Learn the ACE Program

Crude Oil * Directional Position

Get a Free 30 day trial of MarketPlus Premium subscription when you get an hour consultation with Paul Forchione. MarketPlus Premium shows how we (Oahu) can use information to form actionable trade strategies.

By using our website, you agree to accept our terms of use (click to read)

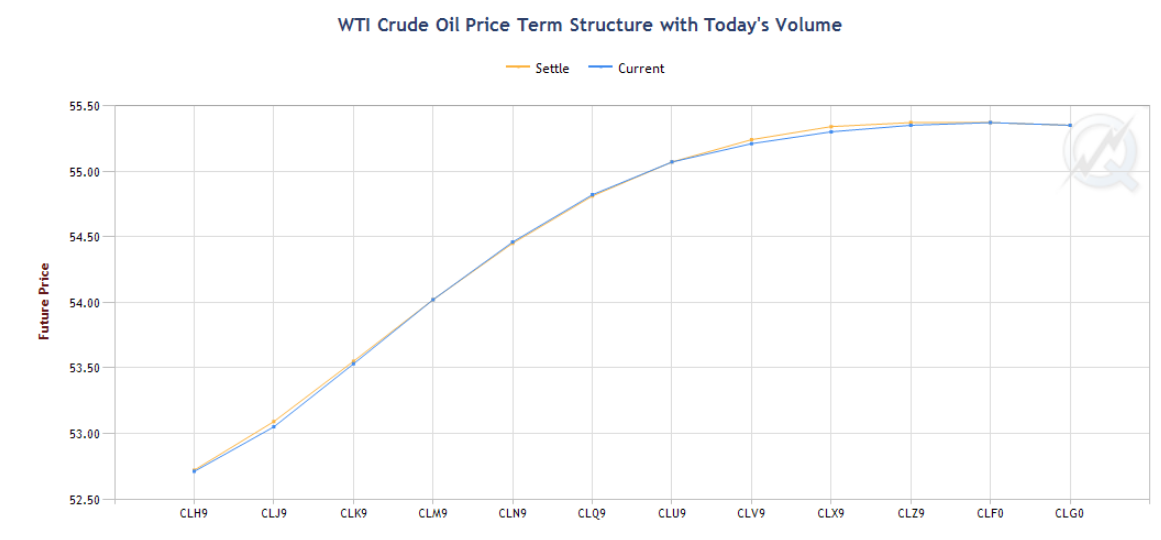

Term Structure

Contango.

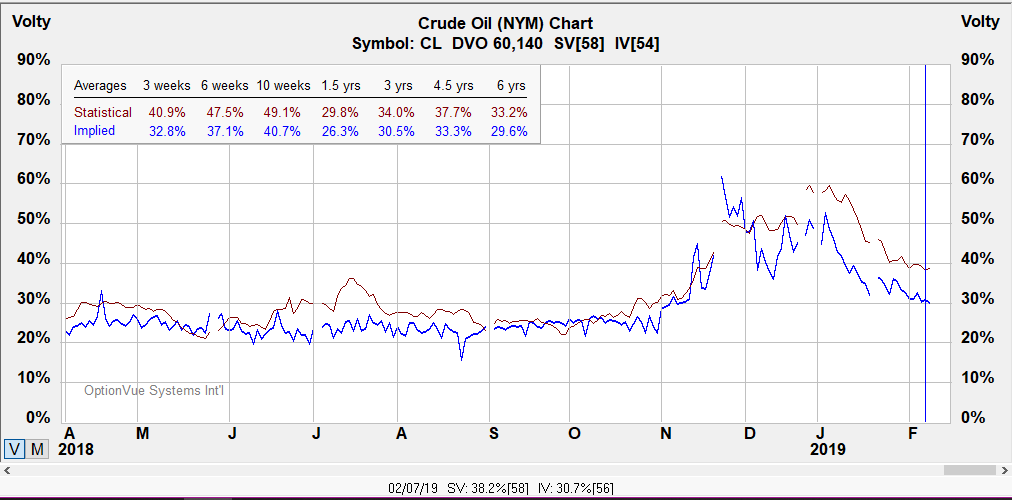

Volatility

Crude Oil implied volatility has slowed below historic levels.

Notes:

Contract Size - 1,000 barrels.

