Get your copy of Paul Forchione's book, "Trading Iron Condors". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

Commentary: Straits Financial

The feeder cattle market has remained subdued in recent weeks. The market has moved far off its early April lows around 110, however, and is currently in a trading range in the 120-130 region. Like other financial markets, feeders have taken their cues from overall supply and demand, coronavirus worries and risk aversion.

The recent Philip Livestock Auction in South Dakota saw steady action in feeders, with both steers and heifers steady. Market conditions were considered to be moderate and demand was okay, but nothing special. Receipts saw an increase from totals calculated two weeks ago. The market could potentially start seeing additional buying interest if the spread of coronavirus appears to be slowing down. A slowdown in the ongoing spread could lead to the reopening of the U.S. economy and thousands of bars, restaurants and other locations that use beef suddenly opening for business again, driving up demand.

In addition to the continuing economic worries, farmers have also had to deal with weather that has been less than ideal. Thursday saw producers in the Southern Plains in short sleeves, some even baling and wrapping hay. Producers in the Northern Plains had a challenging time, however, with over 10 inches of snow being reported in some areas of Iowa. Unusual for April but not unseen, the snow will likely be the last seen this year.

Estimates for March placements are sharply lower, with some suggesting a decline of over 17 percent year over year. March marketing is expected to show a strong climb of over 12 percent year over year. USDA estimated cattle slaughter stands at 339,000 a head as of last week, down from 477,000 head a year ago. The sharp decline has been attributed to plant closures and operating limitations.

Further downside pressure in feeders could put the price of the contract around lows not seen since 2010. The market may, however, find a lot of willing buyers in that region. The market traded in a sideways range for several years around 100, moving to the low 90s and back up to near 120 before finally staging a sustainable upside breakout in 2010. The market appears to have now formed a large head and shoulders pattern on the daily chart and that could potentially spell trouble for the bulls. A breakdown below the 100 area on a closing basis could set the stage for a fresh and significant leg lower in price that has the potential to take values all the way down towards the 60 area.

