Outright purchases means buying (locking in) forward prices to eliminate price risk; protective purchases means buying options in crude oil futures or ETFs to limit price risk. (Crude oil options are a proxy for resins options until they become available in the futures market, though processors could request resins options from their suppliers—to their mutual benefit.)

There is a third hedging choice that processors may take and most processors only take: do nothing.

"Do nothing" means purchasing physical supply for short-term processing needs only. It is considered the safe choice, but do-nothing actually equates to taking the position that:

1) future resins costs will be lower than expectations (or low enough to still make a profit)

2) higher resins costs can be, sooner or later, passed through to customers, or

3) competitors are also doing nothing so it’s best to do nothing, too.

Given the volatility of resins prices, do-nothing can be a good hedging decision, but having it as the only decision for the biggest cost component is hardly safe. It’s a disservice to customers, investors, and employees and leaves processors vulnerable to competition from processors who do more than nothing to manage risk. Which processor are you? Which one do you want to be?

This email address is being protected from spambots. You need JavaScript enabled to view it.

Triggers

Like other business decisions, hedging decisions are best made dispassionately, not emotionally or by “gut feel”. For such decisions, price indicators or triggers are useful. Given the high correlation between resins and crude oil prices, it follows that resins prices relative to crude oil prices may provide such triggers: triggers to lock-in forward purchases, protect forward purchases, or do nothing. A resin price relative to crude oil could be a ratio or a difference. I believe the difference (or differential) is most informative because it reflects the profitability of the resin being produced by petrochemical companies and market forces tend to bring a resin’s profitability back in line with historical averages within a month or two.

Resins/Crude Oil Differentials

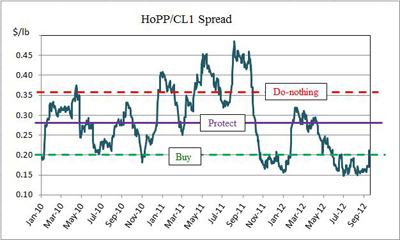

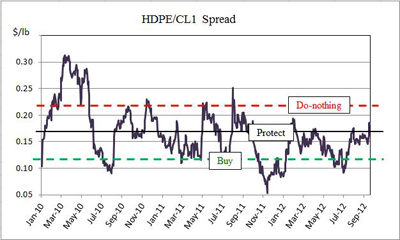

The following charts show daily price differentials between polypropylene and polyethylene (high-density) and front-month crude oil futures prices:

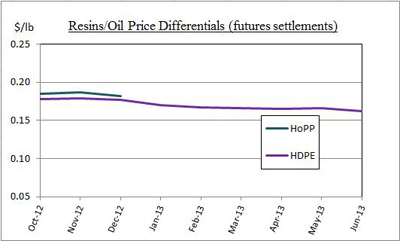

The charts show that polypropylene and polyethylene differentials to crude oil do indeed return to normal (e.g. historical averages) a month or two after straying from the norm. What does the future portray?

If resins futures settlements are realistic, then it appears, relative to crude oil, polypropylene futures are a clear buy and polyethylene futures are neutral (protective purchases). Make sense?

Basing resins hedging decisions—buy, protect, or do nothing—on differentials to crude oil reduces the guesswork. The less guesswork, the more rational decisions are made with the biggest cost component you have. And more rationality means lower costs, even if do-nothing hedging is your default.

About the author: Tom Langan is Risk Manager - Refining & Petro Chemicals for Oahu Capital Group (Asia) Pte. Ltd. Tom has over 20 years of experience in commodity, options trading and risk management. He has developed and implemented risk management programs for electricity, natural gas utilities, oil companies and plastics processors.