The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

Comparing Commodity Selling Strategies

A commodity seller doesn’t have one “perfect” strategy that will fit all market conditions. You need to realize that different economic conditions require different selling strategies. Therefore, a smart seller of commodities should become familiar with all of the available selling strategies. They should learn how to evaluate and compare the strategies, and sometimes realize that a strategy may need to be revised due to changing market conditions.

The commodity selling strategies we looked at in this chapter are fairly common ones, but by no means, are they to be considered an all-inclusive list of selling strategies. Each individual or firm, with their own risk/reward profiles, will have to make the ultimate decision – what strategy is the best for their risk management needs.

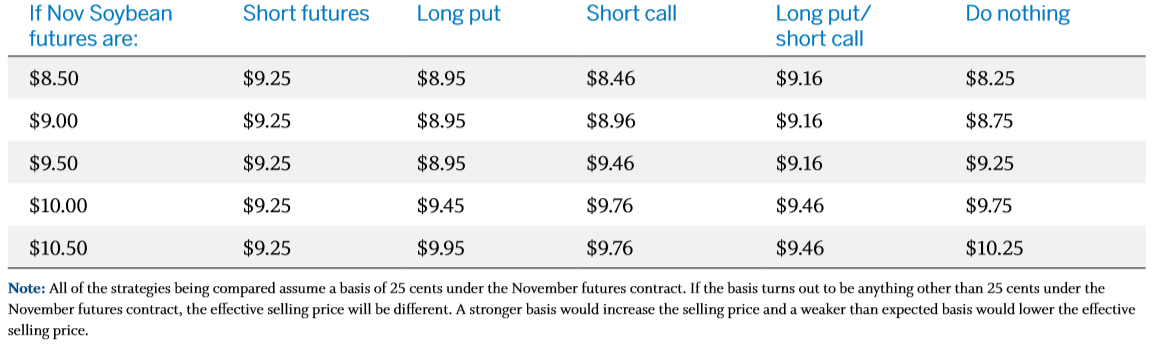

The following table compares four commodity selling strategies involving futures or options and one strategy not involving price risk management. Each of the strategies has their own strengths and weaknesses, which will be discussed in the following paragraphs.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Short Futures

The short futures position is the most basic price risk management strategy for a commodity seller. This strategy allows the commodity seller to “lock in a price level” in advance of the actual sale. It provides protection against the risk of falling prices but does not allow improvement in the selling price should the market rally. This position requires the payment of a broker’s commission, as well as the costs associated with maintaining a performance bond/margin account. In the comparison table, the short futures position fares the best when the risk occurs as the market moves lower.

Long Put Option

The long put option position provides protection against falling commodity prices but also allows the seller to improve on the selling price if the market rallies. The long put position “establishes a minimum (floor) selling price level.” The protection and opportunity of a long put option position comes at a cost – the put option buyer must pay the option premium. In the comparison chart, the long put option provides upside price protection similar to the short futures position with the difference being the cost of the protection – the premium. Unlike the short futures position, the long put option nets a better selling price when the market rallies. When buying a put option, you must pay a brokerage commission but you do not have a performance bond/margin account to maintain.

Short Call Option

Although the short call option position is the riskiest of the selling strategies covered in this section, it provides the best selling price in a stable market, as seen in the comparison table. However, if the futures market price increases, the short call option “establishes a maximum (ceiling) selling price level.” The worst case scenario for this strategy is if the market declines significantly because the downside protection is limited to the premium collected for selling the call.

Long Put Option and Short Call Option

By combining the short call position with the long put position, the commodity seller establishes a higher floor price level because of the premium received for selling the call. However, the cost of this benefit is that the short call position limits the opportunity of higher prices by establishing a ceiling price level. Effectively, the commodity seller using this strategy “establishes a selling price range.” The selling price range is determined by the strike prices and therefore can be adjusted (widened or narrowed) by choosing alternative strike prices. Next to the short futures position, this strategy provides the most protection against falling prices, as noted in the comparison table.

Do Nothing

Doing nothing to manage price risk is the most simplistic strategy for a commodity seller – but also the most dangerous should the market decline. Doing nothing will yield the best selling price as the market rallies but “provides zero price risk management” against a falling market, as indicated in the comparison table.

Other Strategies for Selling Commodities

There are many other strategies available to a commodity seller. These strategies may involve futures, options or cash market positions and each will have their own set of advantages and disadvantages. As stated earlier in this chapter, a commodity seller should be acquainted with all of their alternatives and understand when a specific strategy should be employed or revised. Remember, a strategy that worked effectively for one commodity sale may not be the best for your next commodity sale. The first four strategies discussed are usually used in advance of the actual sale of commodities. The next strategy (#5) can be used after the sale of the commodity.

If you're a commodity risk manager looking for assistance on hedging, please visit our partner site OahuCapital.com for active assistance.