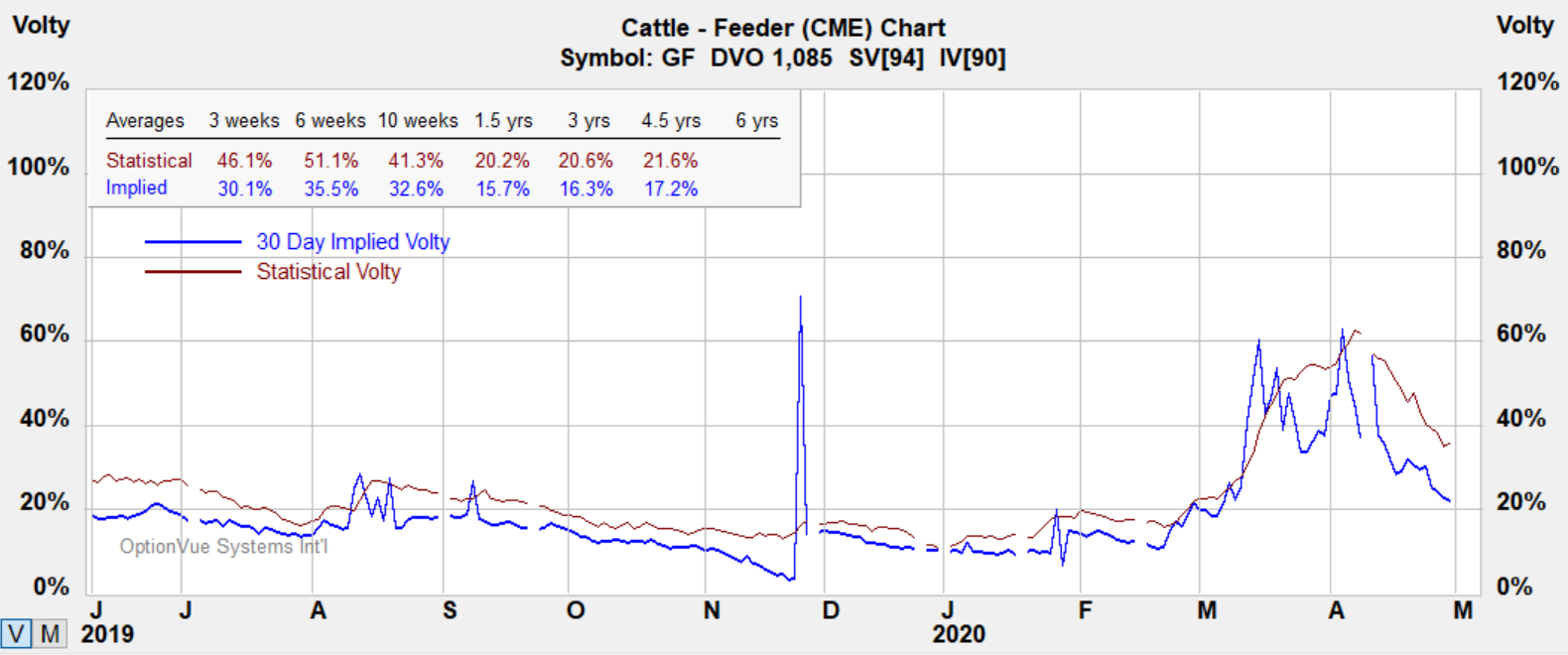

Volatility

Options fall into the category of being undervalued with implied being below historic volatility. Ask about the Weekly Option's Report for more information.

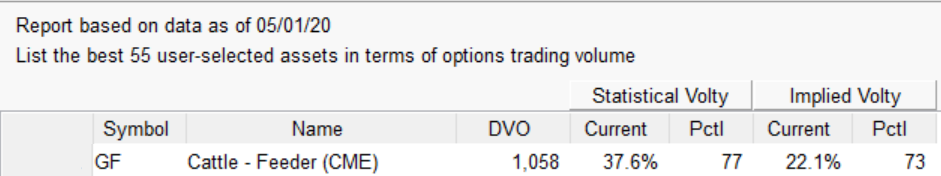

Term Structure

Notes:

Contract Size - 50,000 lbs (~ 23 MT)

Tick Size: $.00025 per pound (=$12.50 per contract)

Trading Hours: CME Globex: Monday - Friday: 8:30 a.m. - 1:05 p.m. CT (9:30 a.m. - 2:05 p.m. ET)

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Feeder Cattle futures and options

Feeder Cattle

Below is a chart for reference.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

