Straits Direct

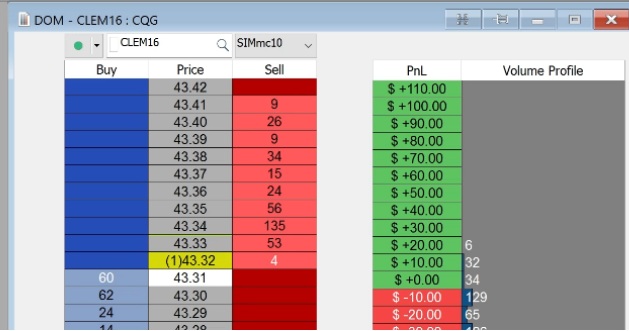

Professional trading chart and execution platform for precise order entry and order management

Below is a list of software used by experienced professionals across futures and options markets. Our team uses these in our training courses and can assist you on setting up with your brokerage account.

Professional trading chart and execution platform for precise order entry and order management

An award winning platform for professional traders. As a registered CTA, Oahu Capital Group, LLC can help you set up and reach a wide network of brokers and clients looking to add managed strategies in their portfolios.

Easily calculate prices for Entry / Exit on Future Options Spreads

Confused on quote conventions with multiple future options contracts? The "OWL-2" (Option Web Ladder) is a browser based calculator designed for trading options on futures. It's the shortened version of our original OWL software. Easily calculate price conventions on ES, GC, CL, ZB, SB, LE, ZC, 6E, 6J ... or any futures market

DZH International offers charting software and data covering international markets. Oahu Capital offers their services to clients looking to trade Asian markets with charting software and indicators.

OptionVue is a front end software that allows professional option traders to model and execute sophisticated spreads. Watch a library of video tutorials below and consider learning to trade futures options from our collection of Paul Forchione's eBooks.

