Learn the ACE Program

Crude Oil * Directional Position

Get a Free 30 day trial of MarketPlus Premium subscription when you get an hour consultation with Paul Forchione. MarketPlus Premium shows how we (Oahu) can use information to form actionable trade strategies.

By using our website, you agree to accept our terms of use (click to read)

Commentary

- WTI up over 3% Friday with new highs for 2019.

- Tarriff talk with China initiating imports positive at 53.85 level

- Feb and Mar futures are at 2019 highs

- U.S. expands leadership into crude while OPEC and Russia agree on production cuts

- IEA expects energy markets to rebalance gradually in 2019

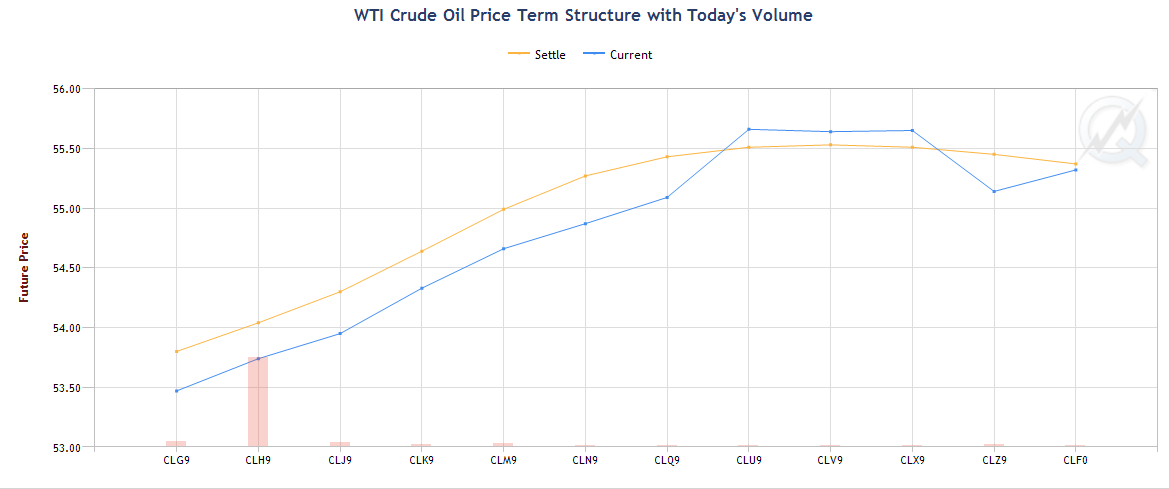

Term Structure

Shift into a normalized market.

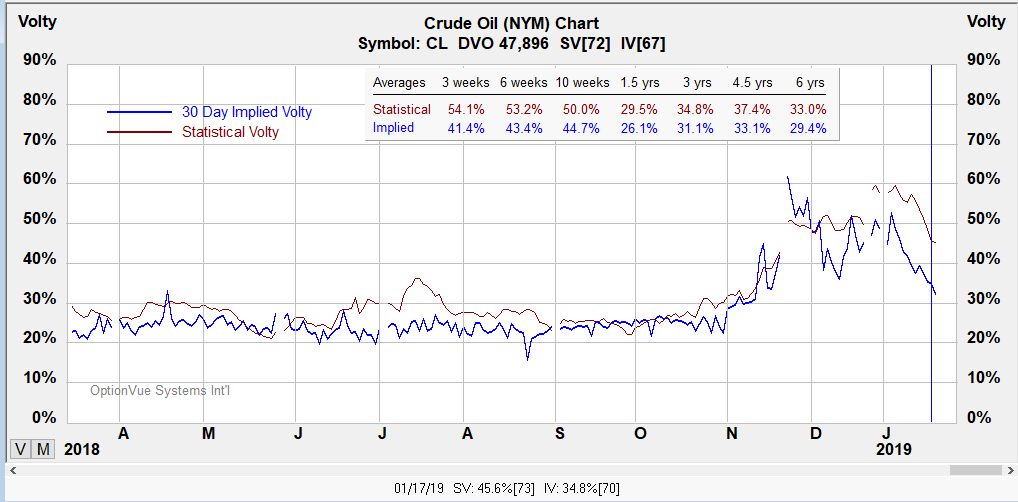

Volatility

Crude Oil implied volatility has slowed below historic levels.

Notes:

Contract Size - 1,000 barrels.

Tick Size: Outright: dollars and cents with 0.01 points=$10

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (CST).

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Crude Oil futures and options

