Get your copy of Paul Forchione's book, "Using Futures Options for Day Trading & Hedging" for $10 USD. Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

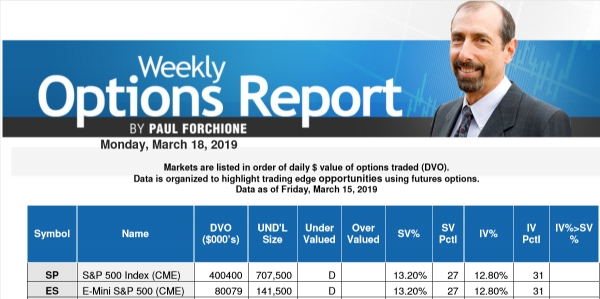

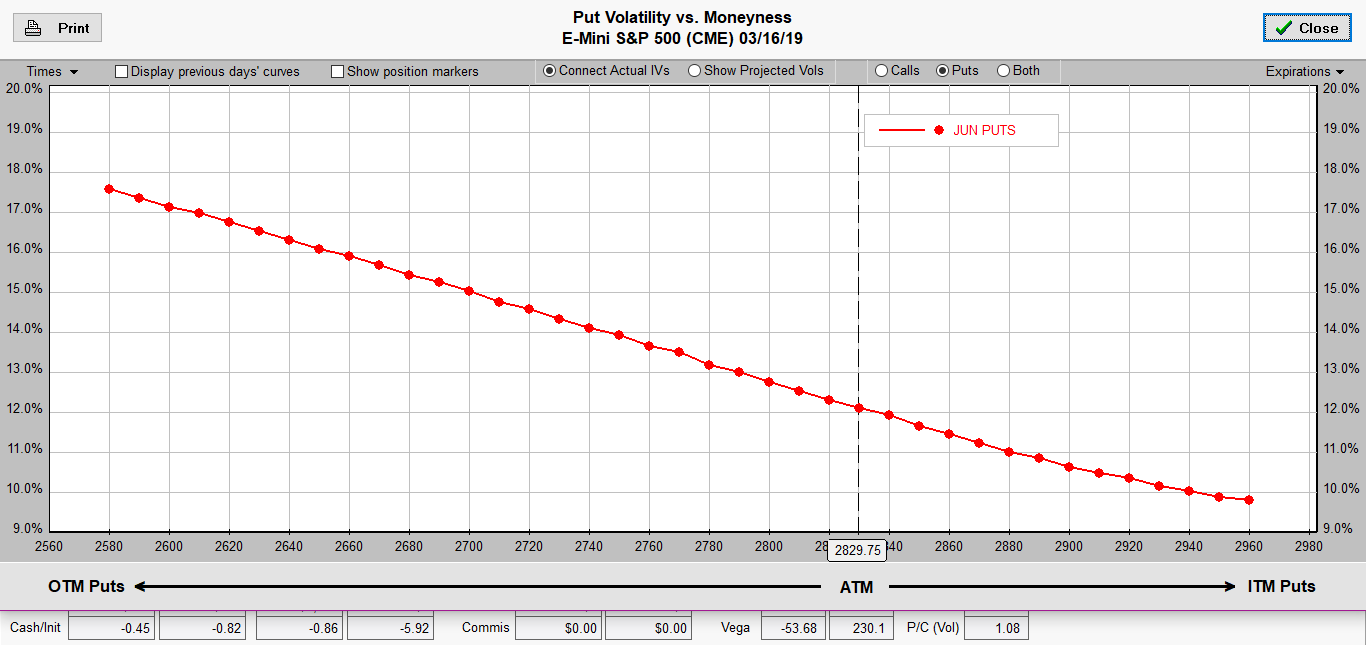

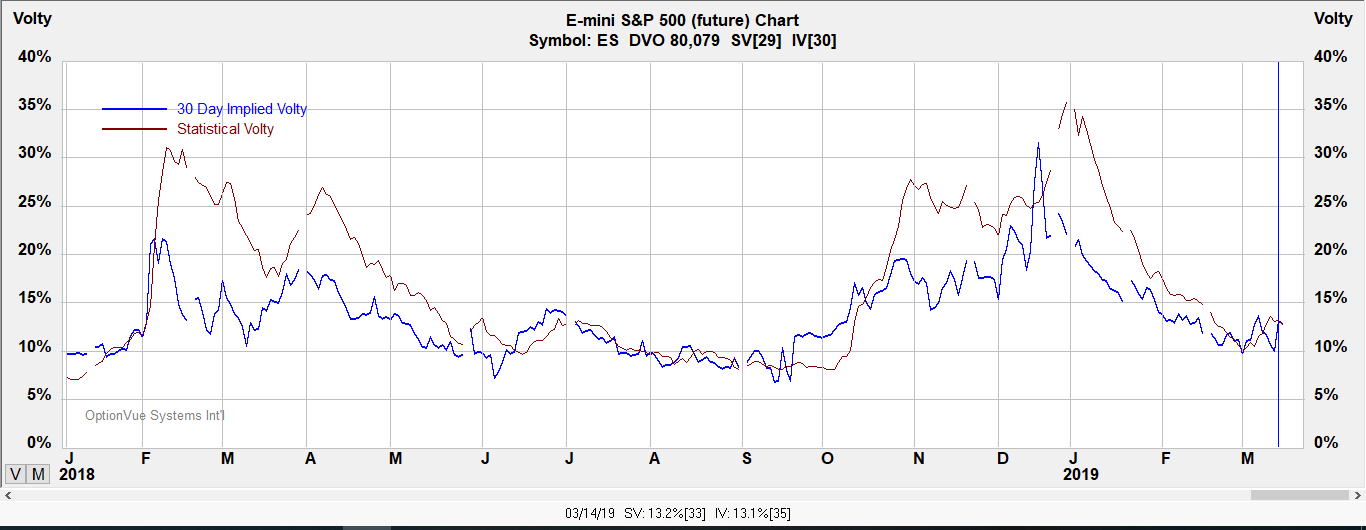

Volatility

Options fall into the category of being slightly undervalued in non-volatile markets in the weekly options report.