Tick Size: Outright: dollars and cents with 0.01 points=$10

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (CST).

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about Crude Oil futures and options

Crude Oil

Below is the CL charts for reference with market moving in a tight range.

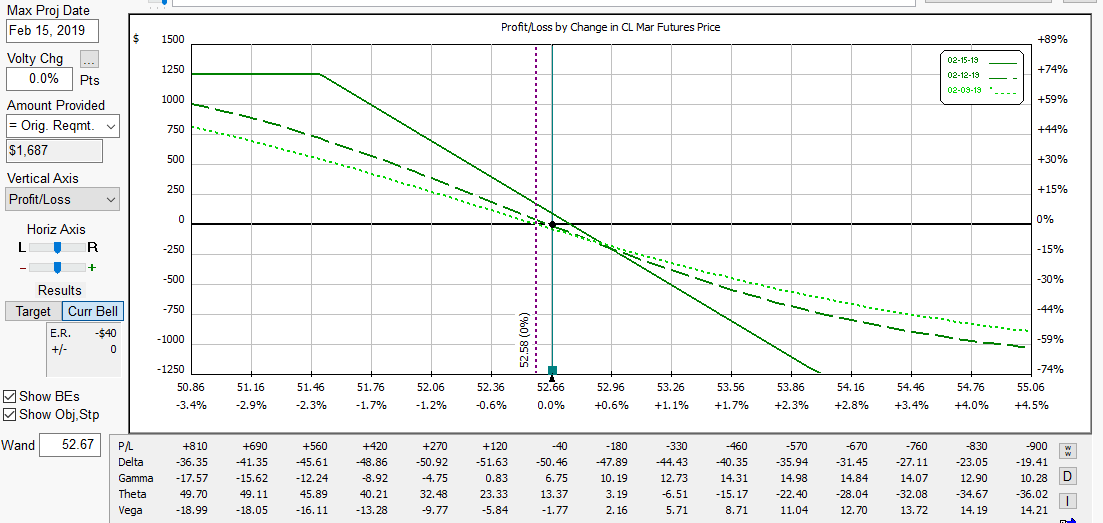

Strategies -

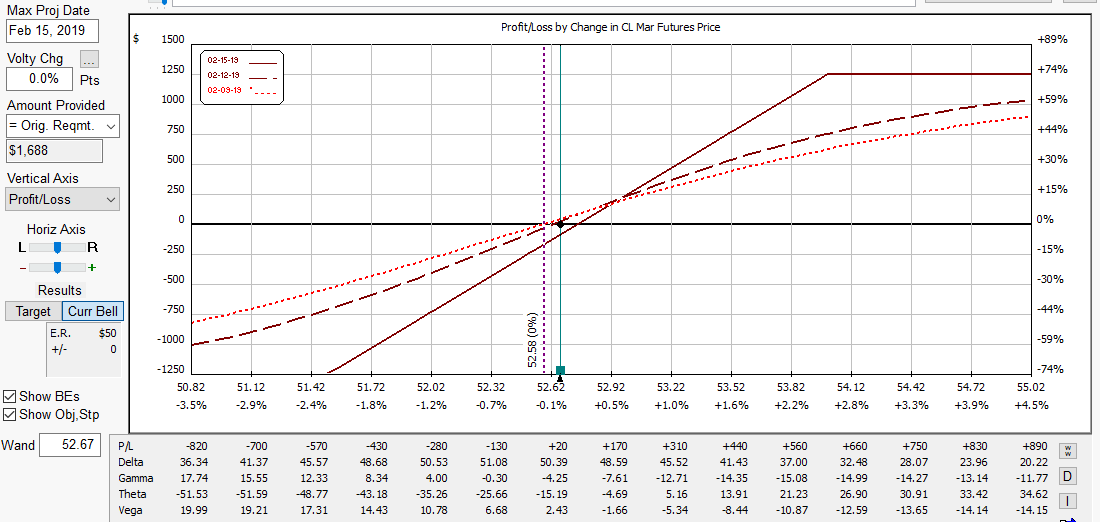

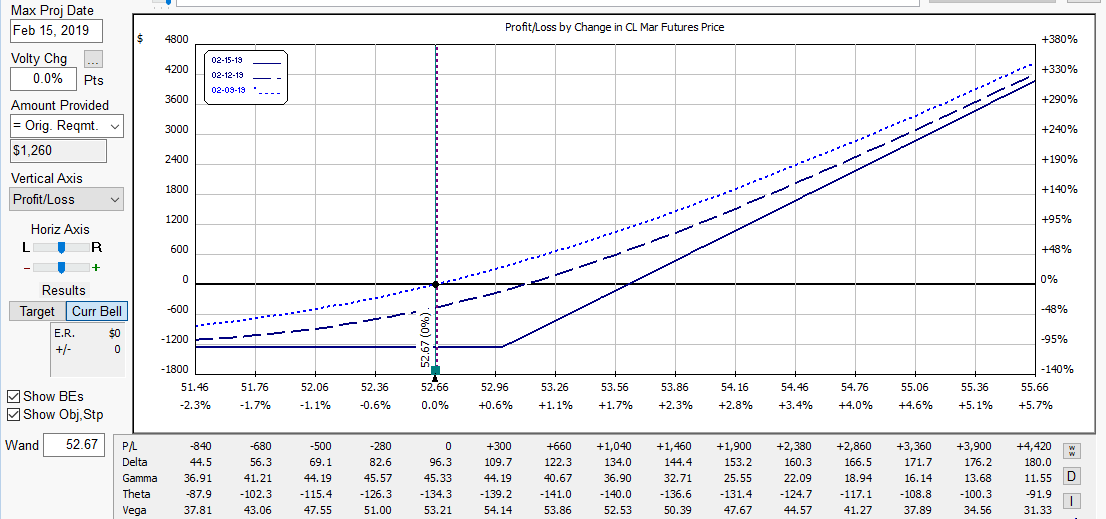

