Get your copy of Paul Forchione's book, "Using Futures Options for Day Trading & Hedging" for $10 USD. Learn techniques from a professional options trader to manage risk while speculating on futures markets.

Click here to view Paul's eBook

By using our website, you agree to accept our terms of use (click to read)

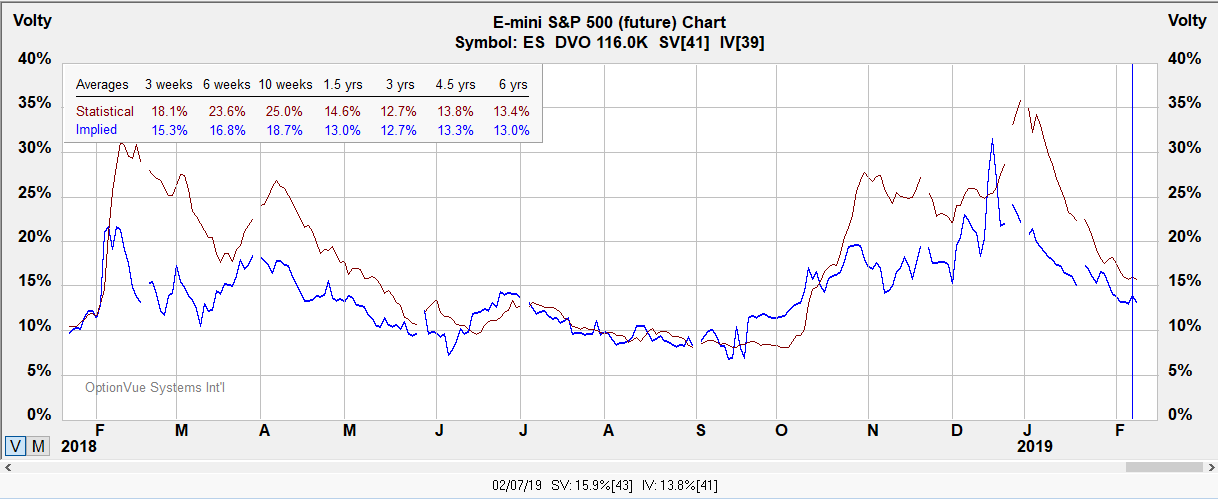

Volatility

Options undervalued with volatility below historic levels.

Notes:

Contract Size - $50 x S&P 500 Index.

Tick Size: Outright: 0.25 index points=$12.50

Trading Hours: CME Globex: Sunday - Friday 6:00 p.m. - 5:00 p.m. Eastern Time (ET) with trading halt 4:15 p.m. - 4:30 p.m.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here to read a helpful tip about E-Mini S&P futures and options

E-Mini S&P

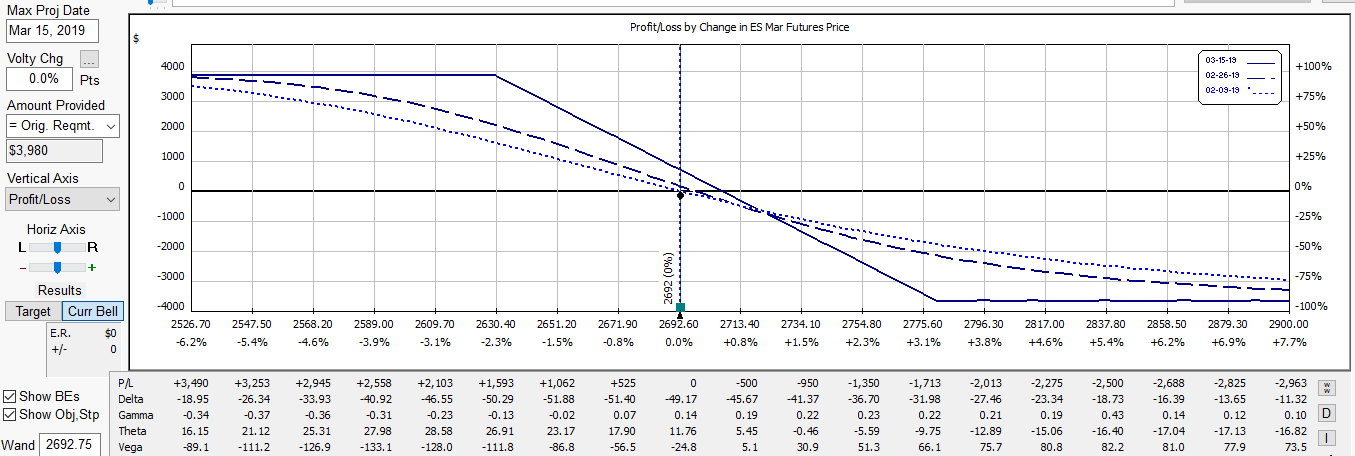

Below is a daily chart where the market has been trending higher.

