Get your copy of Paul Forchione's book, "Trading Iron Condors". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

Commentary: Straits Financial

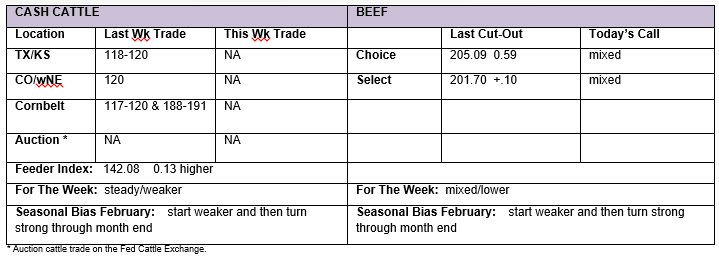

Livestock: There was a fill-in trade on Friday with a small number trading at KS at down money (118) while the north showed almost the complete range on the week on the dressed side of things. For the week we will call last week’s live trade mostly 1.00 higher in the south to steady north and the dressed trade steady at best to slightly weaker. For this week we will start out thinking steady at best, probably slightly weaker.

Beef: The slaughter level came in surprisingly larger than the week prior with the kill estimated at 628k head compared to a week ago at 620k head. The beef trade was 2.00 cents lower in the choice cutout wit the select cutout down 3.51 cents. This week steady at best, probably weaker will be our initial through.

Futures: Last week’s choppy start to the short week ended with Thursday and Friday sessions under extreme selling pressure. The bulls and those wanting to be bullish in calling for a trend change here late in February will try to see the look of a double bottom formation combined with the close just mid-range on Friday as a reason to feel better. They will need to dodge a selloff this morning based on the sharply lower equity markets world-wide, stronger debt markets, and a sharply higher gold market as a reason for the standard ‘risk off’ trade on the part of many fund traders to lead the cattle on lower. The COT data showed the prior week net-trader data to cut the large spec trader net-long in the combined futures and options position in half, but there is still some left-over length at risk. We start out thinking mixed to lower cattle futures with traders keeping one eye on the S&P most of the morning…looking for a corrective bounce in the equity markets as a hopeful sign for cattle. March corn First Notice Day is this Friday. Overnight the corn was under selling pressure from the macro as well as the chart selling as March traded to the lowest level since December 12th. Long liquidation pressure could keep the March under more pressure than the back end for a while as spec length abandons positions coming into deliver as well as general margin selling on the price break dominates the market for a while.

Basis: Last week saw the February live cattle futures settle at 119.72 cents to end the week 1.10 cents lower than the prior Friday close. Comparing this to the mostly 119 to 120 cent live trades and we have a mostly steady to -1.00 cent basis coming into this week for starters. The firmer cash and weaker board were what we needed to tighten the basis with this week being the end of trading for the front month February. With respect to the April basis, the Friday futures closed at 118.25 cents against the 119 to 120 cent level to provide a positive basis in line with historical norms in positive basis years for this time on the calendar

