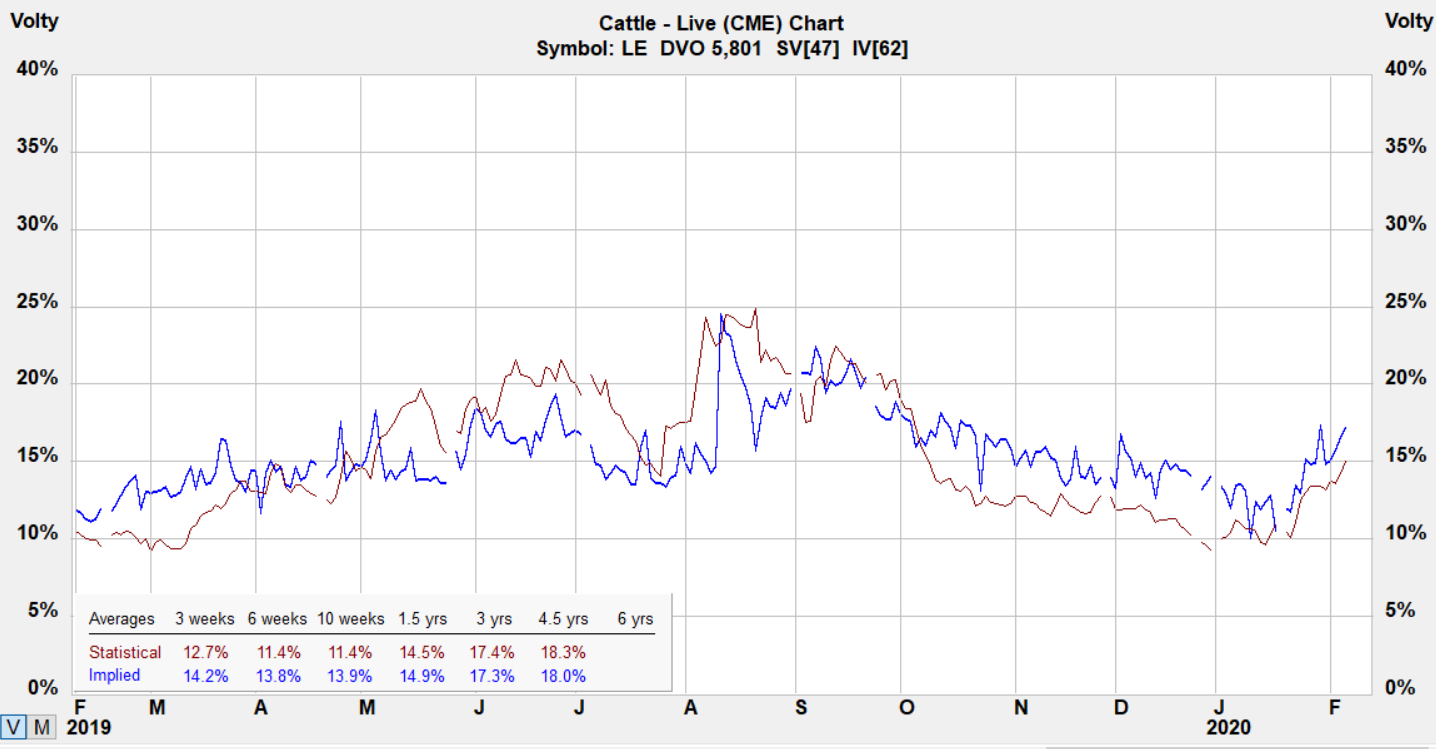

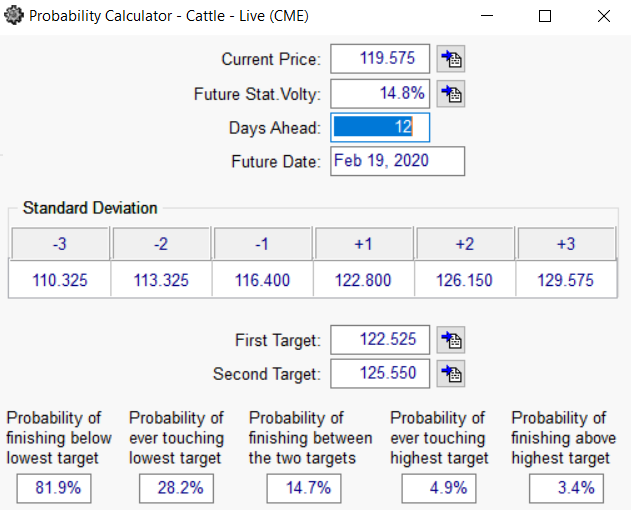

Volatility

Options fall into the category of being overvalued with rise in implied volatility. Ask about the Weekly Option's Report for more information.

