The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

Strategy #3: Selling Call Options

Increase Your Selling Price in a Stable Market

If you are expecting a relatively stable market, you can increase your selling price by selling (going short) a call option. As a commodity seller, you will increase the effective selling price by the amount of premium collected when you sell call options.

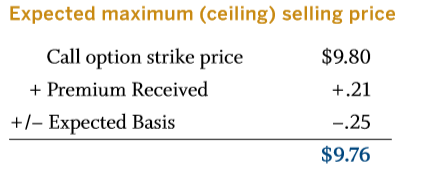

If the futures market price increases above the call strike price, you will be able to sell the cash commodity at a better price but you will begin to lose on the short call option position. If the market rallies above the call strike price by an amount greater than the premium collected, the losses on the short call will outweigh the increased cash selling price. As a result, this strategy locks in a maximum (ceiling) selling price level.

If the futures market declines below the strike price, the only protection you have against falling prices is the premium collected from selling the call option. Note, that by selling options, you have a market obligation and therefore you will be required to maintain a performance bond/margin account. Additionally, as an option seller, you may be exercised on at any time during the life of the option. As with all risk management strategies, the effective selling price will be affected by any change in the expected basis.

Action

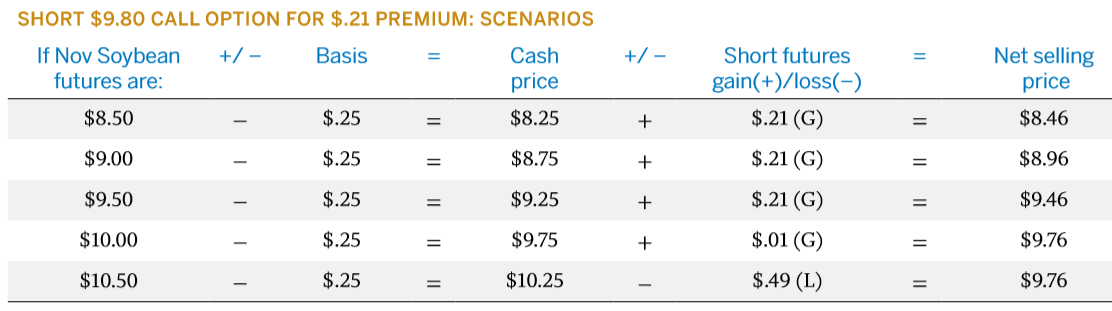

Assume you are a soybean producer who is planning to deliver soybeans in October at harvest and expect the harvest basis to be 25 cents under the Nov Soybean futures. Nov Soybean futures are currently trading at $9.50 per bushel and you don’t expect very much price movement in the months leading up to harvest. To enhance your effective selling price, you decide to sell the $9.80 Nov Soybean call option (out-of-the-money) for a premium of 21 cents per bushel.

Use the following formula to evaluate this strategy. This formula should also be used to compare this type of strategy using different strike prices:

With this strategy, the effective selling price will decrease if the futures price falls below the call strike price. Once that happens, your price protection is limited to the premium collected and you will receive a lower selling price in the cash market.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Results

Your effective selling price will depend on the futures price and the actual basis when you sell your cash commodity. In this example, the following table lists the effective selling prices for a variety of futures price scenarios.

As the formula indicates, after adjusting for the actual basis, the premium received from the sale of the call increases the effective selling price. But note that there are risks associated with selling options. If prices rally above the call strike price, there is the possibility that you will be exercised on and assigned a short futures position at any time during the life of the call option. As the market rallies, the losses sustained on the short call position will offset the benefits of a higher cash price, thereby establishing a ceiling selling price ($9.76). In contrast, if the market prices decline, your downside price protection is limited to the amount of premium collected.

If you're a commodity risk manager looking for assistance on hedging, please visit our partner site OahuCapital.com for active assistance.