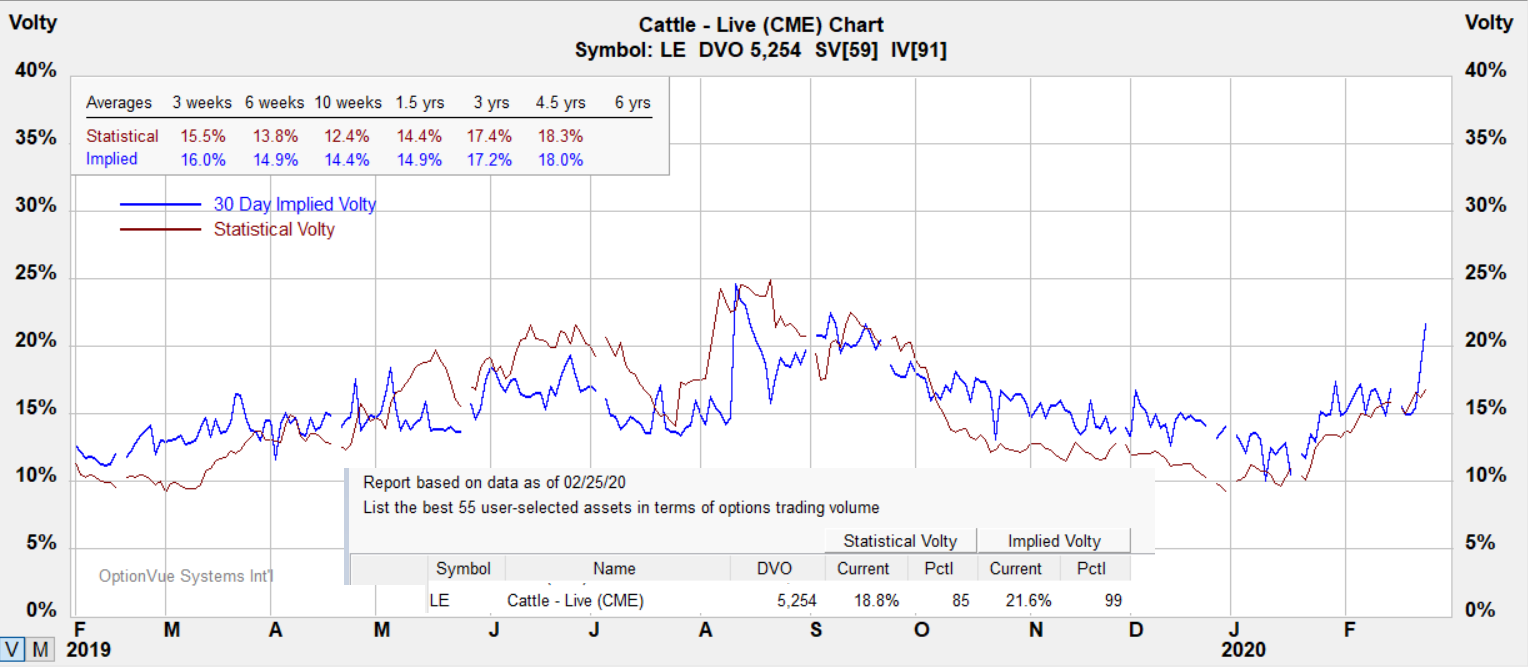

Volatility

Options fall into the category of being overvalued with rise in implied volatility. Ask about the Weekly Option's Report for more information.

