If you're new to commodity and financial futures, our Concepts I and II short crash courses are designed to help you interactively learn how these markets are traded with the ACE Program.

Orders & Execution

Our video series "Concepts II" picks up where we left off from the first course.

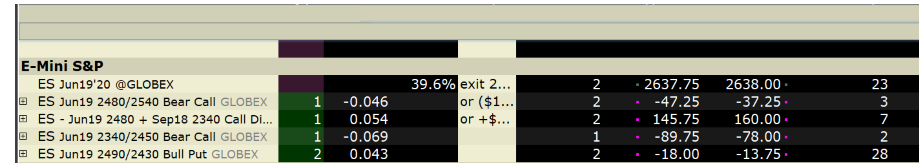

Now that you have a basic idea on how to model a vertical spread on a futures options market, the next step is learning how to place orders on a brokerage platform.

In the second video module, "Concepts II", you'll get a Free demo account using a brokerage platform which is accessible on both a desktop or mobile device. You'll learn how to enter orders using market data and set up combination trades. We'll show you strategies using the ACE Program concepts for trading futures options.

The acroynm "ACE" represents a process: "access, choose, execute" in formulating and managing your strategies.

You can also check out our Oahu TWS Live program with helpful templates from our weekly Watchlist.