Below are illustrations of Vertical Spreads based on a 1 lot. These are explained in Paul's book, "Using Futures Options for Day Trading & Hedging".

For illustration, compare against purchasing 2 x March Calls

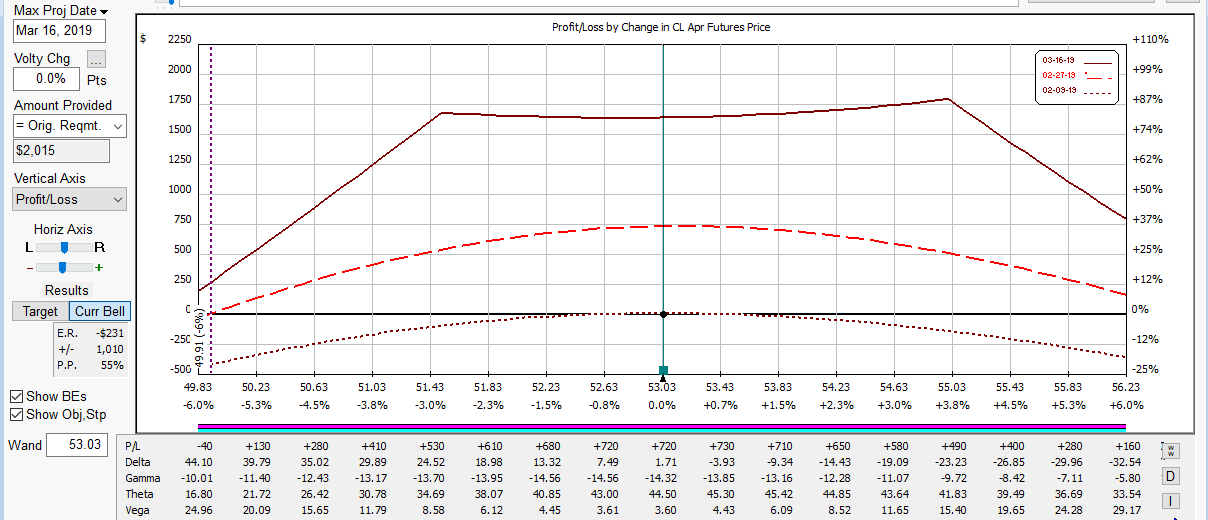

An illustration of a Strangle Swap using front and deferred month combinations. Position is projected as being held till end of month and would be adjusted if markets moved to extremes in the range.

Below is a link to CME settlement prices last Friday.