Notes:

Contract Size - $50 x S&P 500 Index.

Tick Size: Outright: 0.25 index points=$12.50

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (ET) with trading halt 4:15 p.m. - 4:30 p.m.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about E-Mini S&P futures and options

E-Mini S&P

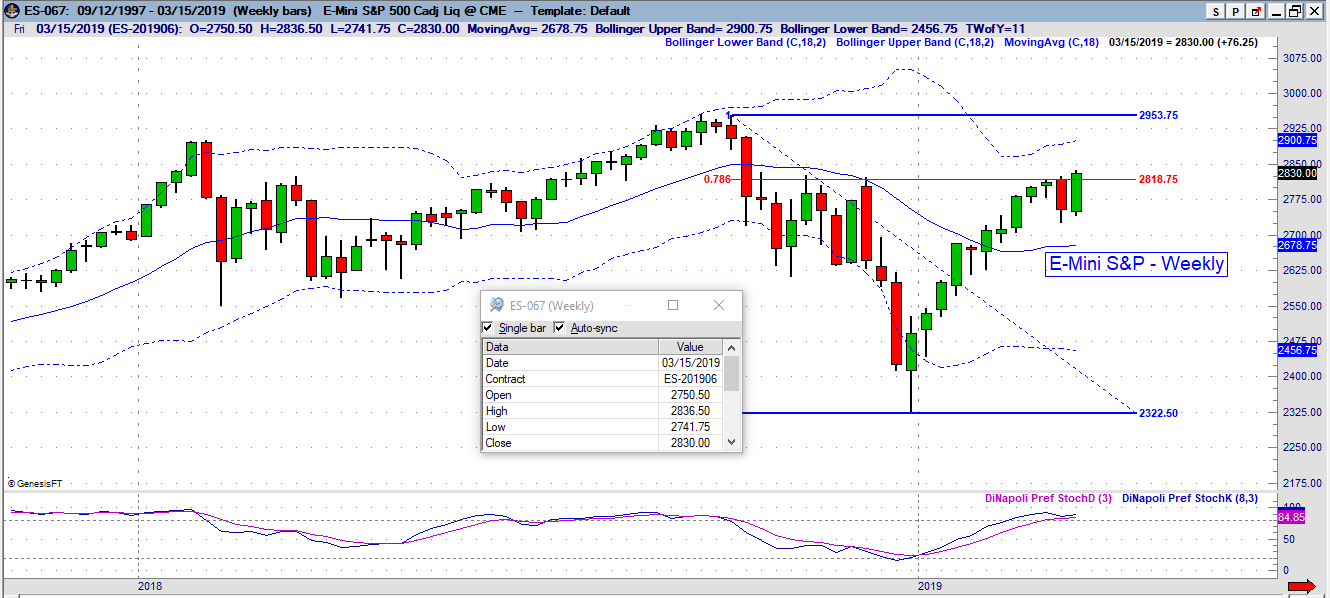

Below are both weekly and daily charts for reference.