?ml=1" class="modal_link" data-modal-class-name="no_title">* Tip: Click here on enlarging images

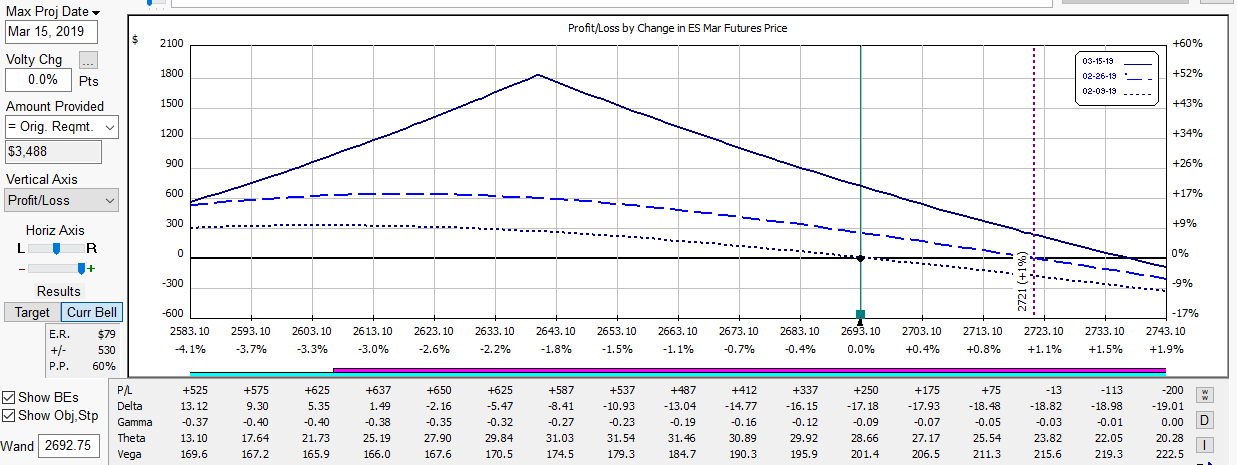

Strategies

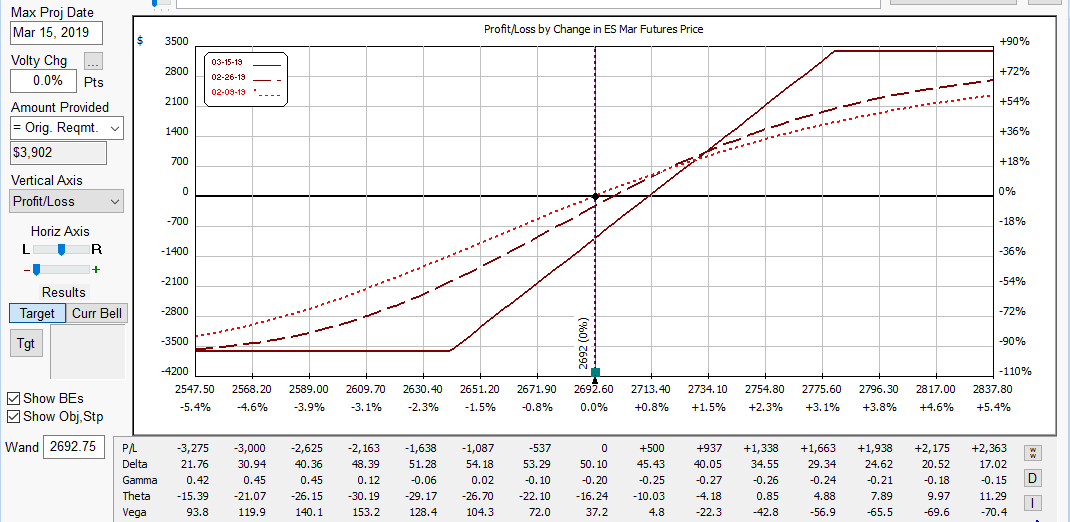

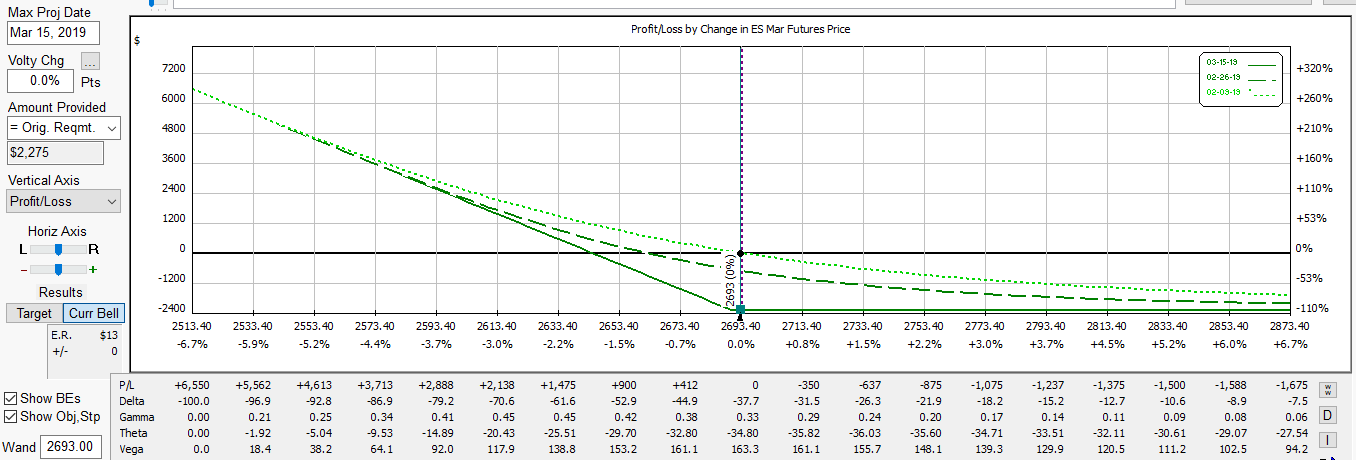

Below is are illustrations of vertical spreads based on a 1 lot. These are explained in Paul's book, "Using Futures Options for Day Trading & Hedging".