The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

Strategy #2: Buying Call Options

Protection Against Higher Prices and Opportunity if Prices Decline

Assume you are a buyer who needs to establish a wheat purchase price for November delivery. The time is August and the Dec Wheat futures price is $7.50 per bushel. At this level, you decide to use options to protect your flour purchase price and related profit margins against a significant rise in the price of wheat. By buying call options you’ll be protected from a price increase yet retain the downside opportunity should prices fall between now and November.

The cash market price for wheat in your region is typically about 10 cents below the December futures price during November. This means the normal basis during late fall is 10 cents under, and, given the current market conditions, you expect this to hold true this year. Therefore, if the December futures price in November is $7.50, the cash price in your suppliers’ buying region is expected to be about $7.40 per bushel.

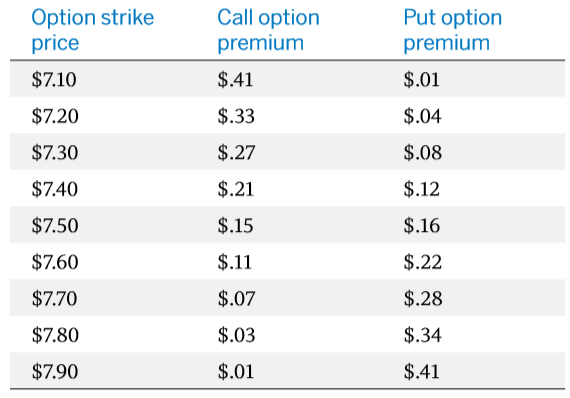

Premiums for Dec Wheat call and put options are currently quoted as follows:

This email address is being protected from spambots. You need JavaScript enabled to view it.

Expected Buying Price

To compare the price risk exposure for different call option strikes simply use the following formula:

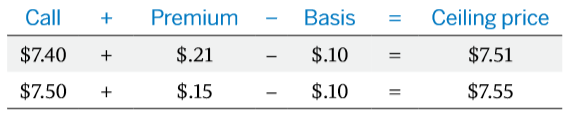

Maximum (ceiling) buying price = call strike price + premium paid +/– basis

In the current example, the comparison between the $7.40 call and the $7.50 call would be:

As you can see, greater price protection involves a somewhat higher cost.

Action

After considering the various option alternatives, you purchase the $7.50 call for 15 cents, which provides protection above the current market price level.

Scenario #1: Prices Rise

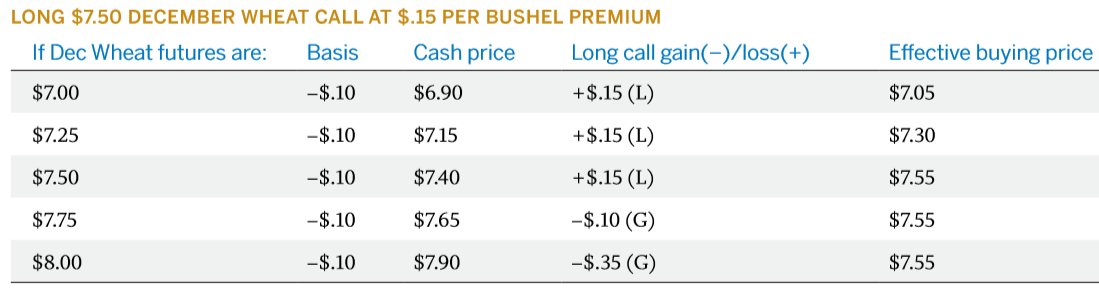

If prices rise, and assuming the basis remains unchanged at 10 cents under, you will pay a maximum of $7.55 per bushel for wheat. That is, the option strike price ($7.50) plus the premium paid for the option (15 cents) less the basis (10 cents under).

Assume the December futures price has risen to $8.50 and your supplier is offering cash wheat at $8.40 ($8.50 futures price – $.10 basis).

With the futures price at $8.50, the call option with a strike price of $7.50 can be sold for at least its intrinsic value of $1.00. Deducting the 15-cent premium paid for the option gives you a net gain of 85 cents per bushel. The cash market price of $8.40 less the 85-cent gain gives you an effective buying price of $7.55 per bushel.

Scenario #2: Prices Decrease

If Dec Wheat futures prices decrease below the $7.50 strike price, your option will not have any intrinsic value but may have some remaining time value. To receive the remaining time value and lower the purchase price, you should attempt to offset the option. Your net wheat flour price will be directly related to the cash price for wheat plus the premium you initially paid for the option minus any time value you recover. If the option doesn’t have any time value, you can allow the option to expire worthless.

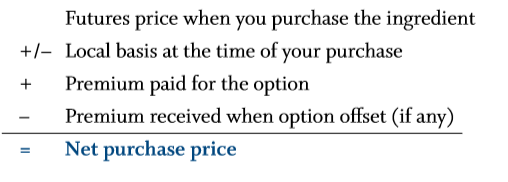

For example, assume the Dec Wheat futures price has decreased to $7.00 at the time you procure your cash wheat and your supplier is offering a local price of $6.90 (futures price less the basis of 10 cents under). You allow the option to expire since it has no intrinsic or time value. The net price you pay for wheat, equals $7.05 ($6.90 cash price + $.15 option premium paid). Whether the market price has gone up or down, the following formula allows you to calculate the net price for the basic ingredient (wheat in this scenario) you are buying:

Results

Note the different price scenarios for the November time period. Regardless of the price increase in cash wheat, the maximum purchase price is $7.55 per bushel because of the increasing profits in the long call option position. As prices decline, the wheat buyer continues to improve on the effective buying price.

Learn about structured commodity finance and commodity margin management.