The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

Buy a Call and Sell a Put

Establish a Buying Price Range

This long hedging strategy provides you with a buying price range. Purchasing a call option creates a ceiling price and selling a put establishes a floor price. The strike prices of the options determines your price range. You would choose a lower strike price for the put option (i.e., a floor price) and a higher strike price for the call option (i.e., a ceiling price). As with all strategies, the range selected depends on your company’s price objectives and risk exposure. The premium received from selling the put allows you to reduce the premium cost of the call. You effectively lower the ceiling price by selling the put. Once more, assume you are buying wheat for your firm and decide to use wheat options to establish a price range for requirements between August and November. As described in Strategy #1, Dec Wheat futures are at $7.50 a bushel and the expected buying basis in November is generally 10 cents under Dec Wheat futures.

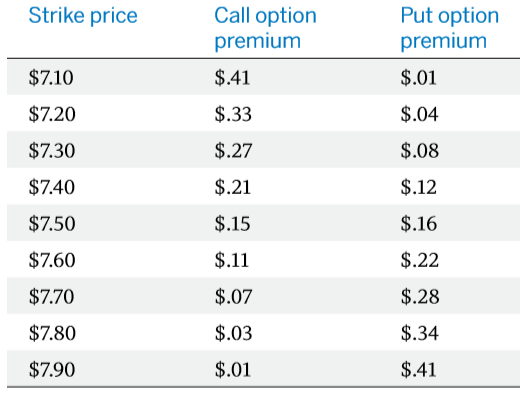

The premiums for the Dec Wheat call and put options (the same as used in Strategies #2 and #3) are:

Action

You first need to calculate the “buying price range” that fits your risk tolerance level. This is done by using the following formulas.

Maximum (ceiling) purchase price =

call strike price + call premium paid – put premium received

+/– expected basis

--------------------------

Minimum (floor) purchase price =

put strike price + call premium paid – put premium received

+/– expected basis

Using these formulas and the various option premiums, you can calculate different buying ranges based upon the strike prices chosen. The greater the difference between the call and put strike prices, the wider the purchase price range. Conversely, a smaller difference in the strike prices will result in a narrower purchase price range.

After considering various options, you decide to establish a buying price range by purchasing a $7.50 call for 15 cents and selling a $7.30 put for 8 cents. The call option was initially atthe-money and the put option was initially out-of-the-money.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Results

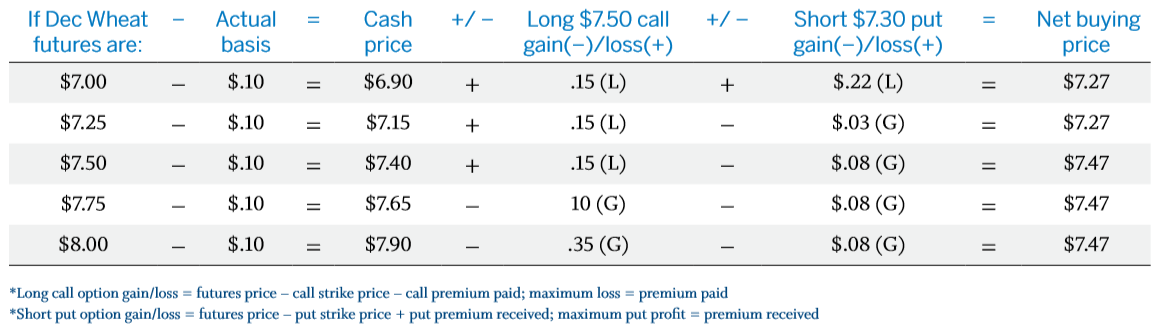

Regardless of what the futures market does, your net buying price will be no more than $7.47 ($7.50 call strike + $.15 call premium paid – $.08 put premium received – $.10 basis) and no less than $7.27 ($7.30 put strike + $.15 call premium paid – $.08 put premium received – $.10 basis), subject to any variation in the basis. The price range is 20 cents because this is the difference between the call and put strike prices.

Looking at the net results based on different futures prices scenarios in the table below confirms the establishment of a buying price range.

If you're a commodity risk manager looking for assistance on hedging, please visit our partner site OahuCapital.com for active assistance.