Trade Options on Futures

Live Cattle * Directional & Neutral Positions

Get your copy of Paul Forchione's book, "Trading Iron Condors". Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

Commentary: Straits Financial

July 31, 2020

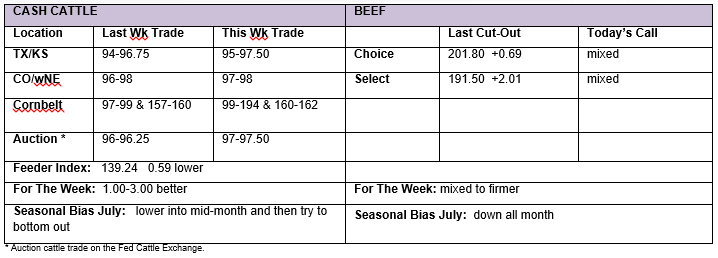

Livestock: The cash trade was quiet in the south but reached higher in the north. Live trade late in NE reached the 102-104 cent level with some of the trade (at 104) reported to be going north to Green Bay to be killed and possibly some going way east (PA.) to Mo Pack. Just rumor. The dressed trade yesterday was 160-162 to substantiate the higher live prices. In general, we will call this week’s cattle trade 1.00-3.00 cents higher. A lot of cattle are being bought with time and this along with a questionable beef demand for next week could slow down things in the near-term.

Beef: Boxes trade firmer on Thursday to bring the week-to-date movement in the cutouts to marginally firmer as packers see their replacement inventory costs rising and are feeling the pressure to some extent from a weakening beef demand. The retail market has restocked after the July 4th holiday, which was not great to begin with, and although packers need to price the boxes higher to maintain margins on their end, it looks like they will have to give ground in that regard as the demand seems to be lacking.