Crude Oil

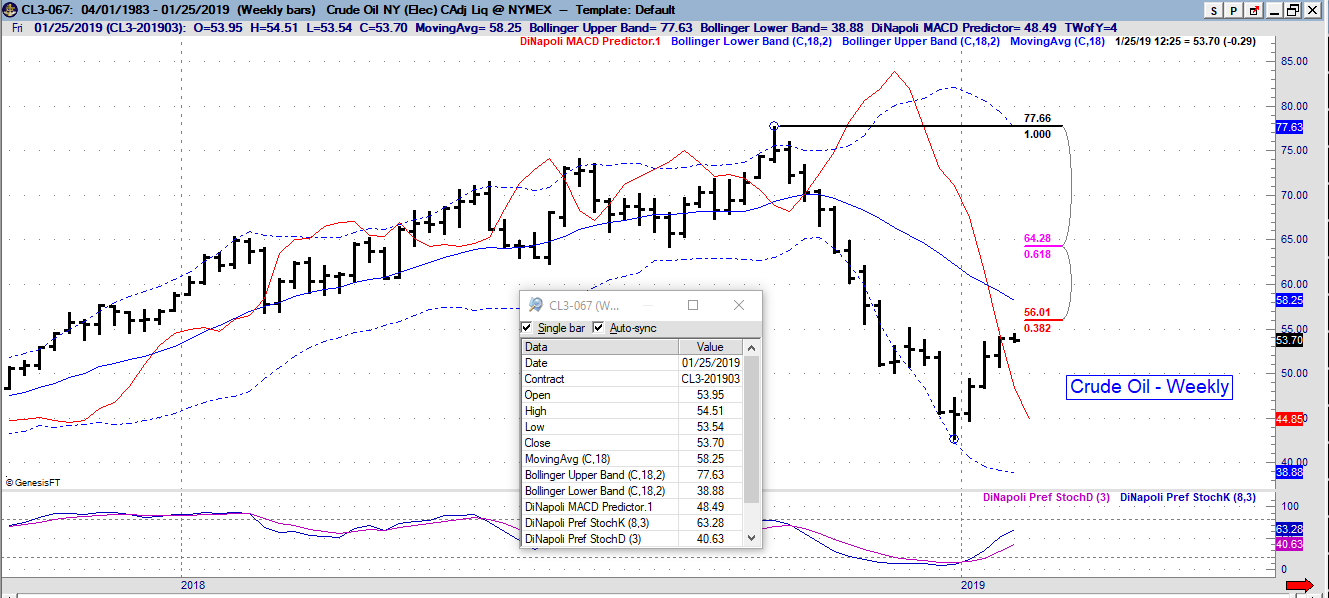

Below is the CL charts for reference. Crude in a tug-of-war between U.S. shale transport capacity and push on global demand and middle east edging up prices.

At prior resistance

Strategies -

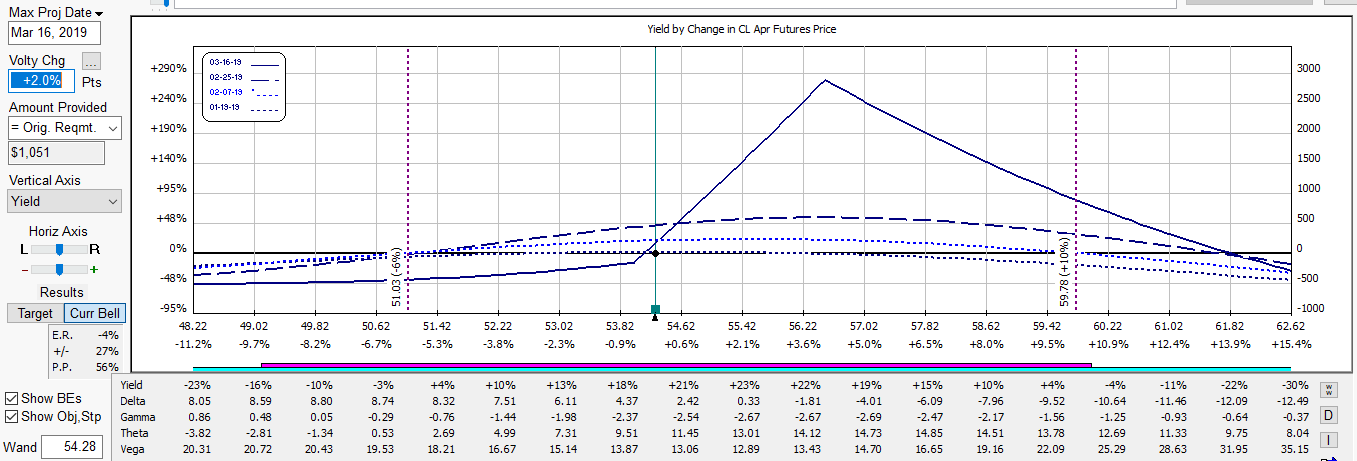

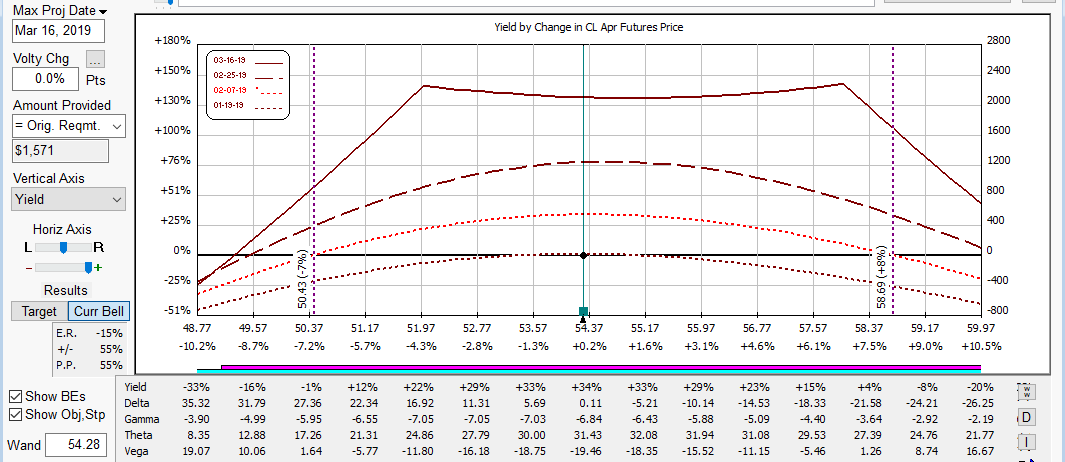

Below is an illustration of a Strangle Swap with small negative Vega. Structure can be managed if price moves to extremes.

Below is a diagonal butterfly with slightly positive Vega and supposed a bullish view on the market.