The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

Strategy #5: Sell Cash Crop and Buy Calls

Benefit from a price increase

Another strategy that can be used by a commodity seller is to buy a call option after you sell the cash commodity. This strategy would enhance your effective selling price if the market rallies after the cash market sale has been completed.

If you’re like most farmers, you’ve probably asked yourself on more than one occasion this question: “Should I sell my crop now or store and hope prices go up by spring?”

If you sell at harvest you receive immediate cash for your crop – money that can be used to pay off loans or reduce interest expenses. It also eliminates the physical risk of storing crops, and ensures you won’t get into a situation where an increase in price still doesn’t cover storage expenses. Therefore, one of the primary comparisons to consider when deciding to store grain or purchase a call option is the cost of storage versus the cost (premium paid) of the call.

Let’s assume you are a corn producer. It is now October and the March futures price is quoted at $4.30 a bushel. At the time, the Mar $4.30 Corn call option is trading at 10 cents per bushel.

Action

You sell your corn at harvest. After reviewing the premiums for the various call options, you decide to buy one at-the-money March call option for every 5,000 bushels of corn you sell at the elevator.

Results

If prices decline, your maximum cost, no matter how steep the futures price decline, will be 10 cents per bushel – the premium paid for the call.

If the March futures price increases anytime before expiration, you can sell back the call for its current premium, and your net profit is the difference between the premium you paid for buying the March call and the premium received for selling (offsetting) the March call.

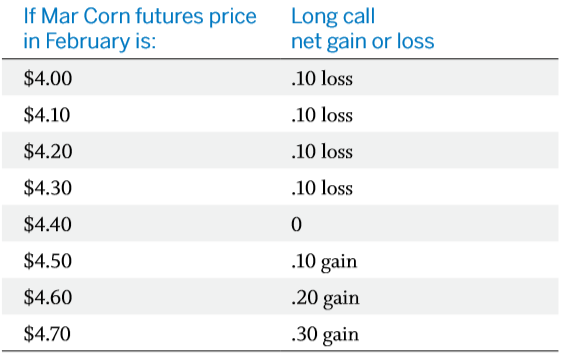

Depending upon the March futures price, the table below shows your profit or loss if you had bought a March $4.30 call at a premium of 10 cents. Assume there is no remaining time value left in the option.

One of the greatest benefits of this strategy is the flexibility it provides to producers. They don’t have to feel locked in to a given harvest price or take on additional storage costs with no guarantee that prices are going up and their grain won’t suffer some physical damage. Of course, there is a price for this flexibility – the option premium. And option premiums will vary, depending on what option strike price you buy. Your options are open.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Options in Combination with other Positions

As you fine-tune your understanding of options, you may well discover potentially worthwhile ways to use puts and calls in combination with hedging or forward contracting, either simultaneously or at different times.

For instance, assume a local elevator offers what you consider an especially attractive price for delivery of your crop at harvest. You sign the forward contract, but you’re a little uneasy about the delivery clause. If you are unable to make complete delivery of the agreed upon amount, the elevator charges a penalty for the undelivered bushels. To protect yourself, you buy enough call options to cover your delivery requirements. Then, if you are unable to make complete delivery on the forward contract due to reduced yields and if the calls increased in value, you could offset some or all of your penalty charges.

For example, suppose a producer has entered into a forward contract to deliver 10,000 bushels of corn at $5.20 in November.

December futures are currently trading at $5.40. He simultaneously buys two Dec $5.60 Corn calls (out-of-the-money) at 10 cents per bushel. A floor price for the crop has been established at $5.10 ($5.20 forward contract – $.10 premium paid).

Suppose it was a long, dry, hot summer, and production fell short of expectations. If these fundamentals caused futures prices to go beyond $5.70, (i.e., the strike price plus the $.10 paid for the option), the farmer could sell back the calls at a profit. The producer could then use this money to offset some of the penalty charges he might incur if he doesn’t meet the delivery requirements of the forward contract.

If you're a commodity risk manager looking for assistance on hedging, please visit our partner site OahuCapital.com for active assistance.