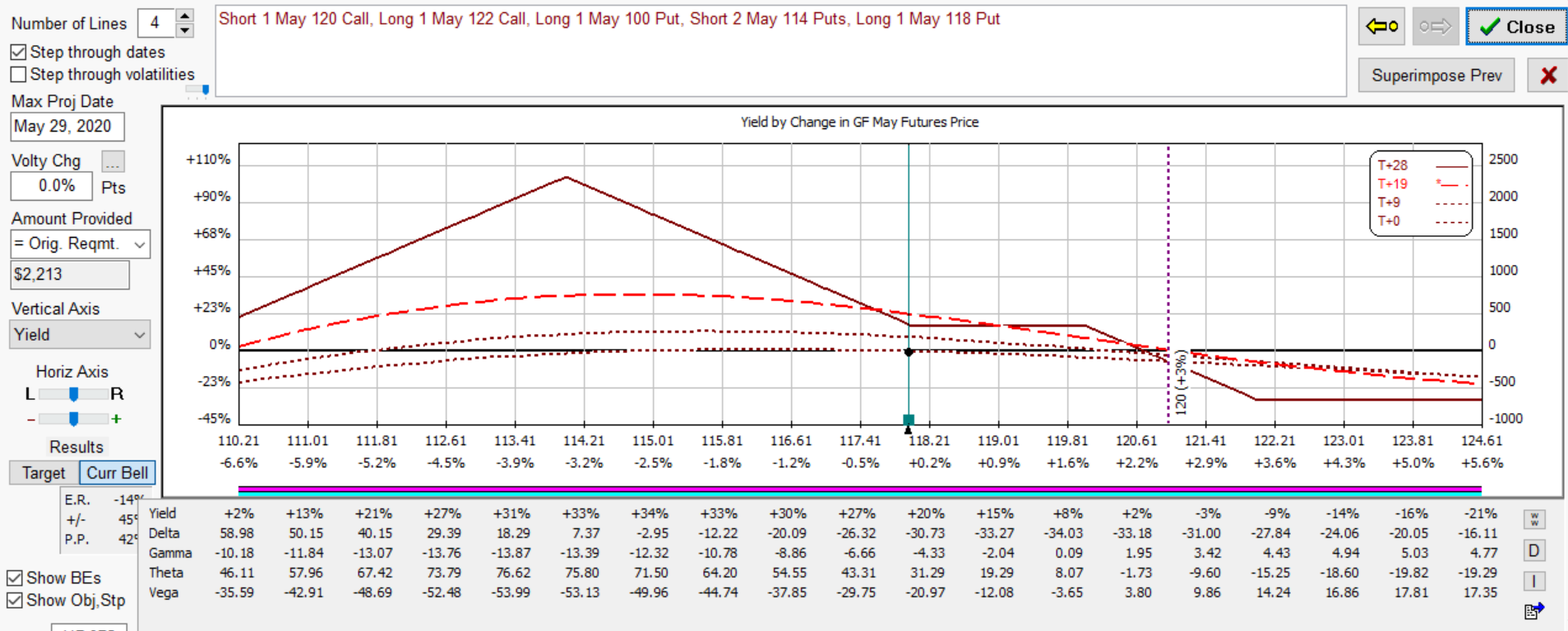

Below illustrates an directional butterfly. The option spread covers a price range where a slight decline in implied volatility would benefit the position. The position would lose if price moved beyond range extremes or volatility suddently picked up and would need to be adjusted or closed.

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below per 1 LOT. The structure has positive time decay which is an advantage over holding outright options. The strategy is for educational purposes only and not meant to be taken as trading or investment advice.