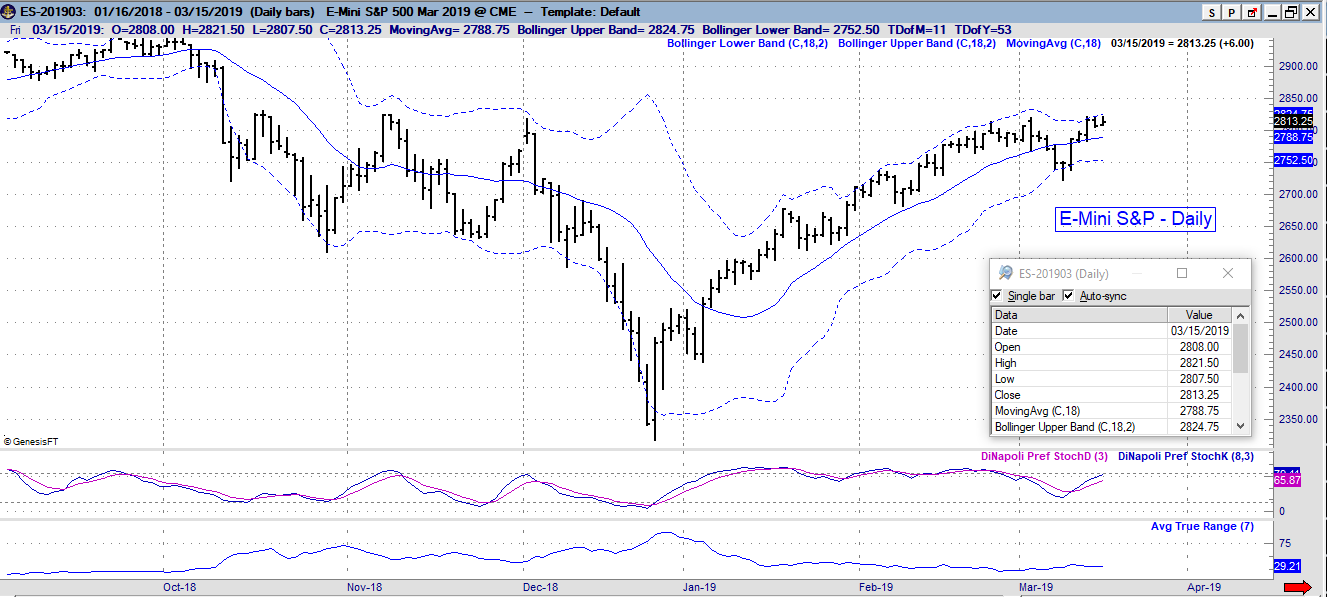

Daily chart below.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

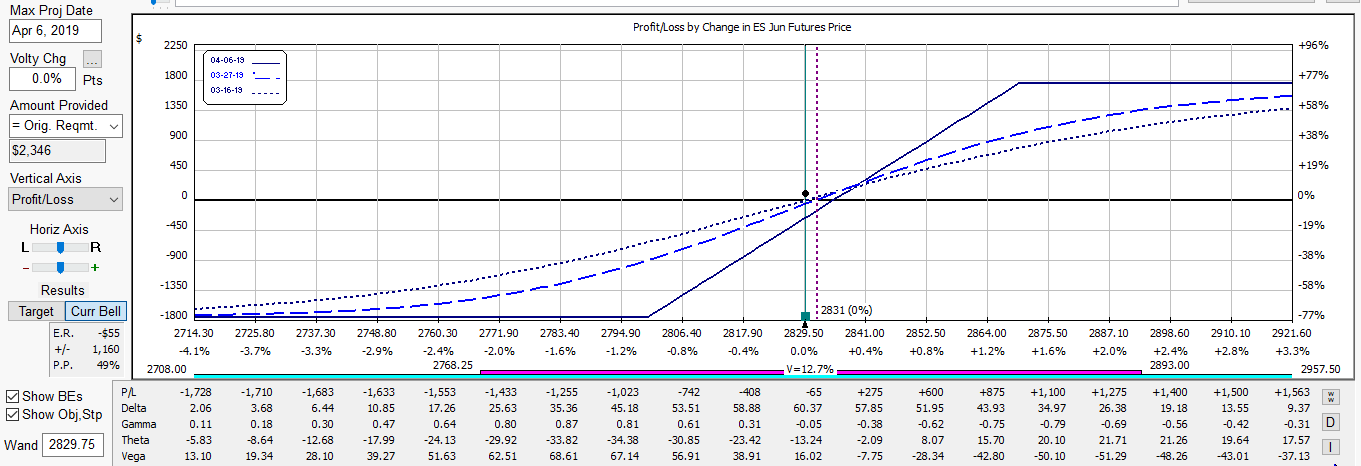