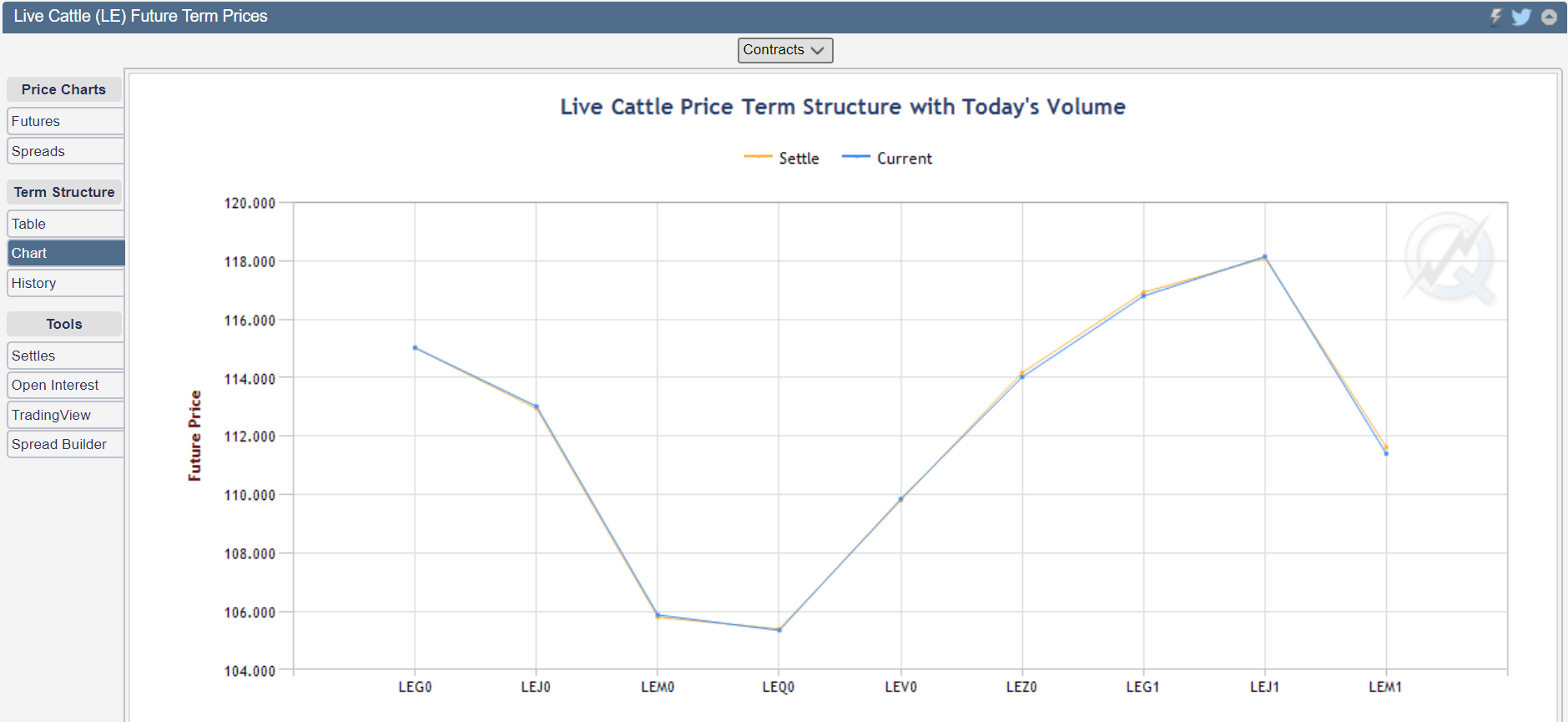

Term Structure

Notes:

Contract Size - 40,000 lbs (~ 18 MT)

Tick Size: $.00025 per pound (=$10 per contract)

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (ET) with trading halt 4:15 p.m. - 4:30 p.m.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Live Cattle futures and options

Live Cattle

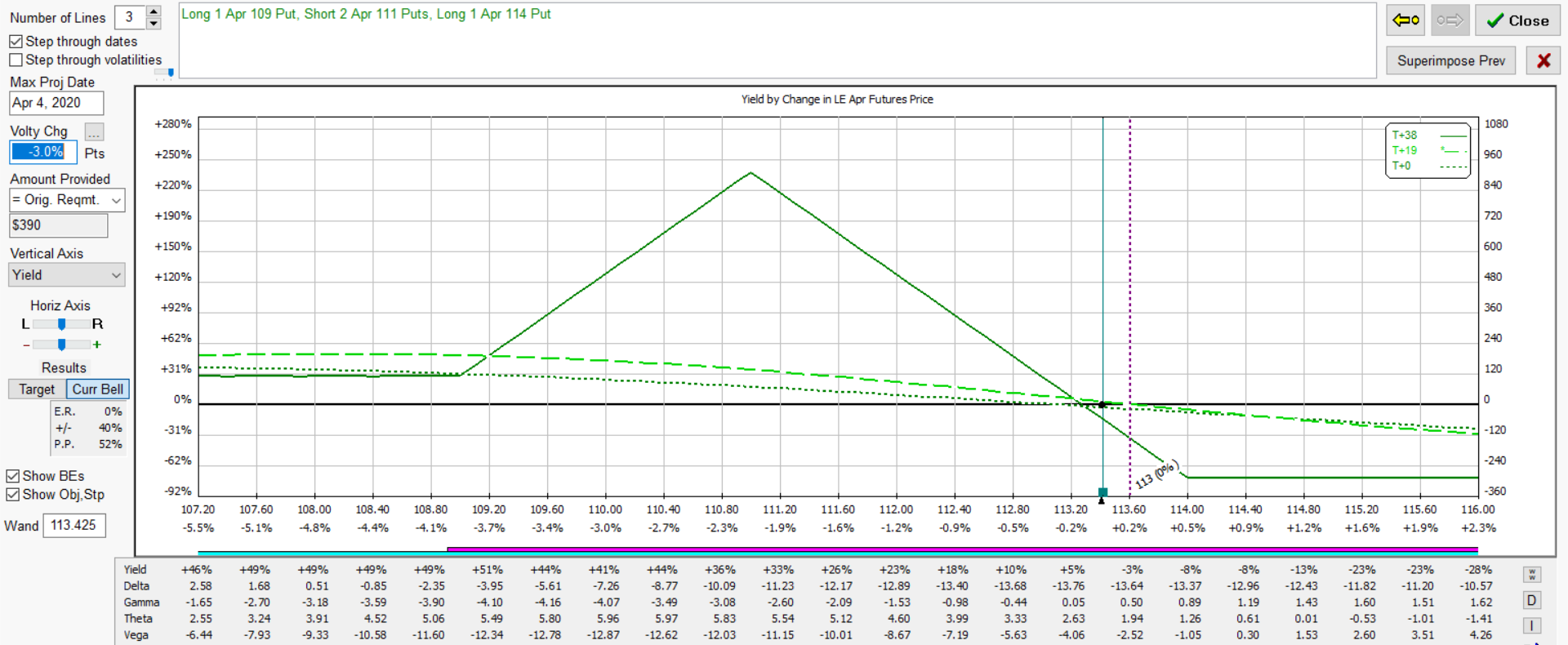

Below is a chart for reference.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

