The following explanation and illustrations are an excerpt from CMEGroup’s publication, “Self-Study Guide to Hedging with Grain and Oilseed Futures and Options”. As an educational supplement, watch an example using a simple online hedge calculator in our newsletter. Take a quiz to help further your knowledge.

The Buyer of Commodities

Commodity buyers are responsible for the eventual purchase of physical raw commodities (e.g., corn, soybeans, wheat, oats) or derivatives of the raw commodities (e.g., soybean meal, soybean oil, fructose, flour). For example, commodity buyers can be food processors, feed manufacturers, feedlots, livestock producers, grain merchandisers or importers. They share a common risk – rising prices. Additionally, commodity buyers share a common need – price risk management. The following strategies illustrate a variety of strategies with varying degrees of risk management that can be used by commodity buyers.

Strategy #1: Buying Futures

Protection Against Rising Prices

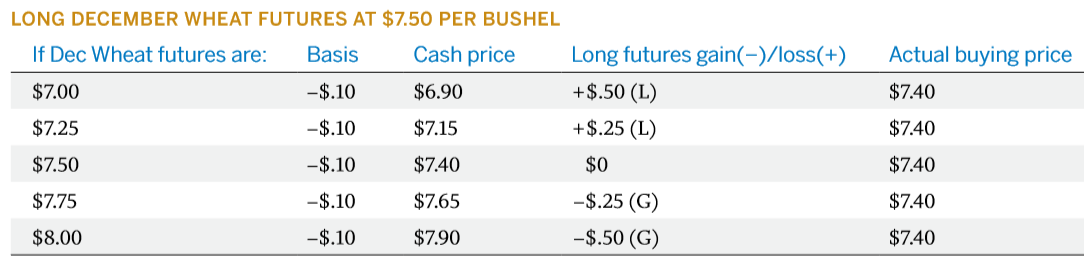

The current time period is mid-summer and you need to purchase wheat during the first half of November. The Dec Wheat futures are trading at $7.50 per bushel. Your business can realize a profit at this price level but may sustain a loss if the prices rally much higher. To lock in this price, you take a long position in Dec Wheat futures. Although, you are protected if the prices move higher, you will not be able to benefit should the prices move to a lower price.

Based on historical basis records in your area, you expect the basis to be about 10 cents under the Dec Wheat futures price. As a buyer of commodities, your purchase price will improve if the basis weakens and worsen if the basis strengthens. For example, if the basis turns out to be stronger at 5 cents under, then your purchase price will be 5 cents higher than expected. If the basis weakens to 20 cents under, then your purchase price will be 10 cents lower than expected.

Action

In August you purchase a Dec Wheat futures contract at $7.50 per bushel.

Expected purchase price = futures price +/– expected basis $7.50 – .10 = $7.40/bushel

Results

Assuming basis turns out to be 10 cents under December futures in November and the Dec Wheat futures move above $7.50 per bushel, the higher price you pay for the physical wheat will be offset by a gain in your futures position. If Dec Wheat futures moves below $7.50 per bushel, you will pay a lower price for the physical wheat but you will have a loss on your long futures position. Note the different price scenarios for the November time period. Regardless, if Dec Wheat futures moves higher or lower, the effective purchase price will be $7.40 per bushel provided the basis turns out to be 10 cents under. A change in the basis will affect the purchase price.

This email address is being protected from spambots. You need JavaScript enabled to view it.

If you're a commodity risk manager looking for assistance on hedging, please visit our partner site OahuCapital.com for active assistance.