The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

Strategy #2: Buying Put Options

Protection Against Lower Prices and Opportunity if Prices Rally

As a soybean producer whose crop has just been planted, you are concerned that there may be a sharp decline in prices by harvest in October. You would like to have protection against lower prices without giving up the opportunity to profit if prices increase. At the present time, the November futures price is quoted at $9.50 per bushel. The basis in your area during October is normally 25 cents under the Nov Soybean futures price. Thus, if the November futures price in October is $9.50, local buyers are likely to be bidding about $9.25.

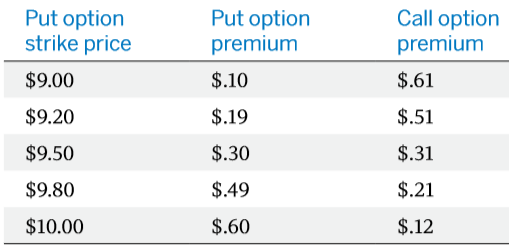

Premiums for Nov Soybean put and call options with various strike prices are presently quoted as follows:

Expected Selling Price

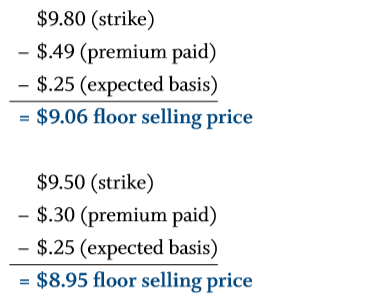

To evaluate the expected minimum (floor) selling price and compare the price risk exposure from the various put options, use the following formula:

Minimum (floor) selling price =

put strike – premium paid +/– expected basis

Comparing two of the put options from the previous chart:

As you can see, the greater protection comes from the put option with the higher strike prices and therefore, the greatest premium.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Action

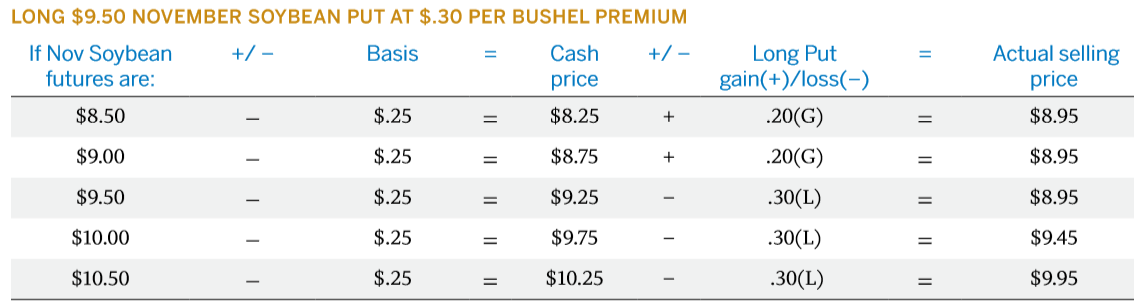

You decide to use options to manage your price risk. After considering the various options available, you buy the $9.50 put (at-the-money) at a premium of 30 cents a bushel.

Scenario #1: Prices Decline

If prices decline and assuming the basis remains unchanged at 25 cents under, you will receive a minimum $8.95 per bushel for your crop. That is the option strike price ($9.50) minus the expected basis (25 cents) less the premium paid for the option (30 cents).

Assume the November futures price has declined to $8.50, and local buyers are paying $8.25 (futures price – the basis of $.25 under).

With the futures price at $8.50, the $9.50 put option can be sold for at least its intrinsic value of $1.00. Deducting the 30 cents you paid for the option gives you a net gain of 70 cents. That, added to the total cash market price of $8.25, gives you a total net return of $8.95 per bushel.

Scenario #2: Prices Increase

If prices increase, you will allow your put option to expire if there isn’t any time value, because the right to sell at $9.50 when futures prices are in excess of $9.50 doesn’t have any intrinsic value. Your net return will be whatever amount local buyers are paying for the crop less the premium you initially paid for the option.

Assume the futures price when you sell your crop has increased to $11.00, and local buyers are paying $10.75 (futures price – the basis of $.25 under).

You would either allow the option to expire if there isn’t any time value or offset the put option if there is time value remaining. If you allow the put option to expire, your net return will be $10.45 (local cash market price of $10.75 – the $.30 premium paid).

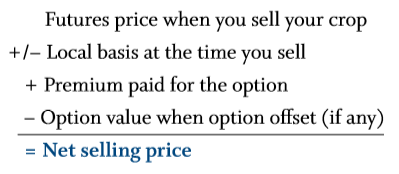

Regardless of whether prices have decreased or increased, there is an easy way to calculate your net return when you sell your crop:

Results

Note the different price scenarios for the October time period. Regardless of the price decline in soybeans, the minimum selling price is $8.95 per bushel because of the increasing profits in the long put option position. As prices rally, the soybean seller continues to improve on the effective selling price. In other words, the soybean seller has protection and opportunity.

If you're a commodity risk manager looking for assistance on hedging, please visit our partner site OahuCapital.com for active assistance.