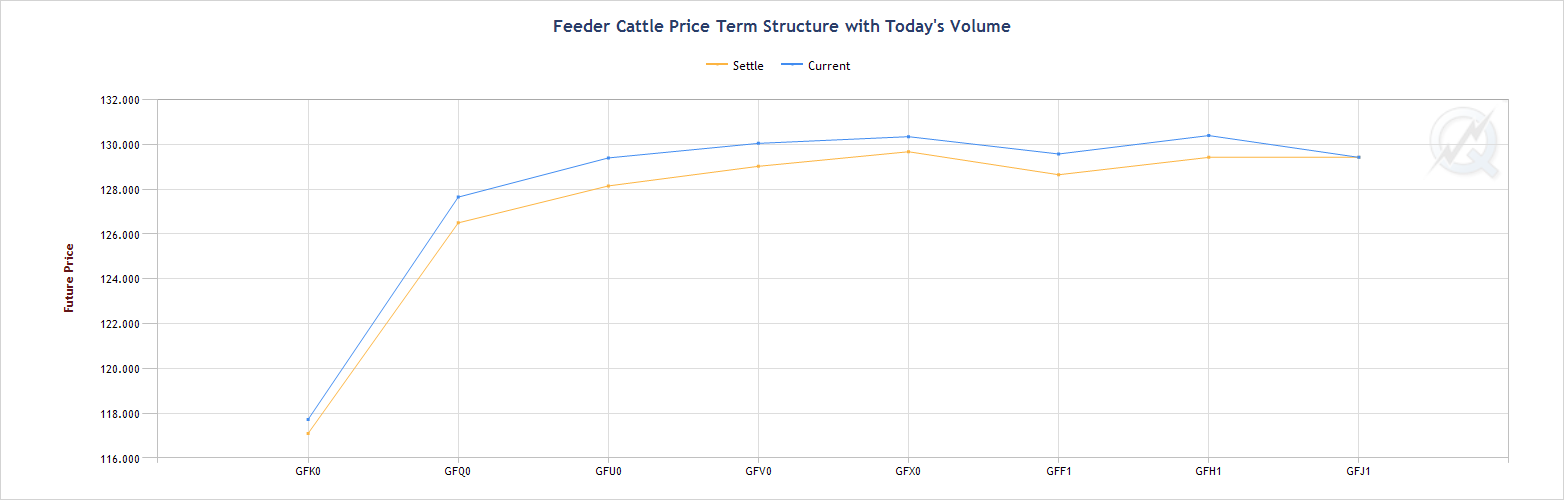

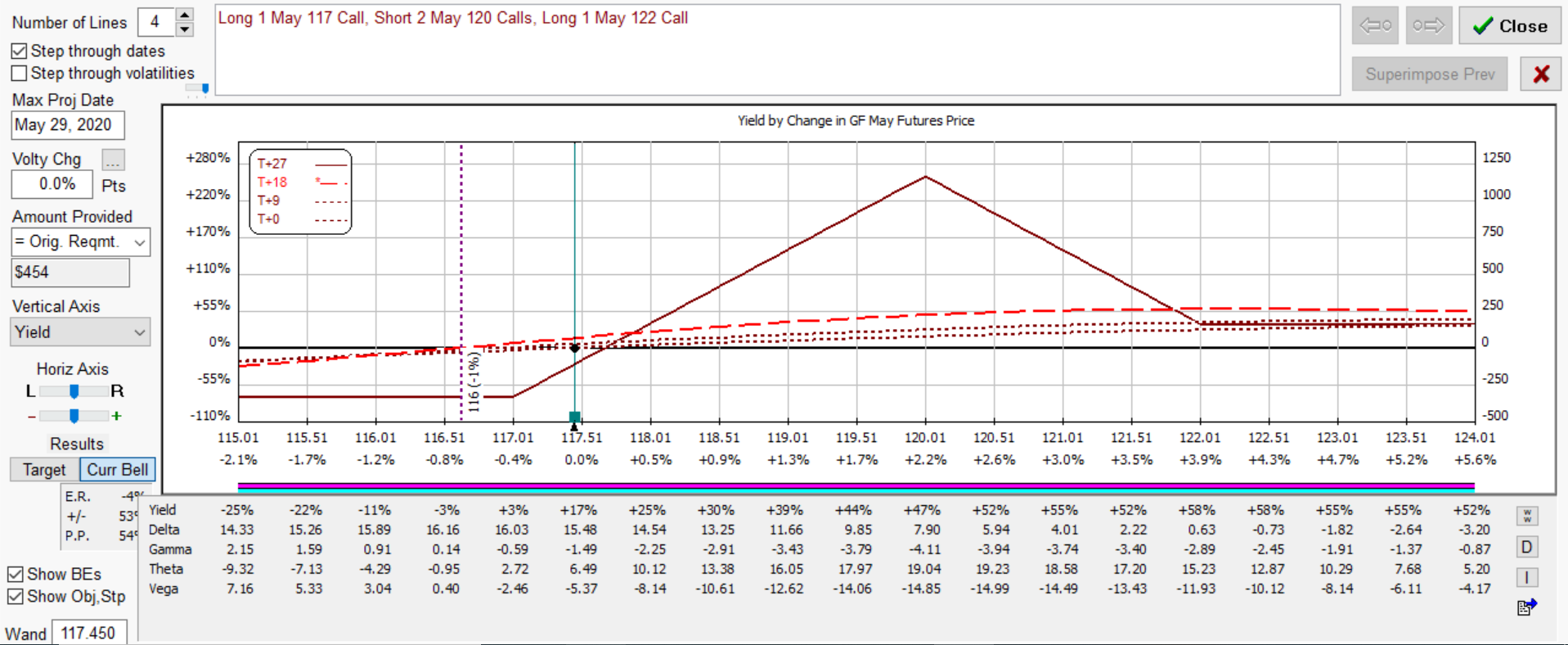

Below is a bear call spread

Combination Call spread and Fly for a delta neutral position covering a range with positive time decay.