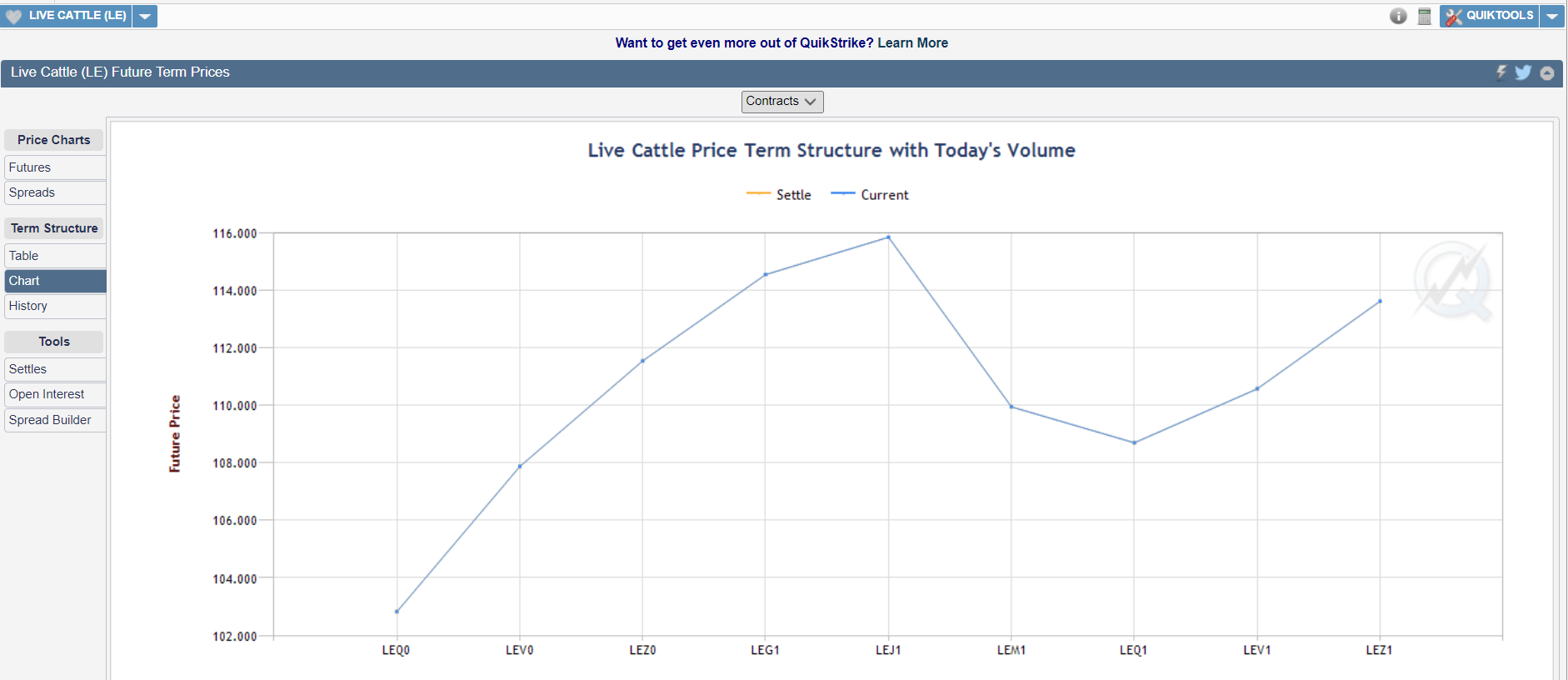

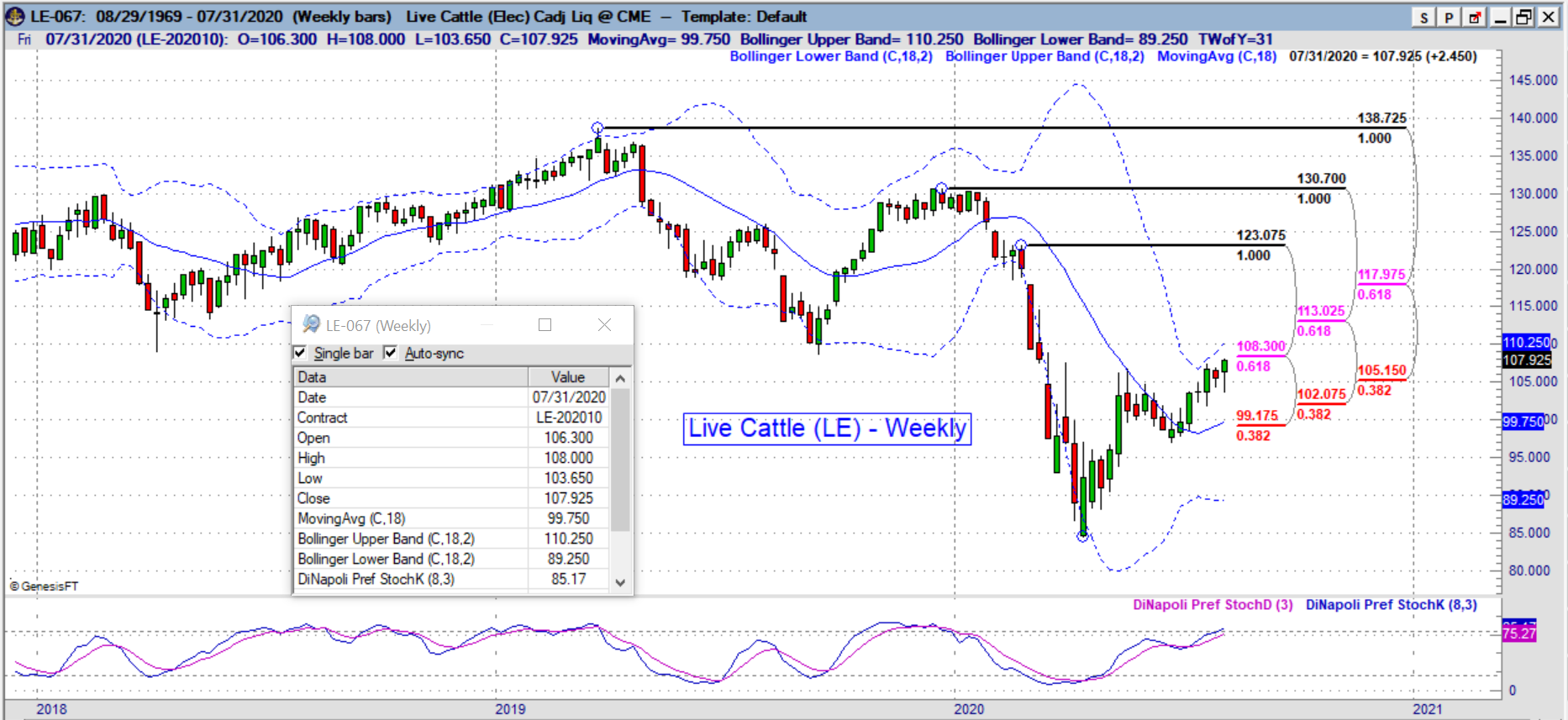

Futures: Thursday was another relatively light volume trade in the futures with open interest marginally bigger. We thought the overall market action was strong in that the market started firm, tried to setback, but then closed on or near the highs as the cash cattle trade showed more strength. Although the front month August is struggling to manage much strength due to its premium to the southern trade, the rest of the curve is taking on a stronger chart read as cash cattle prices rise and there is all kinds of talk that the beef has bottomed…whether that can lead to much of a beef rally for now remains to be seen. We will look for a firm opening this morning and attempt at trading through the mid-July high as a technical goal in all but the front month August which has the big negative basis to struggle with regarding the southern cash trade.

Basis: The August live cattle futures closed on Thursday at 101.72 cents while the cheapest to deliver cash trade in the south remains a little more than 4.00 cents back of the board to keep the southern deliveries in play unless cattle feeders choose to hold cattle back the next couple of weeks to take advantage of the 5.00 cent contango between August and October futures.