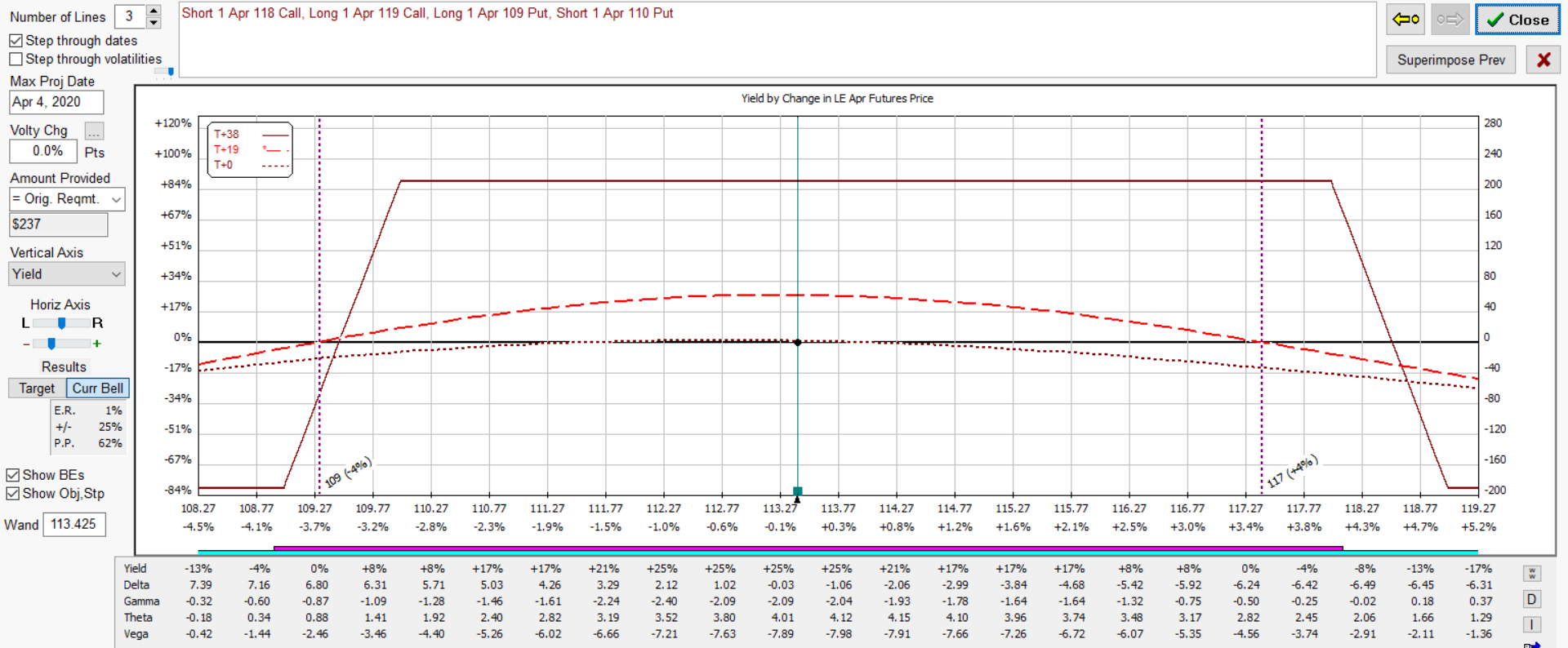

Below illustrates a put butterfly It has positive time decay and benefits from a decline in volatility. The option spread covers a price range where a slight decline in implied volatility offers a theoretical edge. The position would lose if price moved beyond range extremes or volatility suddently picked up and would need to be adjusted or closed.

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below per 1 LOT. The structure has positive time decay which is an advantage over holding outright options. The strategy is for educational purposes only and not meant to be taken as trading or investment advice.

Below is a wide iron condor with the idea of prices finding support near 110 with range. Structure would be adjusted near extremes.

Join our Free Webcast each month and learn how these strategies can benefit your trading.