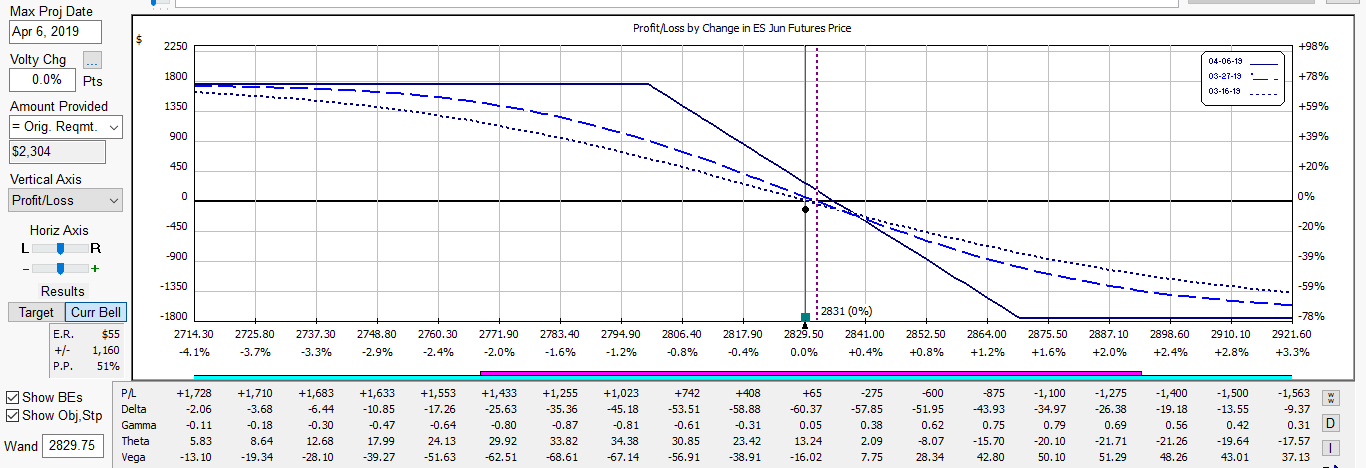

Strategies

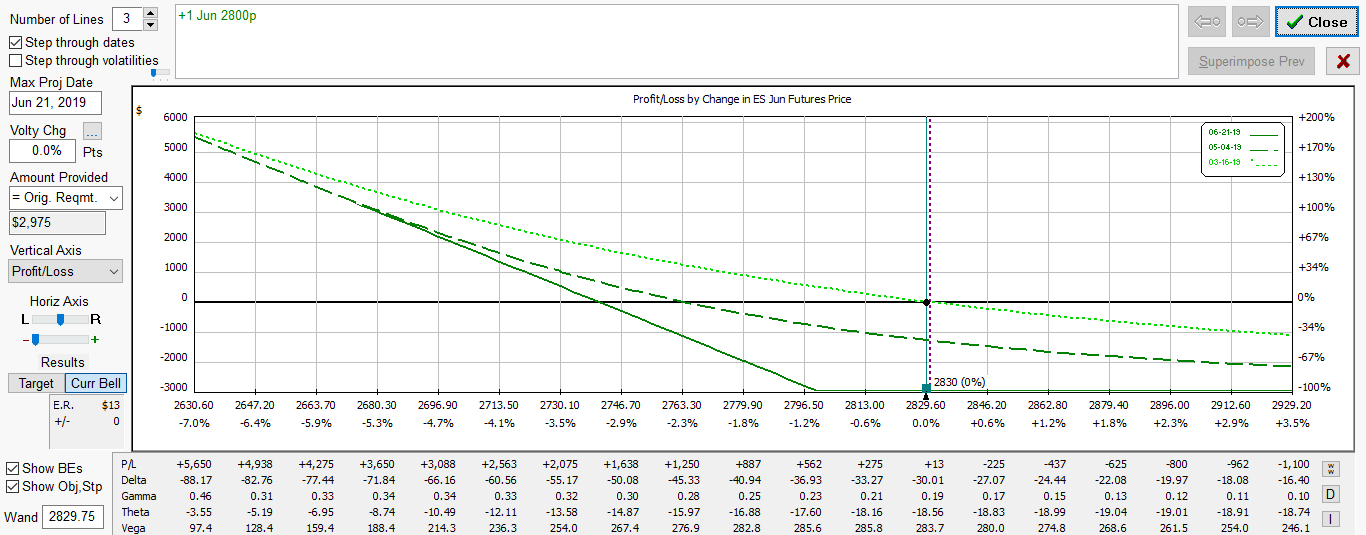

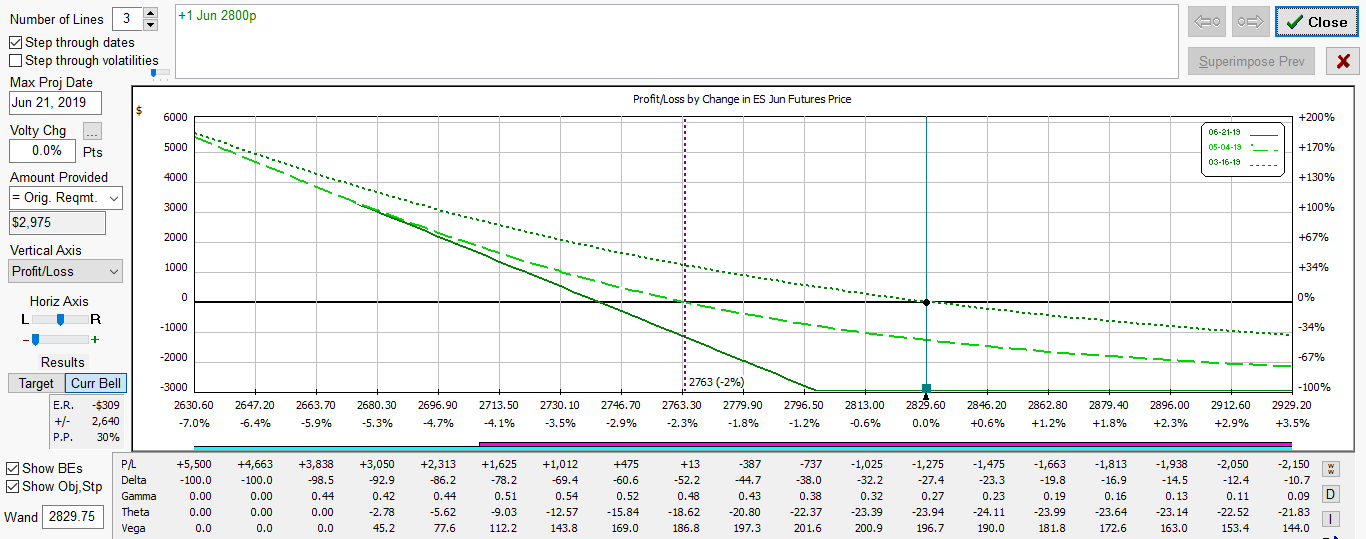

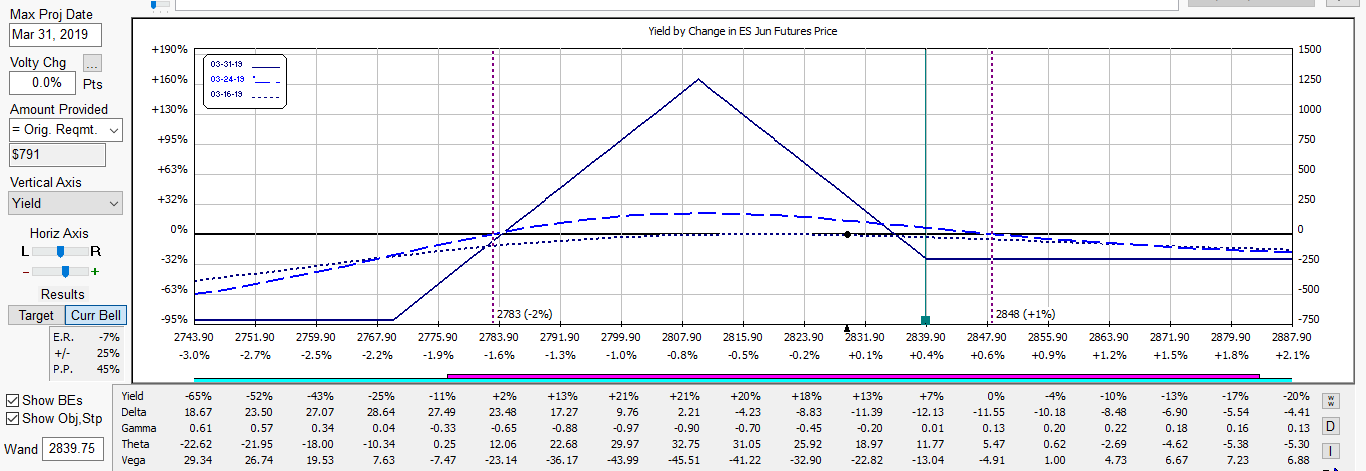