Term Structure

Notes:

Contract Size - 40,000 lbs (~ 18 MT)

Tick Size: $.00025 per pound (=$10 per contract)

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (ET) with trading halt 4:15 p.m. - 4:30 p.m.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Live Cattle futures and options

Live Cattle

Below is a chart for reference.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

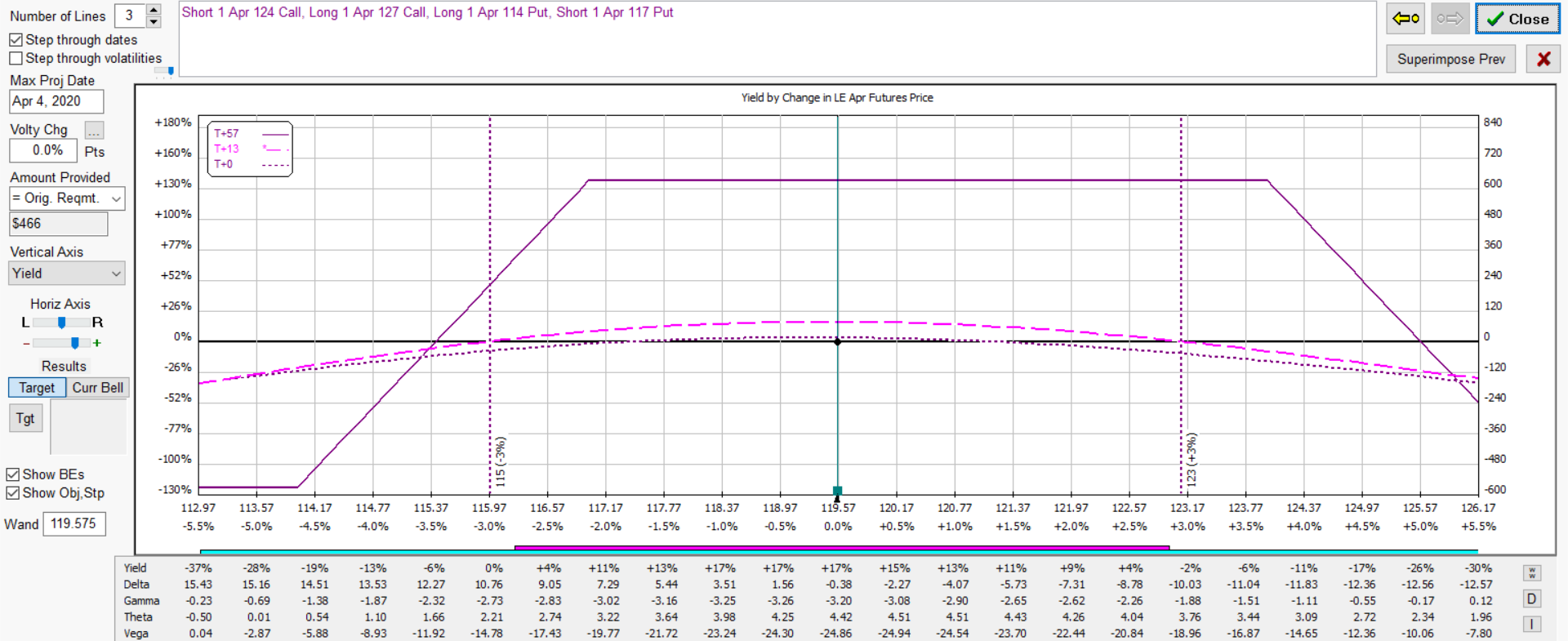

Below illustrates an iron condor It has positive time decay and benefits from an decline in volatility. The option spread covers a price range where a slight decline in implied volatility offers a theoretical edge. The position would lose if price moved beyond range extremes or volatility suddently picked up and would need to be adjusted or closed.

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below per 1 LOT. The structure has positive time decay which is an advantage over holding outright options. The strategy is for educational purposes only and not meant to be taken as trading or investment advice.

Join our Free Webcast each month and learn how these strategies can benefit your trading.