The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

Strategy #3: Selling Put Options

Lower Your Buying Price in a Stable Market

If you anticipate the market remaining stable, you can lower the buying price of your ingredients by selling (going “short”) a put option. By selling a put option as a commodity buyer, you can lower the purchase price of your ingredients by the amount of premium received provided the market remains relatively stable.

If the futures market falls below the put’s strike price, you’ll be able to buy the cash commodity at a lower price than you originally expected (the cash and futures markets generally move parallel to each other), but you will lose on the short put. If the futures market falls below the strike price by more than the premium collected, your losses on the short put offset the lower price paid to your supplier. If the futures market rallies, the only protection you have against the higher cash price is the premium collected from selling the put. Also, because selling options involves market obligations, performance bond/margin funds must be posted with your broker.

Action

Assume again you are a wheat buyer for a food manufacturer that needs to establish a price for mid-November delivery. It is August, the Dec Wheat futures price is $7.50 per bushel, and you expect wheat prices to trade in a narrow range through the next several months. Also, assume out-of-the-money Dec Wheat puts (i.e., strike price of $7.30) are trading at 8 cents a bushel. The expected basis is 10 cents under December. You decide to sell December $7.30 puts to reduce the actual price you pay for cash wheat between now and November. (The December contract is used because it most closely follows the time you plan to take delivery of your ingredients.)

To calculate the expected floor purchase price simply use the following formula:

Minimum (floor) buying price =

put strike price – premium received +/–

expected basis

$7.30 put strike – $.08 premium – $.10 basis = $7.12

With this strategy, the effective purchase price will increase if the futures price rises above the put strike price. Once that happens, your protection is limited to the premium received and you will pay a higher price for wheat in the cash market.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Results

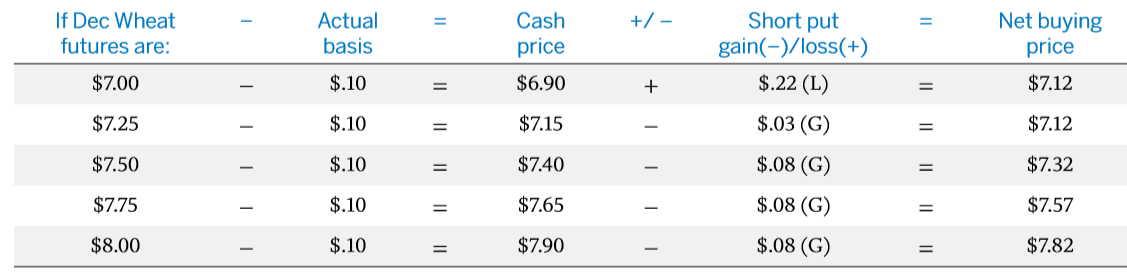

Your effective buying price will depend on the actual futures price and basis (10 cents under as expected) when you purchase your cash wheat. In this example, the previous table lists the net wheat prices as a result of various futures price levels.

As the equation indicates, after adjusting for the basis, premium received from the sale of the puts reduces the effective purchase price of wheat. But there are risks when selling options. If prices fall below the put strike price, there is the possibility you will be exercised against and assigned a long futures position at any time during the life of the option position. This would result in a position loss equal to the difference between the strike price and the futures market price. This loss offsets the benefit of a falling cash market, effectively establishing a floor price level. In contrast, if the market price increases, your upside protection is limited only to the amount of premium collected.

If you're a commodity risk manager looking for assistance on hedging, please visit our partner site OahuCapital.com for active assistance.