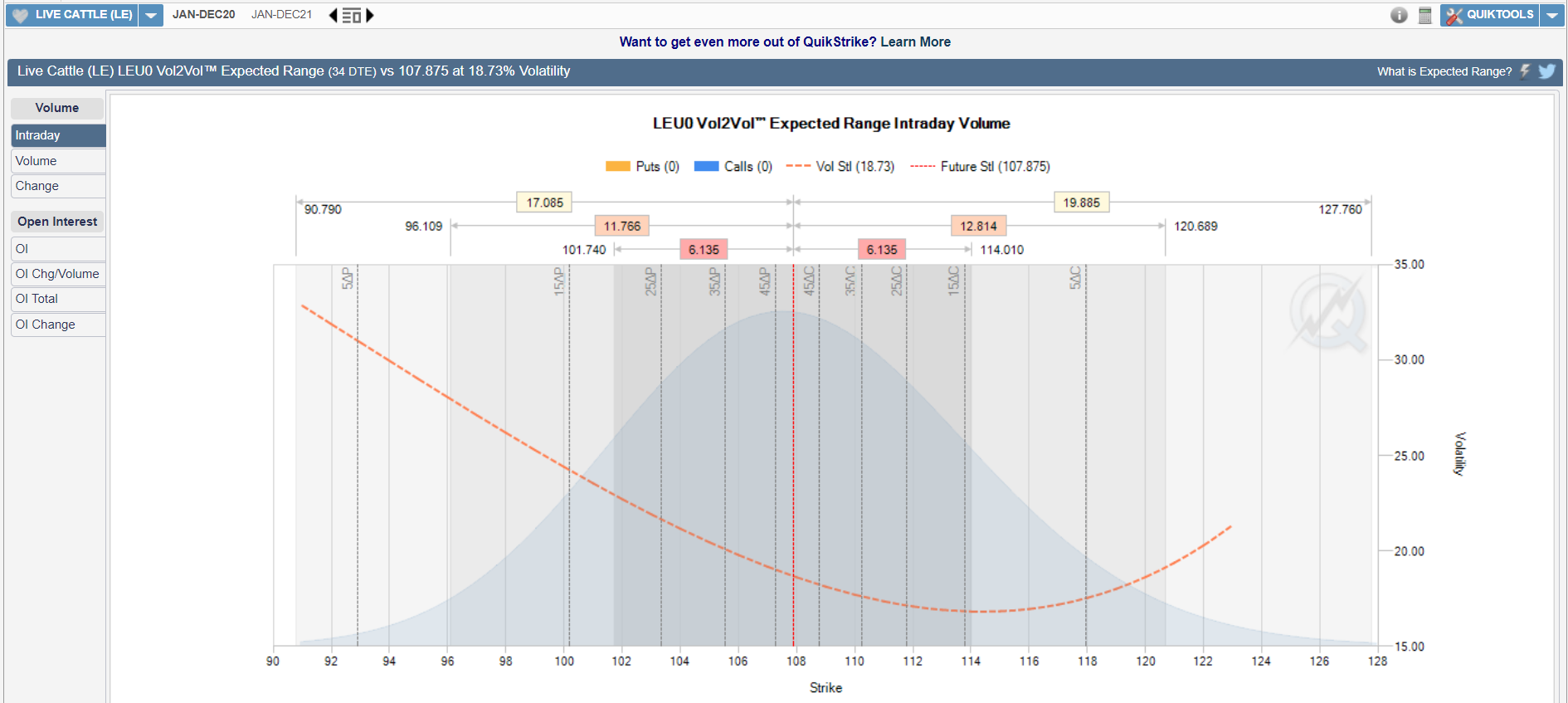

Volatility

Term Structure

Notes:

Contract Size - 40,000 lbs (~ 18 MT)

Tick Size: $.00025 per pound (=$10 per contract)

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (ET) with trading halt 4:15 p.m. - 4:30 p.m.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Live Cattle futures and options

Live Cattle

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

Strategies

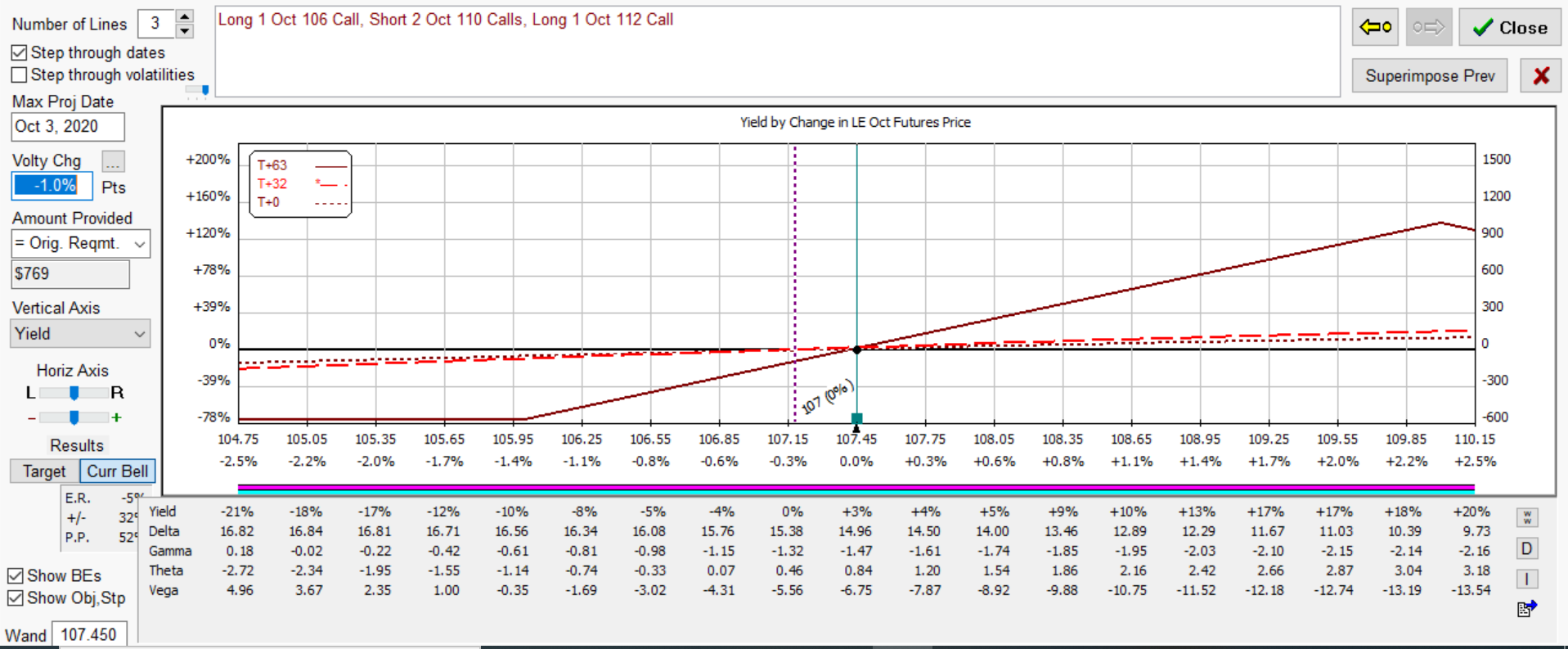

Below illustrates a call butterfly It has positive time decay and benefits from a decline in volatility. The option spread covers a price range where a slight decline in implied volatility offers a theoretical edge. The position would lose if price moved beyond range extremes or volatility suddently picked up and would need to be adjusted or closed.

