The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

Strategy #4: Buy a Put and Sell a Call

Establish a Selling Price Range

This is a short hedging strategy with the net effect of creating both a floor price and a ceiling price. Let’s assume you are a soybean farmer and you have just planted your crop. The November Soybean futures contract is trading at $9.50 per bushel, and you anticipate the local basis to be 25 cents under by harvest. You like the idea of having downside price protection but if there is a market rally between now and fall, you won’t be able to take advantage of it if you’re short futures. Instead, you decide to buy a put option. You have downside protection but are not locked in if prices rise. The only catch is the option premiums are a little higher than what you’d like to spend. What you can do to offset some of the option cost is establish a “fence” or “combination” strategy. With this type of strategy, you buy a put and offset some of the premium cost by selling an out-of-themoney call option.

This email address is being protected from spambots. You need JavaScript enabled to view it.

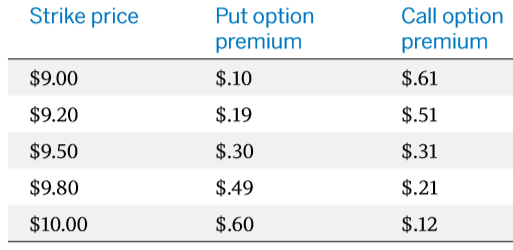

However, this strategy establishes a selling price range where you can’t benefit from a price rally beyond the call strike price. The premiums for the Nov Soybean put options and the Nov Soybean call options are:

Action

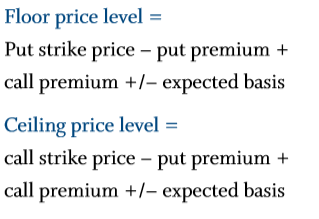

The first step would be to calculate “the selling price range” under various option scenarios. This is easily done by using the following formulas:

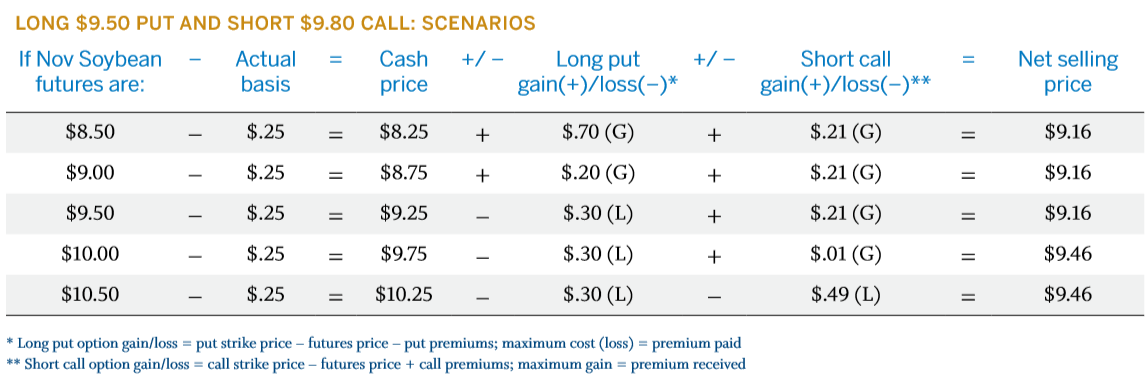

After considering various alternatives, you decide to buy an at-the-money $9.50 put for 30 cents and sell an out-of-the-money $9.80 call for 21 cents. The strategy can be put on for a net debit of 9 cents per bushel, and the selling price range is well within your projected production costs plus profit margin.

Results

As shown in the table above, your net selling price will vary depending on what the Nov Soybean futures price and the basis are when you offset your combination put/call (fence) strategy. What is interesting, is with the long put/short call strategy the net selling price will be anywhere from $8.16 to $8.46 provided the basis is 25 cents under.

If you're a commodity risk manager looking for assistance on hedging, please visit our partner site OahuCapital.com for active assistance.