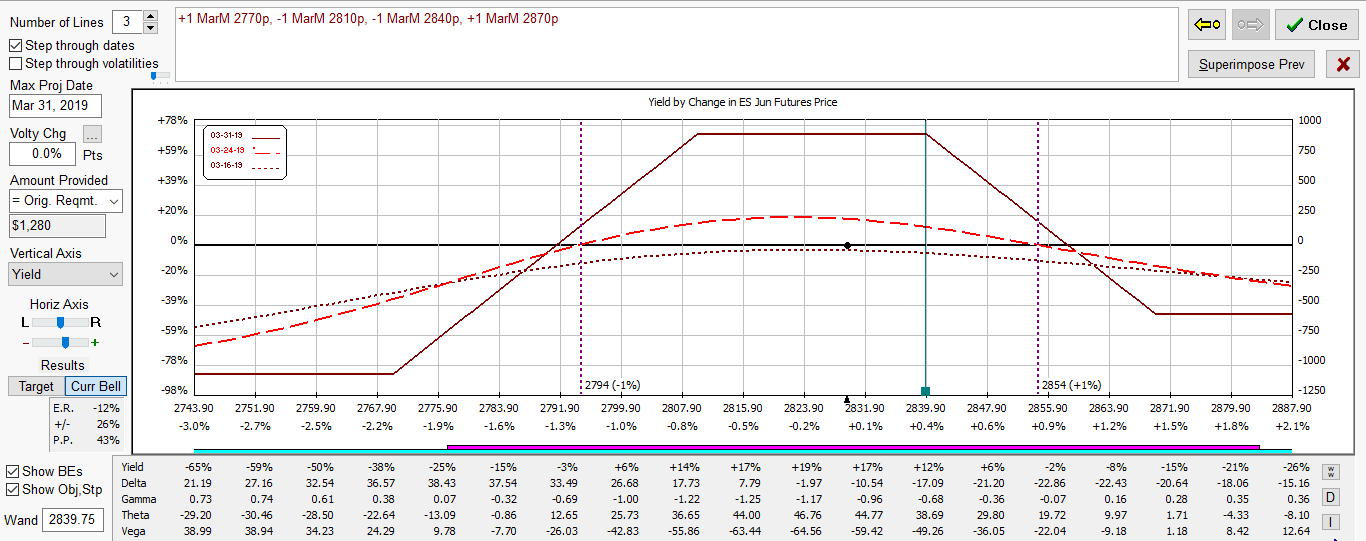

Below are illustrations of vertical spreads based on a 1 lot using weekly options that expire in 12 days as of this post (Mar 29th). These are explained in Paul's 2nd book, "Intro to Advanced Option Spreads" with a section dedicated to trading weekly options.