The % yield shown in the diagrams below represent an estimated return on margin from projected dates shown below per 1 LOT. The structure has positive time decay which is an advantage over holding outright options. The strategy is for educational purposes only and not meant to be taken as trading or investment advice.

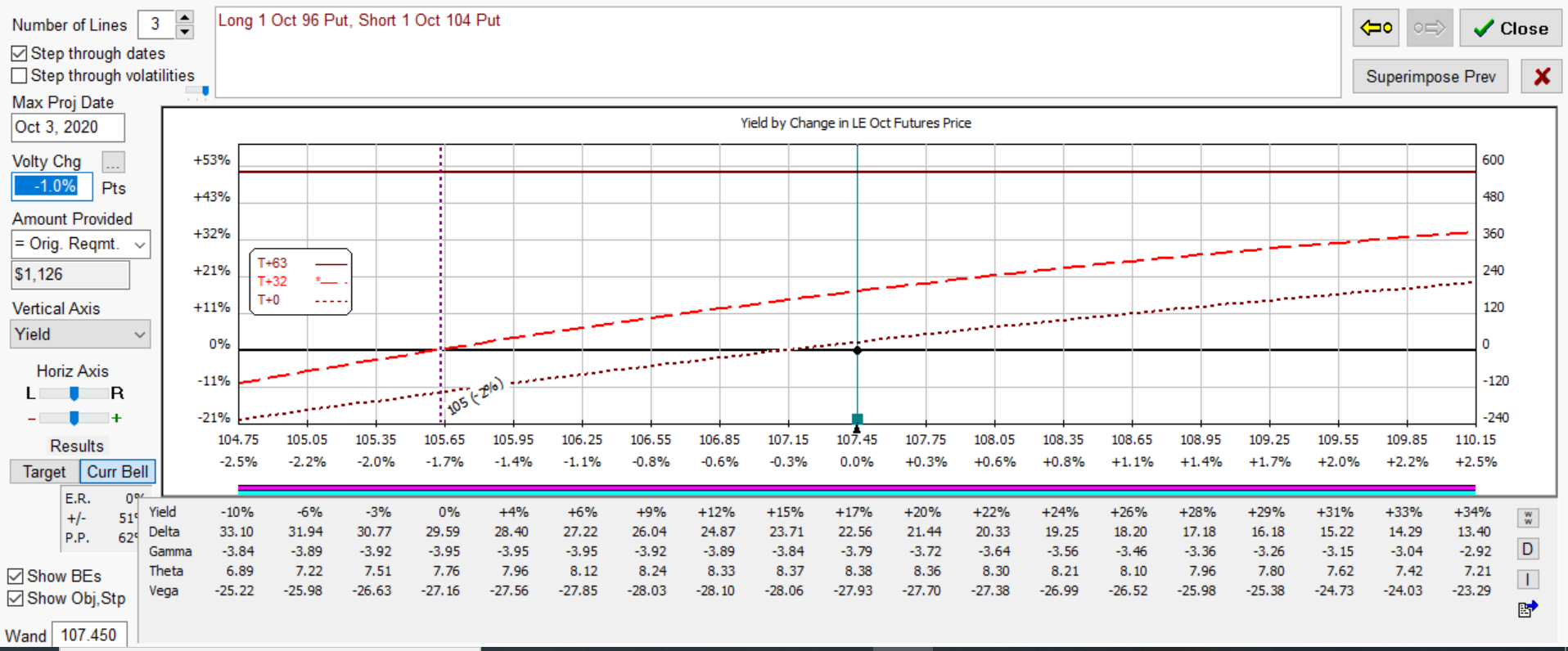

Bull Put

Bullish Fly - Conservative

Join our Free Webcast each month and learn how these strategies can benefit your trading.