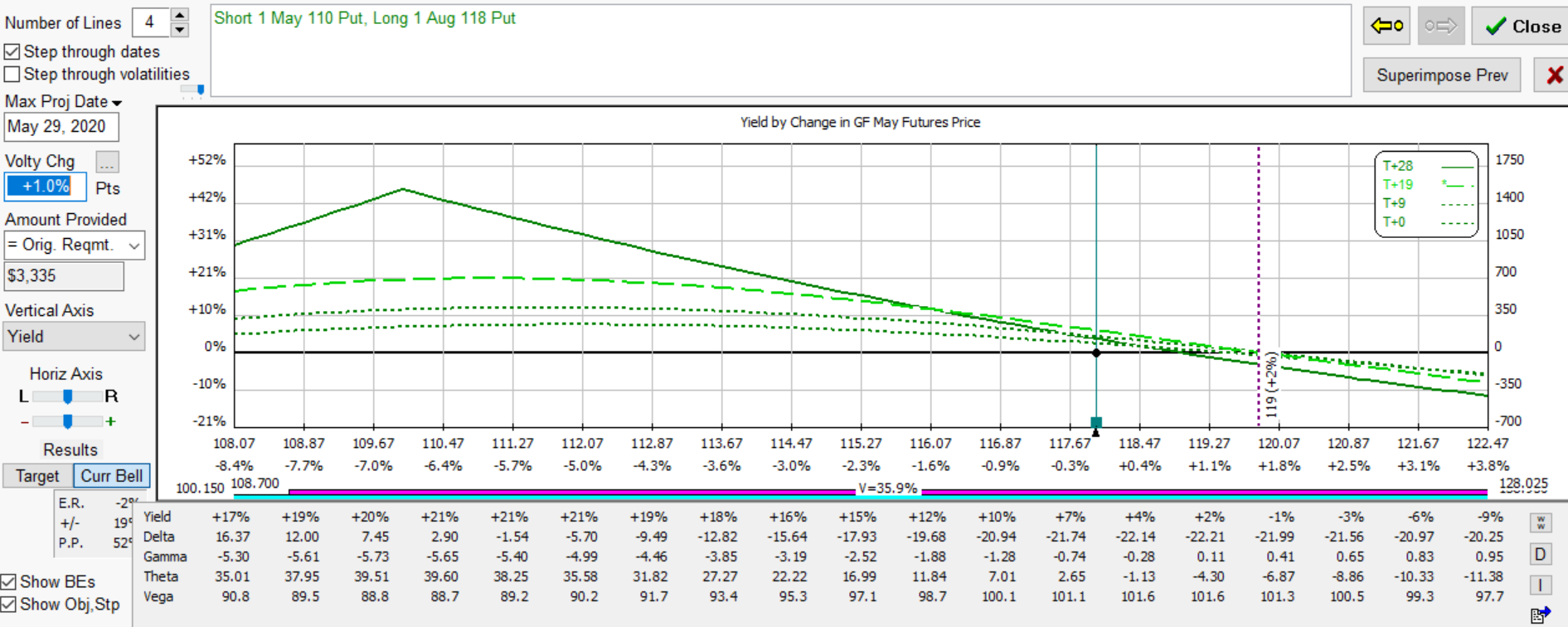

All above will benefit if implied volatility were to decline. If further downward pressure on cattle prices force a drop with volatility increasing, below is a calendar spread which benefits from a sudden rise in volatility.

Below is a directional call butterfly for a perspective to the upside.

Join our Free Webcast each month and learn how these strategies can benefit your trading.