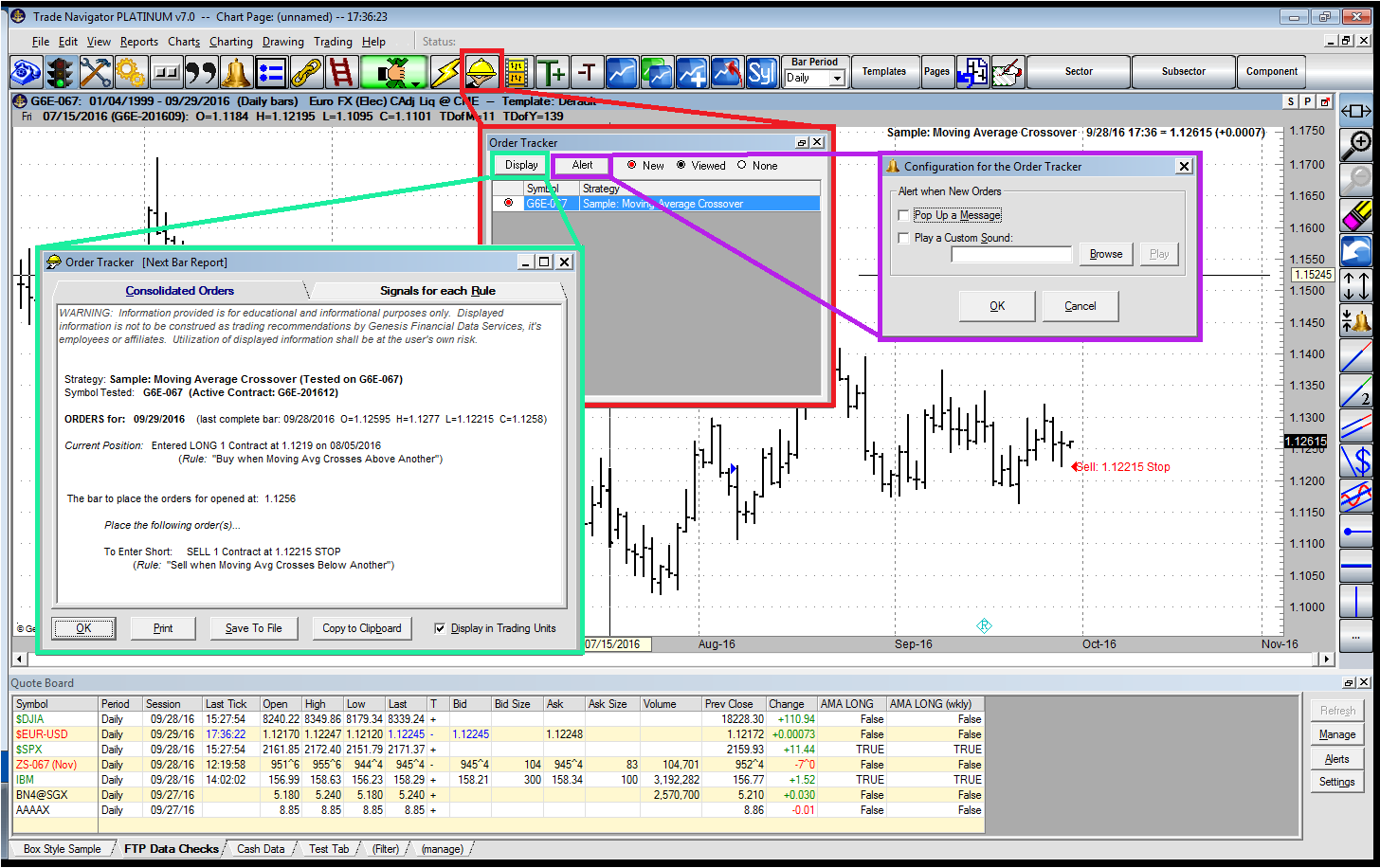

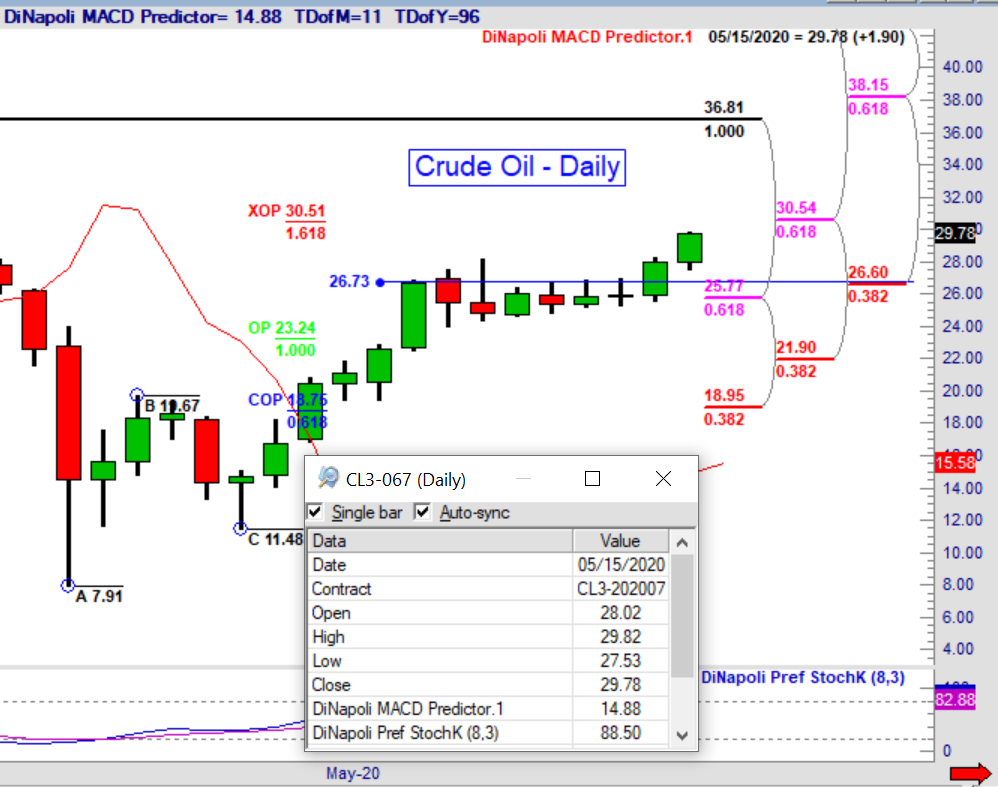

TradeNavigator - Learn System Building, Auto Trade & Management

Online courses designed to help you get the most from using TradeNavigator software. Build your system with over 100+ studies and indicators.

Purchase or start by watching a short video and get a free guest pass to try TradeNavigator with us!

Purchase or start by watching a short video and get a free guest pass to try TradeNavigator with us!

You may purchase the set of DiNapoli indicators called Coast Trading Package (CTP) as a standalone if you already own TradeNavigator software.

You may purchase TradeNavigator Software and the set of DiNapoli indicators called Coast Trading Package (CTP) and DLevels together here.